The Unseen Enemy: Safeguarding Your Financial Fortress

Thieves lurk everywhere. That’s the harsh reality—your wallet, your emails, even that old receipt in the trash can serve as gateways to financial ruin. Identity theft isn’t some distant threat; it’s a booming industry, with over 1.4 million cases reported in the US alone last year, according to the Federal Trade Commission. Yet, here’s the contradiction: while we bolt our doors and set alarms for our homes, many leave their digital lives wide open. This article dives into practical ways to protect against identity theft, empowering you to reclaim control over your finances and sleep a little easier at night.

Imagine the peace of mind knowing your hard-earned money is shielded from predators. By the end, you’ll have actionable strategies to fortify your defenses, blending everyday vigilance with smart financial habits. Let’s face it, in a world where **identity theft can erase years of savings in minutes**, staying proactive isn’t just wise—it’s essential.

My Wake-Up Call: A Personal Tale of Financial Invasion

Picture this: a few years back, I was juggling bills, thinking I had my ducks in a row. Then, bam—one day, my credit card declined at the grocery store. Turns out, someone had racked up thousands in fraudulent charges, all traced back to a phishing email I barely glanced at. It was a gut punch, especially as a single parent relying on that income stream. I spent weeks untangling the mess, dealing with banks and credit bureaus, and let me tell you, it’s not just about the money; it’s the violation, like someone rifling through your diary.

This experience taught me a profound lesson: complacency is the thief’s best friend. In finance, where **protecting personal information** is key, I now advocate for regular audits. It’s not about paranoia; it’s about empowerment. Subjectively, I believe that if more people shared these stories, we’d normalize defenses like two-factor authentication as routine as locking your front door. And just there, in the midst of that chaos, I realized how a simple habit could have prevented it all.

To draw an unexpected analogy, think of identity theft like a termite infestation—silent, destructive, and often undetected until the damage is done. By monitoring your credit reports annually, you’re not just reacting; you’re building resilience, much like reinforcing a home’s foundation.

From Ancient Vaults to Modern Safeguards: A Historical Parallel

Dive deeper into history, and you’ll see that protecting assets isn’t new. Back in ancient Rome, emperors guarded their treasuries with elaborate vaults and sentries, drawing from Greek influences where financial secrecy was a cultural norm. Fast-forward to today, and we’re in a digital age where **ways to prevent identity theft** mirror those old defenses, but with a twist. In the US, where individualism reigns, we often treat personal finance like a solo mission, unlike in places like Japan, where community vigilance is embedded in daily life—think of it as a neighborhood watch for your bank account.

This cultural comparison highlights an uncomfortable truth: while historical figures like the Medici bankers used coded ledgers to shield wealth, modern folks overlook tools like encryption. It’s ironic, really— we’ve got technology that makes those ancient vaults look primitive, yet phishing scams still snare millions. For instance, referencing the TV series «Billions,» where characters weave elaborate financial webs, it shows how even the savvy can slip up. In reality, adopting encrypted communications isn’t just a tech fix; it’s a nod to those historical guardians, ensuring your financial data stays as secure as a Roman fortress.

Here’s a simple table to compare traditional and modern methods, because sometimes, seeing it side by side drives the point home:

| Aspect | Traditional Approach | Modern Equivalent |

|---|---|---|

| Storage of Assets | Physical vaults with guards | Encrypted digital wallets and VPNs |

| Monitoring | Daily ledger checks by scribes | Real-time credit monitoring apps |

| Advantages | Immediate physical security | 24/7 alerts and remote access |

| Disadvantages | Vulnerable to invasions | Relies on user vigilance |

This evolution underscores how **financial security measures** evolve, but the core principle remains: stay alert.

The Quiet Intruders: Exposing Risks and Building Barriers

Ever wonder why identity thieves succeed? It’s often because we overlook the small stuff—like that junk mail pile or sharing too much on social media. Let’s address this head-on: in a serious tone, the problem is that **defending against fraud** feels overwhelming, but here’s the irony—simple steps can turn the tide. For example, regularly shredding documents isn’t glamorous, yet it thwarts dumpster divers who treat your trash like a treasure hunt.

To counter this, start with a mini experiment: grab your phone right now and check your app permissions. You might find that fitness tracker sharing your location—harmless, right? Wrong; it could link to your financial habits. By revoking unnecessary access, you’re not just protecting data; you’re reclaiming privacy. And what if a skeptic argues, «But isn’t this overkill?» Well, consider this: in finance, where one breach can cascade into debt, being overly cautious is better than regretting it later.

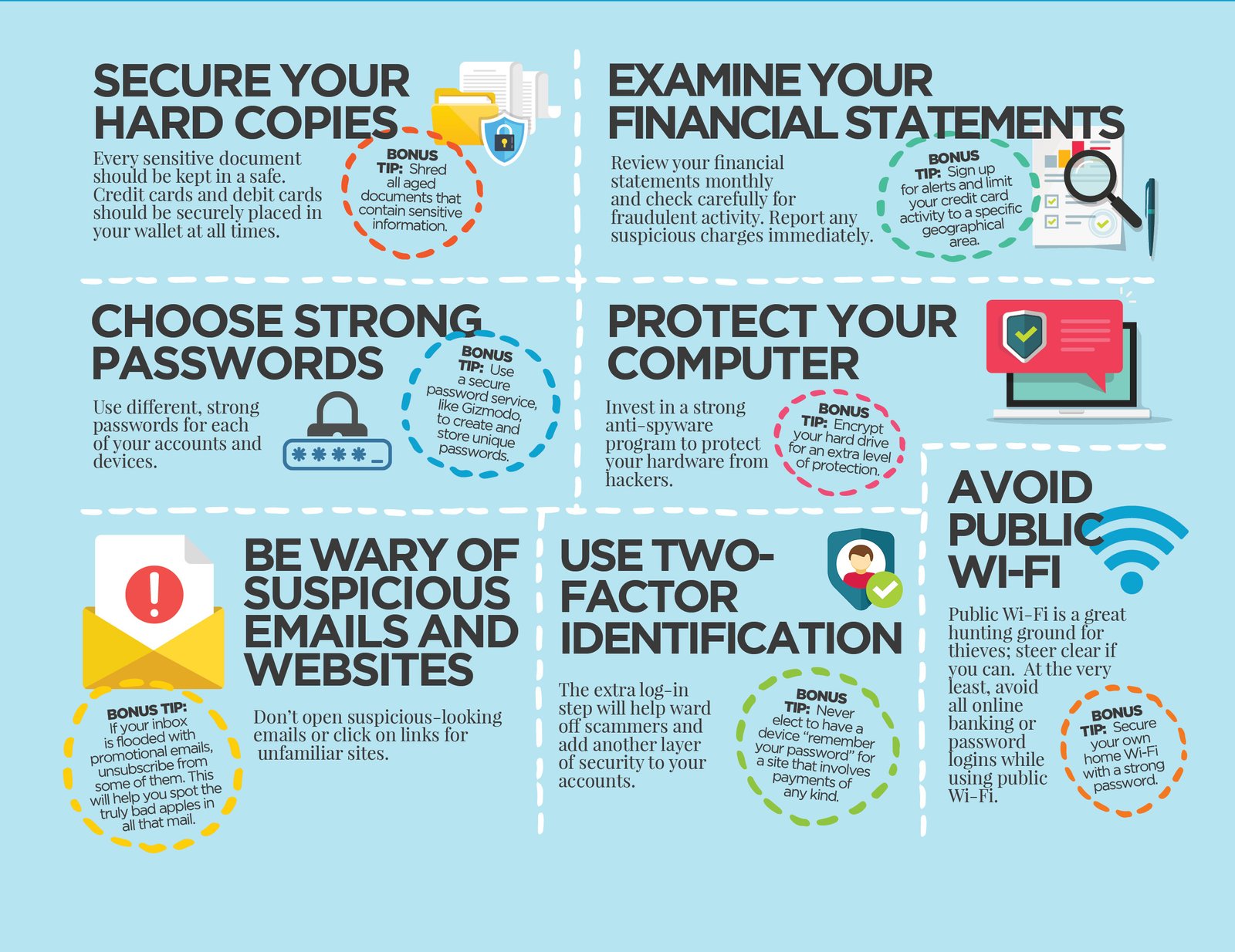

Building on that, use **long-tail keywords** like «best practices for identity theft protection» by implementing layered defenses: 1. Freeze your credit with major bureaus to block new accounts. 2. Use strong, unique passwords for financial sites. 3. Enable transaction alerts on your bank app. These steps, when combined, create a robust shield, much like an unexpected metaphor—a hedge maze that confounds intruders while keeping your path clear.

A Final Twist: Empowering Your Financial Legacy

In wrapping this up, here’s the twist: identity theft isn’t just about what you lose today; it’s about the future you secure tomorrow. By adopting these strategies, you’re not merely reacting—you’re proactively shaping a legacy of financial wisdom. So, take action now: freeze your credit reports through services like Experian or Equifax; it’s a quick step that could save you headaches down the line.

And one last thought: what if protecting your identity meant more than guarding money—it’s about preserving your peace? Share in the comments: How has a financial scare changed your habits, or what barrier are you building next? It’s time to turn knowledge into action.