Suddenly, job vanished. That’s the harsh reality many face, a contradiction to the stability we chase in our careers. You know, I’ve seen friends—solid professionals—woken up to pink slips with no warning, their savings drained faster than a smartphone battery on a busy day. In a world where layoffs hit like unexpected storms, unpreparedness can lead to financial ruin, from mounting debts to emotional stress. But here’s the benefit: by mastering financial preparation for job loss, you can build a safety net that not only cushions the fall but empowers you to bounce back stronger. Let’s dive into how, drawing from real experiences and smart strategies, to turn potential disaster into a manageable transition.

My Wake-Up Call: Surviving the Layoff Labyrinth

Picture this: back in 2008, I was knee-deep in a corporate gig, thinking I was untouchable. Then, bam—recession hit, and my department got the axe. It wasn’t just me; colleagues with families and mortgages were suddenly adrift. I remember scrambling, my mind racing like a squirrel in traffic, trying to piece together a plan. That experience taught me a gritty lesson: financial preparation isn’t about paranoia; it’s about realism. According to the U.S. Bureau of Labor Statistics, unemployment rates can spike unexpectedly, affecting even high earners. My opinion? We often overlook the emotional toll, like the sleepless nights worrying about bills, because we’re conditioned to believe job security is forever. But it’s not—it’s as fragile as a house of cards in a breeze.

In my case, I had a modest emergency fund, which I now see as a lifesaver. It covered essentials for six months while I retrained. Here’s an analogy: think of it like a backpack for a hike; without it, you’re lost when the path twists. I incorporated localisms from my Midwest roots, where folks say «belt-tightening» means cutting back ruthlessly, a phrase that stuck with me as I downsized my lifestyle. And just there, in the midst of chaos, I realized preparation means building a buffer against financial shocks, like saving three to six months’ worth of expenses. It’s subjective, sure, but based on my ordeal, starting small adds up—literally.

Echoes of Economic Upheaval: What History Whispers About Job Loss

Fast-forward to the Great Recession, a chapter in American history that still echoes in boardrooms and kitchens alike. Back then, millions lost jobs overnight, much like the tech layoffs we’re seeing now, proving that economic cycles don’t discriminate. It’s a comparison that hits home: in the 1930s, families turned to community support and frugal living, much as people did during the 2020 pandemic. I find it ironic how we repeat patterns—hoarding cash or ignoring risks—yet history shows that preparing financially for unemployment can mean the difference between recovery and ruin.

Take the stock market crash of 1929; survivors who had diversified assets fared better, a truth as uncomfortable as admitting your favorite comfort food isn’t healthy. In modern terms, that’s like comparing a diversified investment portfolio to a well-balanced diet—it sustains you. From a cultural angle, in places like the UK, they talk about a «rainy day fund» as a staple, similar to how Americans view 401(k)s. My take? We should learn from these echoes; for instance, the Federal Reserve’s data on emergency savings strategies highlights how liquid assets helped households weather storms. And that’s when it hits—preparation isn’t just numbers; it’s a cultural mindset shift, weaving financial resilience into everyday life, much like how characters in «The Big Short» predicted the meltdown and protected themselves.

Unearthing Forgotten Tactics

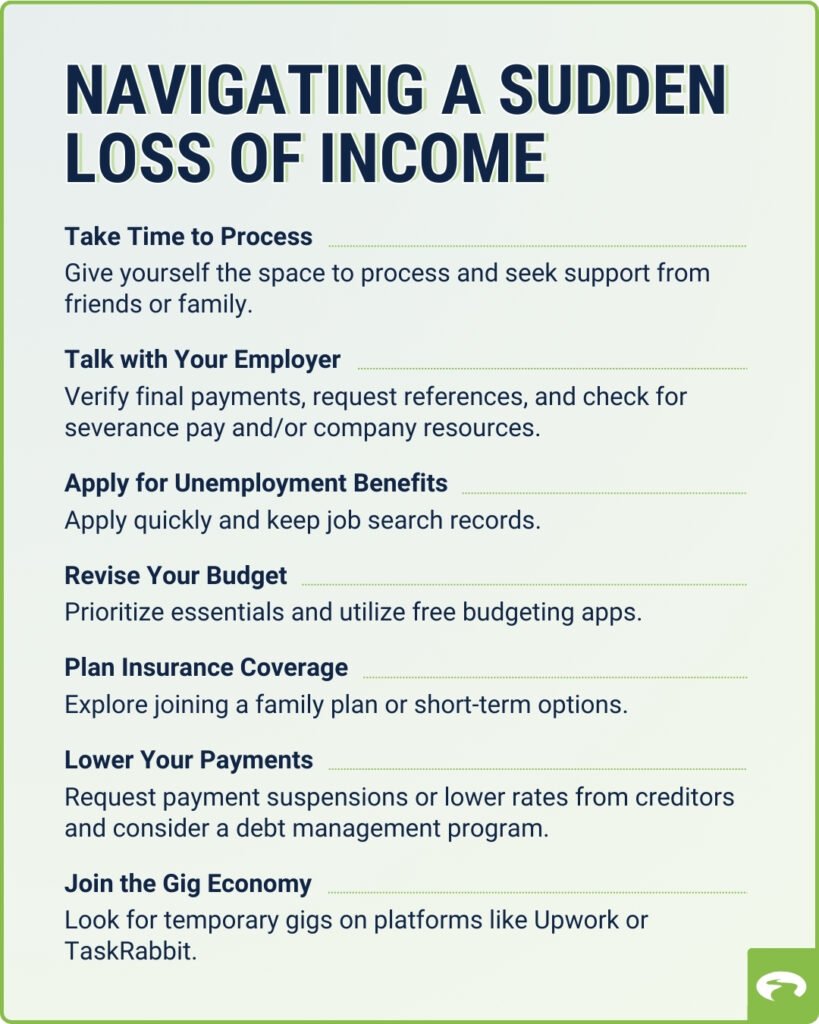

Digging deeper, historical figures like Franklin D. Roosevelt pushed for social safety nets, reminding us that government programs like unemployment insurance are tools, not crutches. But rely on them alone? That’s a mistake; blend them with personal efforts for true security.

Navigating the Storm: Ironies of Financial Safeguards and How to Master Them

Here’s the irony: we joke about job loss in pop culture, like Michael Scott’s blunders in «The Office,» but in reality, it’s no laughing matter. The problem? Many overlook basic steps, thinking, «It won’t happen to me,» only to face a cascade of bills. Solution? Start with a clear-eyed assessment. First, audit your expenses—cut the non-essentials, like that unused gym membership. Second, bolster your income diversification tactics, such as freelancing or side gigs, to create multiple streams. It’s like building a raft instead of a single boat; when one leaks, you stay afloat.

From my perspective, ignoring debt is a common pitfall—subprime loans derailed many during recessions. To counter that, prioritize high-interest debts with a snowball method; it’s straightforward and effective. Propose this exercise to yourself: track your spending for a week, then imagine a 20% cut—what stays? That kind of hands-on approach reveals vulnerabilities, turning abstract advice into actionable insight. And remember, in finance circles, they say «don’t put all your eggs in one basket,» a modism that underscores risk management. By addressing these head-on, you craft a plan that’s as robust as a well-anchored ship in turbulent seas.

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Emergency Fund | Provides immediate access to cash; reduces stress | Requires discipline to build; opportunity cost of not investing |

| Debt Reduction | Lowers monthly outflows; improves credit score | Can feel restrictive; doesn’t generate income |

| Skill Upgrading | Enhances employability; long-term security | Takes time and possibly money upfront |

Final Twist: From Vulnerability to Victory

In wrapping up, here’s the twist: preparing for job loss isn’t about living in fear; it’s about transforming uncertainty into opportunity, like turning a layoff into a career pivot. So, take this CTA seriously—start by calculating your emergency fund needs today, even if it’s just setting aside $50 a paycheck. And here’s a reflective question: how would your financial story change if you prioritized preparation now, rather than reacting later? It’s not just about money; it’s about reclaiming control in an unpredictable world.