Money slips away, faster than you can say «unexpected expense,» and suddenly, you’re staring at a bank statement that doesn’t add up. Here’s the uncomfortable truth: in a world where 78% of Americans live paycheck to paycheck, according to a recent survey, mastering your finances isn’t about fancy apps—it’s about simple tools like spreadsheets that put you in control. This tutorial dives into budgeting with spreadsheets, showing you how to turn chaos into clarity, one cell at a time. By the end, you’ll have a personalized plan that not only tracks your spending but also builds a buffer for life’s curveballs, all while keeping your wallet healthier than ever.

My Wake-Up Call with Spreadsheets

Picture this: a few years back, I was knee-deep in credit card debt, juggling bills like a circus act gone wrong. And that’s when it hit me—staring at a pile of receipts after a particularly rough month. I’d always thought budgeting was for the uber-organized types, but spreadsheets? They were my game-changer. I remember firing up Excel for the first time, fumbling with formulas, and finally seeing my spending habits laid bare. It was like holding a mirror to my financial soul.

This isn’t just my story; it’s a lesson in empowerment. Spreadsheets, with their grid-like simplicity, act as a **personal finance lifeline**, allowing you to input income, expenses, and savings goals without the fluff of paid apps. I mean, who needs a subscription when you can whip up a budget template in Google Sheets for free? From my perspective, it’s the ultimate democratization of financial tools—everyone, regardless of background, can use them. Take it from someone who’s been there: starting small, like tracking your daily coffee runs, can lead to big revelations. And just to add a twist, think of spreadsheets as your very own «Fort Knox» for money management, guarding your dollars with precision.

The Unexpected Ally in Daily Life

What surprised me most was how spreadsheets adapt to real life. They’re not rigid; they’re flexible, like a chameleon in the finance world. Whether you’re in the US dodging inflation or across the pond in the UK facing different economic pressures, a well-crafted spreadsheet can adjust to local costs—think utility bills or currency fluctuations.

From Ancient Ledgers to Modern Sheets

Fast-forward from the merchants of ancient Rome, who etched transactions on wax tablets, to today’s digital era—spreadsheets have evolved, but their core purpose remains: tracking wealth. It’s a fascinating comparison, really. Back then, a misplaced digit could mean ruin; now, with tools like Microsoft Excel or Google Sheets, auto-calculations do the heavy lifting, making **spreadsheet budgeting** accessible to all.

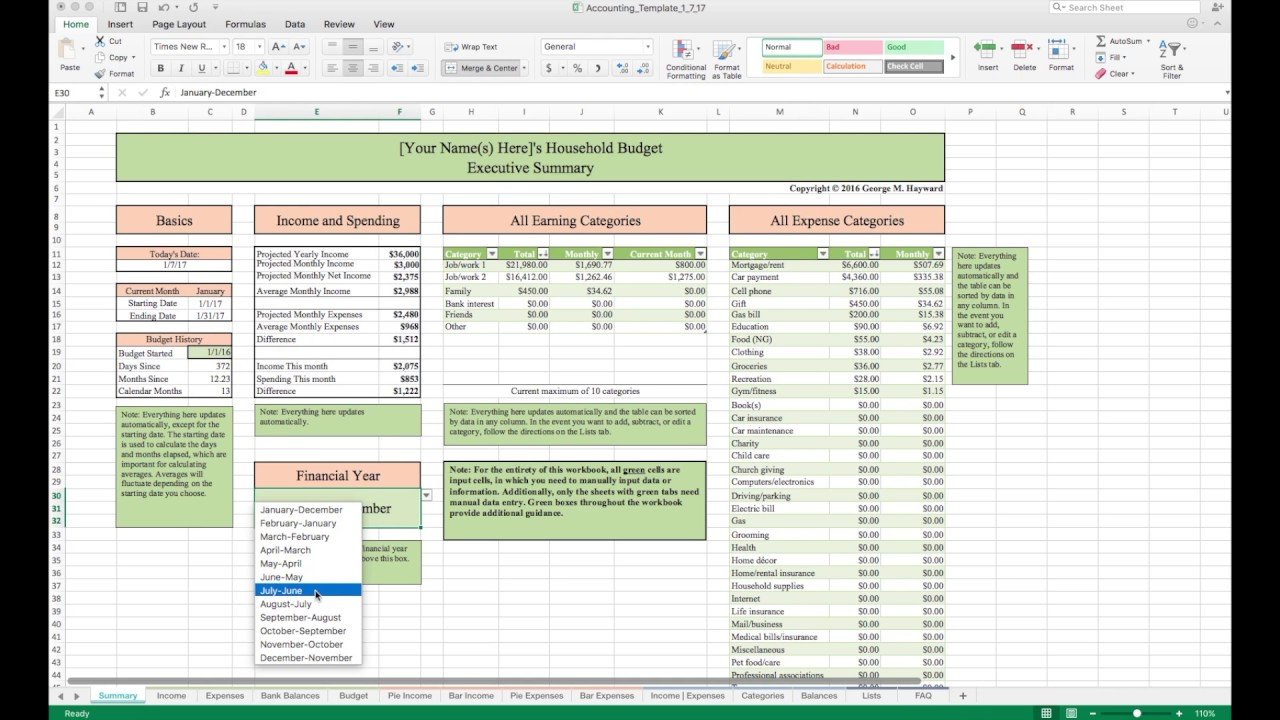

Here’s where it gets intriguing. In historical contexts, like the ledger books of the Renaissance bankers, every entry was a lesson in discipline. Similarly, modern spreadsheets force you to confront spending patterns—perhaps revealing that your entertainment budget rivals a Medici’s extravagance. But let’s bust a myth: not all spreadsheets are created equal. A basic Excel sheet might suit casual users, while Google Sheets offers real-time collaboration, ideal for couples budgeting together. To illustrate, here’s a quick table comparing the two for personal finance needs:

| Feature | Microsoft Excel | Google Sheets |

|---|---|---|

| Cost | Part of Office suite (paid) | Free with Google account |

| Ease of Use | Advanced features, steeper learning curve | Intuitive, cloud-based access |

| Best For | Detailed financial modeling | Quick, shared budgeting on the go |

This evolution underscores a deeper truth: **how to budget using spreadsheets** isn’t about technology; it’s about building habits that stick, much like how those old ledgers taught fiscal responsibility.

Tackling Budgeting Pitfalls Head-On

Okay, let’s get real—nobody’s perfect, and spreadsheets can trip you up if you’re not careful. Imagine trying to balance your budget only to realize you’ve double-counted expenses; it’s like that scene in «The Office» where Michael’s financial schemes fall apart. But instead of laughing it off, let’s fix it with a practical exercise.

Start by identifying common traps, such as overlooking irregular costs like car repairs. Here’s how: 1. List your fixed expenses first, like rent and utilities. 2. Add variable ones, such as groceries, with a buffer. 3. Use conditional formatting in your spreadsheet to highlight overspending—red for warnings, green for wins. This approach turns potential pitfalls into stepping stones, making **personal finance budgeting** less daunting.

From my view, the irony is that spreadsheets, often seen as cold and mechanical, actually foster a human connection to your money. They’re not just tools; they’re your financial confidants, revealing truths you’d rather ignore.

Wrapping It Up with a Fresh Angle

In wrapping this up, consider this twist: what if your spreadsheet isn’t just a budget tool, but a roadmap to freedom? By mastering **budgeting with spreadsheets**, you’re not merely tracking dollars—you’re reclaiming control over your life’s direction. So, take action now: pull up your preferred sheet, input last month’s expenses, and watch patterns emerge. It’ll be eye-opening, I promise.

And one last thought: what’s one change you’d make to your financial routine based on this? Share in the comments; let’s start a real conversation about making money work for us, not against.