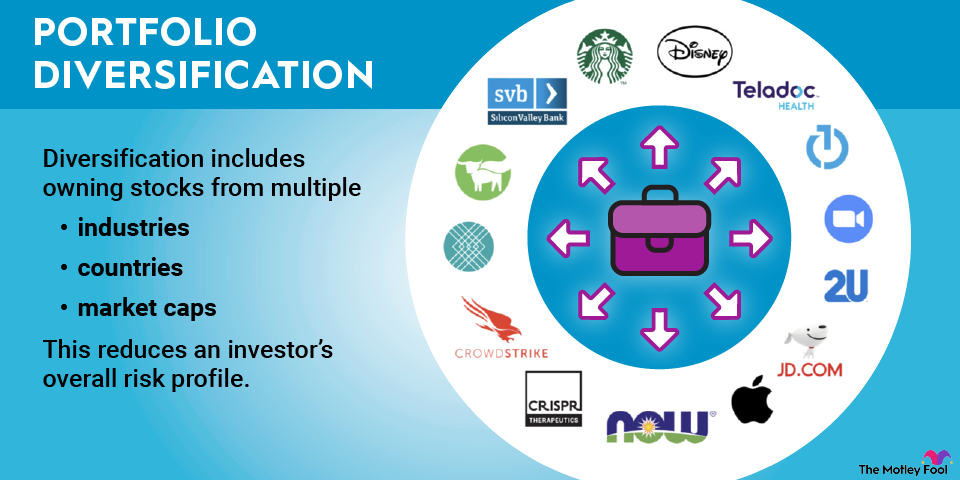

Money whispers secrets. In a world where fortunes rise and fall like unpredictable tides, the harsh truth is that putting all your eggs in one basket can lead to heartbreak. Think about it: over 70% of investors who don’t diversify end up facing unnecessary losses during market downturns. But here’s the silver lining—by mastering strategies to diversify your investment portfolio, you can shield your hard-earned wealth and pave the way for steady growth. In this article, we’ll dive into practical, real-world approaches that go beyond the basics, drawing from personal insights and timeless wisdom to help you navigate the financial seas with confidence.

That Fateful Market Crash: A Personal Wake-Up Call

Let me take you back to 2008, when the global financial crisis hit like a freight train I never saw coming. I was a mid-level analyst, overly confident in tech stocks that had been soaring for years. «This is the future,» I thought, pouring most of my savings into a handful of big names. And then, just like that, the bubble burst. Watching my portfolio shrink by 40% in months was a gut punch that taught me the irreplaceable value of diversification. It’s not just about spreading risk; it’s about creating a safety net for life’s uncertainties.

In my opinion, based on years of watching markets ebb and flow, diversification isn’t a luxury—it’s a necessity. I remember sifting through endless reports, realizing that asset allocation strategies could have softened the blow. By mixing stocks, bonds, and even real estate, you build resilience. Think of it as planting a garden with various crops; if one fails, others thrive. This approach isn’t foolproof, but it drastically reduces volatility. And that’s when the markets started to teach me: diversity isn’t just smart; it’s survival.

Unexpected Allies in Your Portfolio

Digging deeper, I discovered international investments as an unexpected ally. Ignoring global markets back then was my biggest regret—focusing solely on U.S. equities meant missing out on emerging opportunities in Asia. Today, incorporating risk diversification strategies like exchange-traded funds (ETFs) that span continents has become my go-to. It’s like adding spices to a stew; a little from everywhere enhances the flavor without overwhelming it.

Wall Street Echoes: Historical Parallels That Shape Modern Investing

Fast-forward to the Roaring Twenties, when speculators rode the stock market wave only to crash in 1929. It’s a stark reminder that history doesn’t repeat, but it rhymes, as Mark Twain might say—though in finance, that rhyme often sounds like a warning bell. Comparing that era to today’s volatile crypto scene, we see how over-concentration in high-flying assets led to ruin. Investors then, much like some today, ignored the basics of diversifying investment portfolios, betting everything on momentum.

From a serious standpoint, this historical lens reveals that diversification has always been key to longevity. Take the post-WWII boom; those who balanced their holdings across industries outpaced the risk-takers. It’s not about chasing trends but building a mosaic of assets. For instance, blending alternative investments like commodities with traditional stocks mirrors how post-war economies stabilized through varied resources. This comparison underscores a uncomfortable truth: ignoring diversification is like ignoring the lessons of the past, and in finance, that can cost you dearly.

To put this in perspective, let’s break it down with a simple table comparing two approaches—concentrated vs. diversified portfolios:

| Aspect | Concentrated Portfolio | Diversified Portfolio |

|---|---|---|

| Risk Level | High—One bad sector tanks everything. | Lower—Losses in one area are offset by gains elsewhere. |

| Potential Returns | High if it hits, but often volatile. | Moderate and steady, like a reliable old friend. |

| Long-Term Outlook | Unpredictable, prone to market whims. | More stable, aligning with goals like retirement. |

This isn’t just history; it’s a blueprint. By drawing from these parallels, you can avoid the pitfalls that have tripped up generations.

The Hidden Dangers: Irony in Overconfidence and How to Overcome It

Here’s a twist that’s all too common: many investors pat themselves on the back for picking winners, only to find that overconfidence is the silent thief of wealth. I recall advising a friend who swore by a single stock, dubbing it «the next big thing.» When it plummeted, he muttered, «Who could’ve seen that coming?» The irony? Basic diversification techniques could have saved him. It’s like thinking you’re invincible in a storm just because you’ve dodged a few raindrops.

To tackle this, start by auditing your holdings—perhaps using tools like portfolio trackers that highlight imbalances. Step 1: Identify your current asset classes. Step 2: Allocate based on your risk tolerance; for example, younger investors might lean 60% stocks and 40% bonds. Step 3: Rebalance quarterly to maintain that mix. This methodical approach transforms irony into empowerment, turning potential losses into learning opportunities. And don’t forget, in finance, it’s not about being perfect; it’s about being prepared.

A Mini Experiment to Try at Home

Why not put this to the test? Grab your investment statements and map out your exposures. You’ll likely uncover blind spots, like over-reliance on tech stocks—a nod to how even Silicon Valley darlings can falter, much like the plot twists in «The Big Short.» This exercise isn’t just eye-opening; it’s a serious step toward mastering your financial destiny.

In wrapping up, consider this twist: what if diversification isn’t just about money, but about freedom? By applying these strategies, you’re not merely protecting assets; you’re securing peace of mind. So, take action now—review your portfolio and adjust for balance. What’s one change you’ll make today to ensure your investments weather any storm? Share your thoughts in the comments; let’s keep the conversation going.