As the markets twist, money slips away. It’s a harsh truth: traditional investing often feels like a club for the elite, with hefty fees and complex jargon gatecrashing your dreams of financial freedom. Yet, here’s the contradiction—robo-advisors, those automated investing platforms, democratize access to smart strategies without the bank-breaking costs. In this article, we’ll unpack why using robo-advisors for investing isn’t just a trend; it’s a practical path to building wealth, especially if you’re juggling a day job and want straightforward, low-cost financial guidance. By the end, you’ll see how this tech can empower your portfolio, making expert advice as accessible as your smartphone app.

My Unexpected Dive into Automated Wealth Building

Picture this: a few years back, I was buried under student loans, staring at my first real paycheck, thinking, «How on earth do I turn this into a nest egg?» I’d tried a traditional financial advisor once—paid a pretty penny for what felt like generic advice that didn’t quite fit my life. And just when I thought I’d cracked it, the market dipped, and so did my confidence. That’s where robo-advisors entered the scene for me, like a silent partner in my corner.

These digital helpers, essentially algorithms powered by AI, craft personalized investment portfolios based on your goals, risk tolerance, and even your time horizon. Unlike my human advisor experience, which was riddled with subjective biases, robo-advisors stick to data-driven decisions. Robo-advisors for investing cut through the noise, offering diversification across stocks, bonds, and ETFs without the emotional highs and lows. My turning point came when I switched; suddenly, my returns weren’t just surviving market volatility—they were thriving. The lesson? Technology doesn’t replace intuition; it amplifies it, letting you focus on what matters, like living your life while your money works smarter.

To add a personal spin, I remember using a platform like Betterment—ironic, right, since it literally means improvement—and watching my investments grow steadily. It’s not about flashy gains; it’s the steady climb that counts. In a country like the US, where automated investing has boomed since the 2008 crisis, this approach feels like a cultural shift, moving from Wall Street’s old boys’ club to everyday folks taking charge.

From Ancient Markets to Digital Democracy: A Financial Evolution

Let’s rewind to the 18th century, when stock exchanges like the London Stock Exchange were born, relying on human brokers who, let’s face it, could be as unpredictable as a British weather forecast. Fast-forward to today, and robo-advisors represent a quiet revolution, blending that historical grit with modern tech. It’s like comparing a hand-cranked car to a Tesla—both get you places, but one does it with precision and efficiency.

In the US, we’ve got this «Wild West» mentality in finance, where innovation runs rampant, but it often leaves novices in the dust. Enter robo-advisors as the great equalizer. They use algorithms to rebalance your portfolio automatically, minimizing taxes through strategies like tax-loss harvesting—something that sounds straight out of a sci-fi flick, but it’s real. A low-cost investing option, they typically charge fees under 0.50%, compared to 1% or more for human advisors. Think about it: that savings can compound over time, turning pennies into thousands.

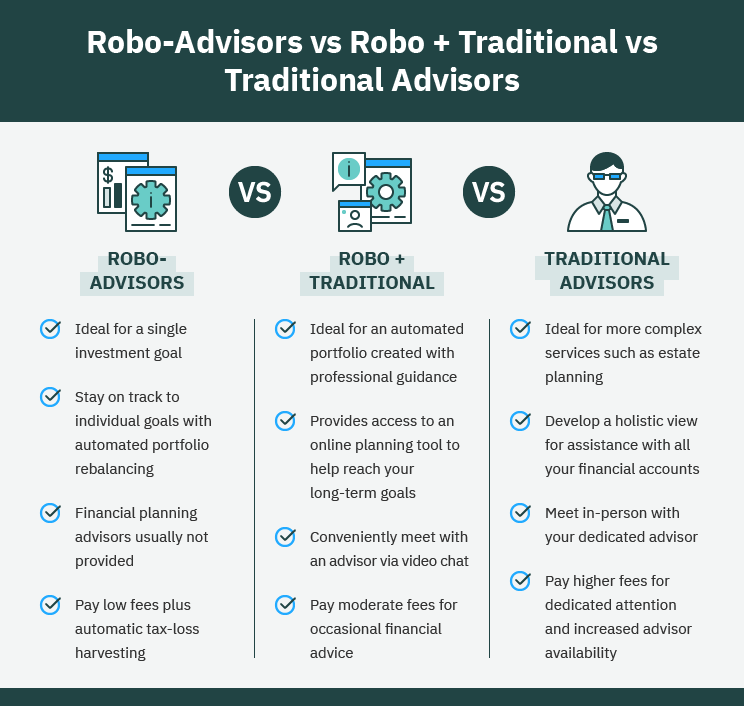

Here’s a simple comparison to drive the point home:

| Aspect | Traditional Advisors | Robo-Advisors |

|---|---|---|

| Cost | 1-2% annual fees | 0.25-0.50% or less |

| Accessibility | Requires meetings and minimum investments | 24/7 access via app, no minimums often |

| Personalization | Human insight, but prone to bias | Data-backed, adaptive to market changes |

| Advantages | Emotional support in crises | Consistent performance, less emotional interference |

This evolution isn’t just tech for tech’s sake; it’s about making financial advice as democratic as voting. And if you’re skeptical, imagine chatting with a doubtful friend: «Sure, it’s all algorithms, but would you rather have a human who’s tired from their last client or a machine that’s always on point?»

The Overlooked Pitfalls of Hands-On Investing and How Automation Fixes Them

We’ve all heard the saying, «Don’t put all your eggs in one basket,» but in finance, that basket often gets heavier with human errors—like chasing hot stocks only to watch them cool. The irony? While human advisors bring empathy, they also introduce fees that erode your returns faster than a bad market day. Enter robo-advisors as the unsung heroes, tackling these issues head-on.

For instance, behavioral finance shows how emotions lead to poor decisions, like panic-selling during downturns. Robo-advisors, with their unyielding logic, keep your strategy intact. I once dodged a bullet myself—passive investing through a robo-platform meant I didn’t sell low when the market mimicked that chaotic scene from «The Big Short.» You know, where experts are scrambling, but algorithms just chug along.

Here’s a quick exercise for you: Grab your current investment statements and calculate the fees you’re paying. Now, compare that to what a robo-advisor offers. 1. Assess your risk level honestly. 2. Look up a platform like Vanguard’s or Wealthfront. 3. Simulate a portfolio transfer. It’s eye-opening, and it might just save you money in the long run. By addressing these pitfalls, AI-based investment tools don’t just protect your wealth—they help it grow steadily, like a reliable old friend who’s always got your back.

In wrapping this up, here’s the twist: While robo-advisors might seem cold and calculated, they’re actually about giving you back control, turning investing from a chore into a confident stride. So, take action now—sign up for a free trial on a reputable robo-advisor and watch your financial future unfold. And ballpark figure this: What if your money could work as hard as you do? It’s a serious question that might just spark your next move: Are you ready to let technology handle the heavy lifting in your investment journey, or will you stick with the status quo and miss out?