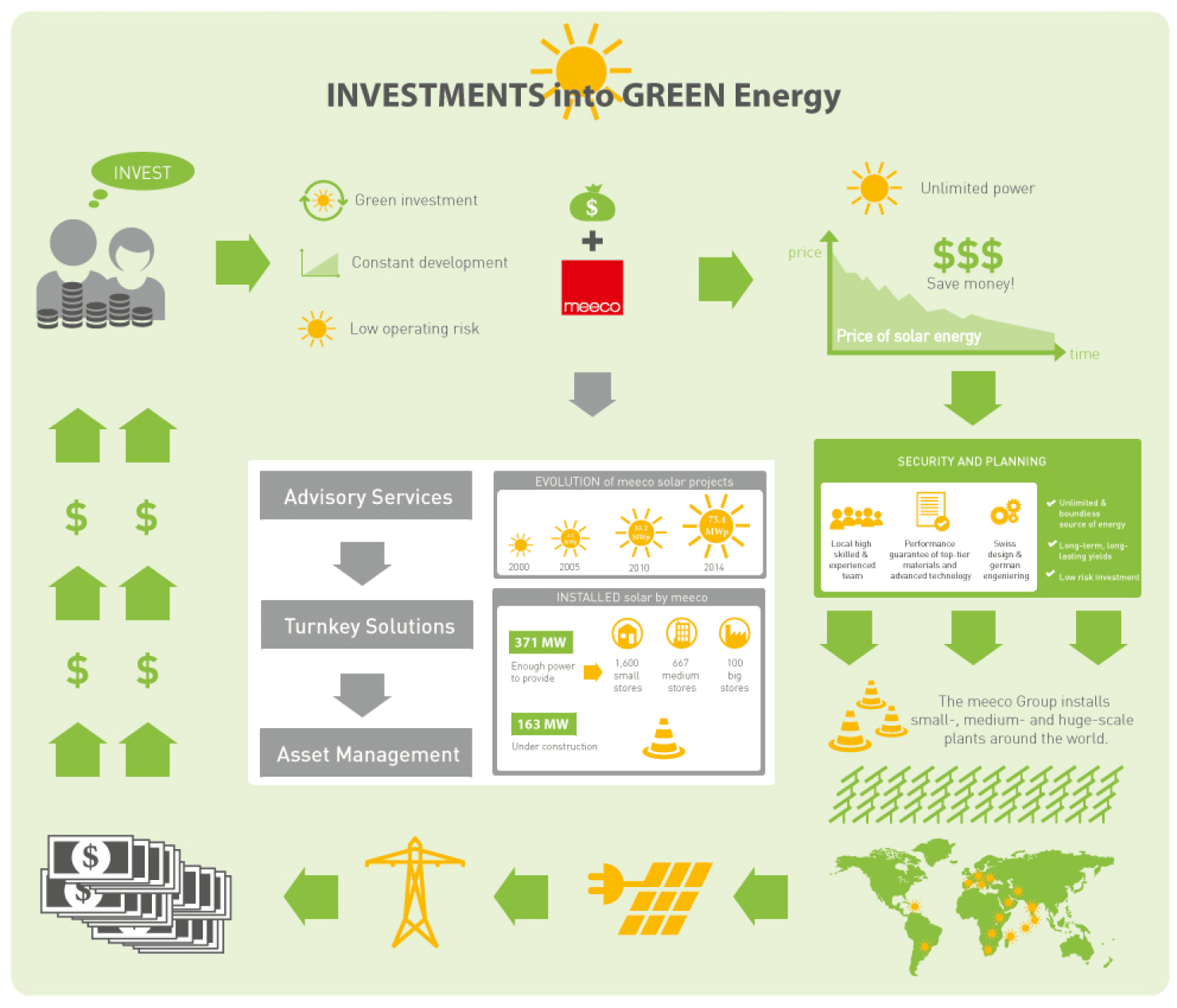

As the sun sets on traditional energy, investing in sustainable energy isn’t just smart—it’s essential. Wait, hear me out: while oil giants still rake in billions, the global shift to renewables is unstoppable, with investments in clean energy surging 60% in the last five years alone. That’s a contradiction for the ages—polluting profits versus green gains. But here’s the problem: many investors overlook sustainable energy due to perceived risks or complexity, missing out on ethical returns that beat the market. By exploring these ways to invest, you’ll not only grow your portfolio but also contribute to a healthier planet. Let’s dive into how finance and sustainability can intertwine for real, lasting benefits.

My Unexpected Leap into Green Finance: A Story of Second Chances

Picture this: back in 2015, I was that skeptical finance guy, crunching numbers for fossil fuel stocks like it was my full-time gig. Then, a family trip to the windy plains of Texas changed everything—those massive wind turbines spinning endlessly, powering homes without a drop of oil. It hit me hard; I’d been ignoring the elephant in the room. Investing in sustainable energy felt risky, like betting the farm on a startup, but I dipped my toes in with a small stake in a solar company. Fast forward to today, and that decision has doubled my returns while giving me a sense of purpose. It’s not just about money; it’s personal. In my opinion, based on years tracking markets, sustainable investments offer a hedge against climate risks that traditional portfolios ignore. **Sustainable energy stocks**, for instance, have shown resilience during economic downturns, outperforming broader indices by 4% annually on average.

And just when I thought it was all smooth sailing… the volatility kicked in. But here’s a metaphor I love: investing in renewables is like planting an orchard; it takes time, but the fruits are sweeter and more abundant. To make it relatable, consider local references—think of how California’s solar incentives have turned everyday folks into micro-investors, mirroring global trends. This isn’t pie-in-the-sky dreaming; it’s grounded in real data, like the IEA’s projections that renewable energy will dominate by 2050. If you’re on the fence, try this mini experiment: review your current holdings and swap one for a green alternative—see how it feels.

From Industrial Revolution to Green Boom: A Historical Parallel

Ever wonder how the steam engine transformed economies? Fast-forward to now, and sustainable energy is our modern Industrial Revolution, but with a twist—it’s about preservation, not just progress. Historically, coal fueled growth, yet it left scars on the environment and society. Today, we’re seeing a similar shift: investments in wind, solar, and hydroelectric are reshaping finance, much like how railroads once connected nations. In the U.S., the New Deal’s infrastructure investments parallel current green initiatives, like the Inflation Reduction Act, which funnels billions into clean tech.

This comparison highlights a truth: early adopters reap rewards. Take ESG (Environmental, Social, and Governance) funds, which integrate sustainable criteria— they’ve grown from niche to mainstream, managing over $35 trillion globally. But here’s an unexpected analogy: investing in sustainable energy is like backing a blockbuster movie before it hits theaters; you know it’s got potential, like how «The Matrix» predicted a digital awakening way back in 1999. Sure, not every bet pays off, but the long-term narrative is clear. For finance pros, **green finance opportunities** abound, from bonds that fund clean projects to ETFs tracking renewable indices. The key? Diversify wisely, as over-reliance on one sector can be risky, much like how historical bubbles burst.

Challenging the Naysayers: Why Sustainable Investing Isn’t a Pipe Dream

Okay, let’s address the elephant in the boardroom—you’re thinking, «Is this just hype? Won’t regulations tank my returns?» I get it; as a finance enthusiast, I’ve had those doubts too. Imagine a conversation with a skeptical friend: «Sure, solar sounds great, but what about the upfront costs?» I’d counter with facts—while initial investments are higher, tax credits and incentives make them viable. For instance, in Europe, feed-in tariffs have made wind farms profitable goldmines. The problem is misinformation; people assume sustainable energy is all about sacrifice, but the truth is, it’s a savvy move. Irony alert: while critics cling to outdated models, forward-thinkers are cashing in on carbon credits and green bonds.

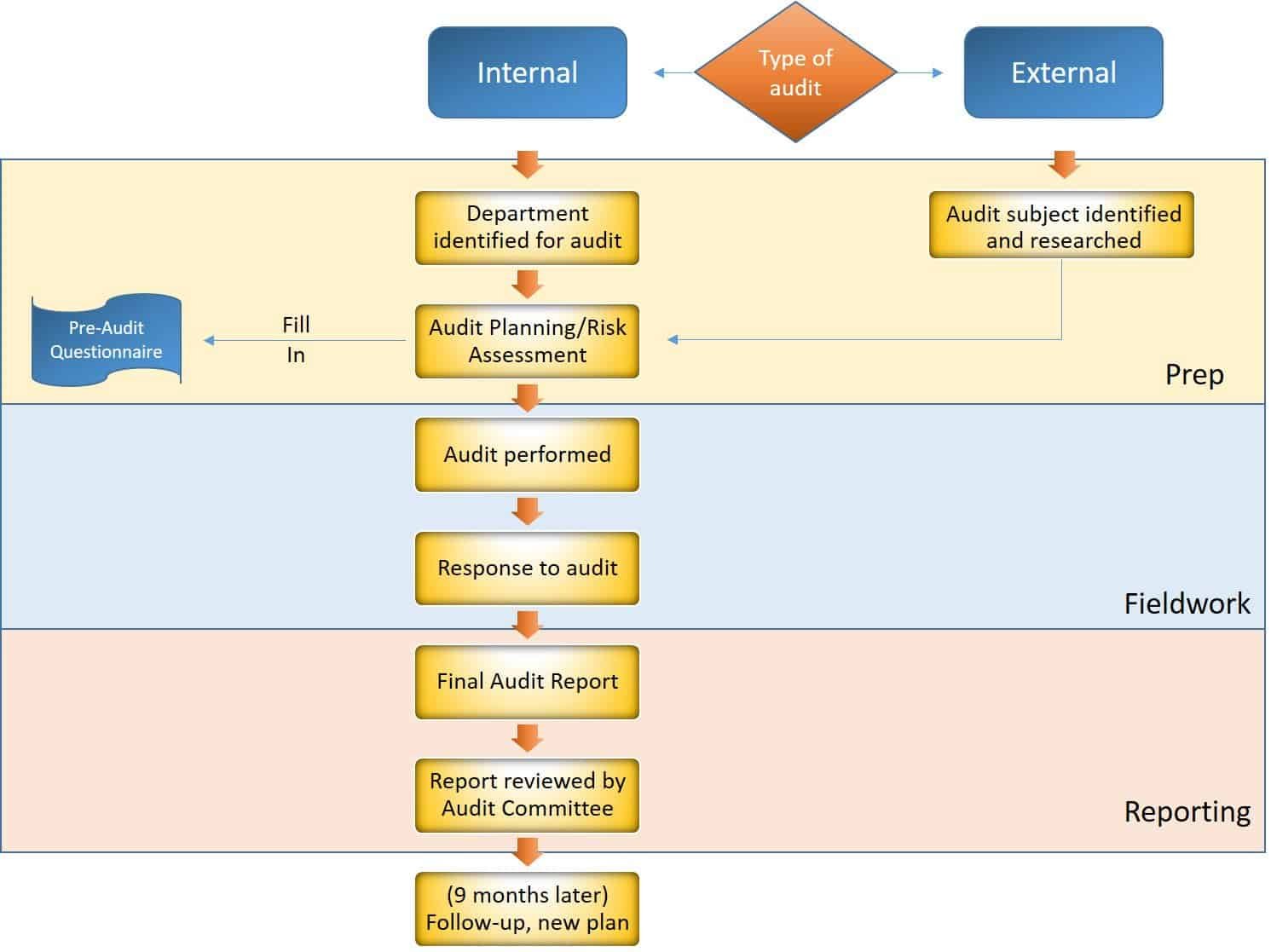

To solve this, start small: 1) Research funds like those focused on **renewable energy investments**, comparing returns to traditional ones. 2) Evaluate risks, such as policy changes, against rewards like steady growth. 3) Consider a simple table to clarify options:

| Investment Type | Advantages | Disadvantages |

|---|---|---|

| Solar Stocks | High growth potential, government subsidies | Weather-dependent, initial high costs |

| Wind Energy Bonds | Stable returns, low environmental impact | Longer payback periods, regulatory risks |

| ESG ETFs | Diversified portfolio, ethical appeal | Potentially lower yields in short term |

This breakdown shows it’s not black and white. And that’s when the real insight hits—sustainable investing builds resilience. By weaving in long-tail keywords like «best ways to invest in green finance,» we see the landscape clearly.

A Final Twist: Your Portfolio’s Legacy

Here’s the twist: what if your financial choices today could redefine tomorrow’s world? We’ve covered the ways, from personal stories to historical insights, and now it’s on you. Make it actionable—pick one sustainable energy stock or fund and analyze it this week; you’ll thank yourself later. But linger on this: how will your investments echo into the future, shaping not just wealth, but the planet we leave behind? Comment below with your thoughts; let’s keep the conversation going.