Wealth builds silently, often overlooked in the hustle of daily life. Did you know that Albert Einstein once dubbed compound interest the «eighth wonder of the world»? It’s a stark contradiction to how we treat money as something static, yet this financial force can turn a modest savings into a fortune over time. Many folks, myself included, have stumbled through early careers without grasping its power, missing out on exponential growth that could secure a comfortable retirement. But here’s the benefit for you: by mastering compound interest basics, you’ll gain a tool to build wealth steadily, turning everyday saving into a strategic advantage in an unpredictable economy. Let’s dive in, shall we?

A Time I Let Money Work for Me

Picture this: back in my early twenties, fresh out of college and buried in student loans, I stumbled upon compound interest almost by accident. I had a small inheritance—nothing extravagant, maybe a couple thousand bucks—and instead of blowing it on gadgets, I parked it in a high-yield savings account. Fast forward a decade, and that initial sum had ballooned thanks to interest compounding annually. It wasn’t a get-rich-quick scheme; it was more like watching a seed grow into a tree, quietly but persistently. I remember thinking, «And that’s when it hit me—money can multiply without me lifting a finger.» This personal lesson taught me that compound interest basics aren’t just numbers; they’re a pathway to financial independence. If you’re skeptical, imagine starting with $1,000 at a 5% annual rate; after 10 years, it’s worth over $1,600. My opinion? Early action is key, as delaying can cost you thousands in lost growth.

The Ancient Roots of Exponential Growth

Fast-forward from my story to history’s grand stage: compound interest has been shaping economies for centuries, from ancient Babylonian loan tablets to medieval European trade. Think about it—like a virus spreading undetected, compound interest fueled the Renaissance by allowing merchants to reinvest profits, turning small ventures into empires. In contrast to simple interest, which is straightforward like a straight-line path, compound interest twists and turns, mirroring the complexity of human ambition. For instance, the Medici family in 15th-century Italy used it to dominate banking, proving that how compound interest works isn’t just modern finance; it’s a timeless strategy. A cultural nod here: in the U.S., we often say «get ahead of the game,» echoing how early adopters like those Italian bankers outpaced their peers. This historical comparison underscores a hard truth—ignoring compound interest tutorial elements means leaving money on the table, much like skipping a chapter in a blockbuster saga such as «The Godfather,» where family legacies build over generations.

When Misconceptions Meet Reality: A Gentle Wake-Up Call

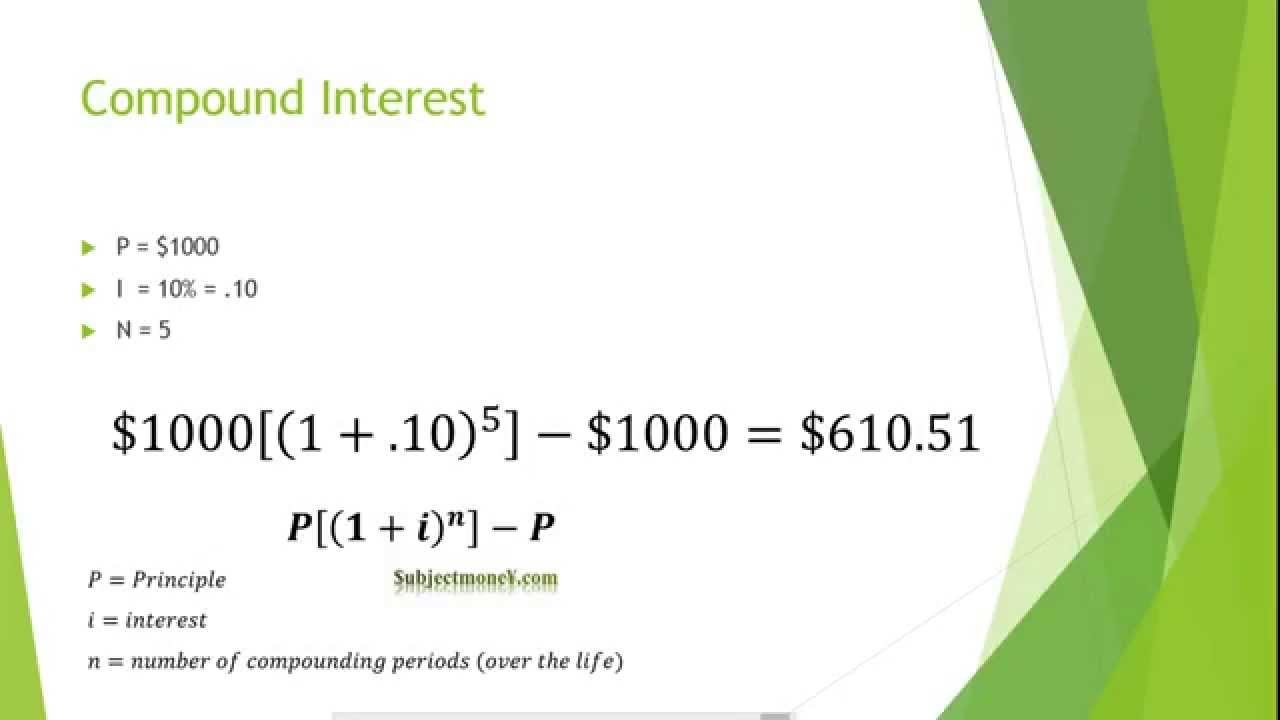

Here’s a problem that irks me: too many people buy into the myth that compound interest is only for the wealthy or requires complex investments. Irony alert—it’s actually accessible to anyone with a basic savings account, yet folks treat it like rocket science. Take the «Rule of 72,» a ballpark figure in finance that estimates how long it takes to double your money; for example, at 6% interest, it takes about 12 years. But wait, the solution is simpler than you think: start small and let time do the heavy lifting. In my view, this is where investment basics shine, turning a overlooked tool into a powerhouse. To put it in perspective, compare simple interest versus compound in this straightforward table:

| Aspect | Simple Interest | Compound Interest |

|---|---|---|

| Calculation Base | Principal only | Principal + accumulated interest |

| Growth Example ($1,000 at 5% for 10 years) | $500 total interest | $628 total interest |

| Advantages | Easier to understand | Exponential growth potential |

| Disadvantages | Limited returns | Requires patience and consistency |

As you can see, compound interest isn’t just better; it’s transformative. And just there, in the details, lies the magic—benefits of compound interest like this can sneak up on you, much like that plot twist in a serious drama series. No exaggeration, it’s the quiet hero of your financial story.

Wrapping It Up with a Fresh Perspective

In a twist, what if I told you that compound interest isn’t about getting rich overnight but about outsmarting time itself? It’s the ultimate long game, where patience pays off in ways simple saving never could. So, here’s a specific call to action: grab a calculator right now and plug in your numbers using a free online compound interest tool—what’s your $100 monthly investment worth in 20 years at 7%? Finally, a reflective question: how will you adjust your financial habits today to ensure tomorrow’s security? Share your thoughts in the comments; it’s more than curiosity—it’s a step toward real change.