Money whispers secrets. In a world where financial missteps can echo for years, choosing the wrong advisor isn’t just a bad day—it’s a costly regret. Did you know that nearly 70% of Americans distrust financial advice they receive? That’s a stark contradiction to the promise of expertise these professionals offer. Yet, amid the chaos of market fluctuations and personal budgeting woes, the right financial advisor can turn your fiscal future from a gamble into a solid plan. This guide dives deep into how to choose a financial advisor, drawing from real experiences and hard truths, so you can safeguard your wealth and sleep easier at night.

My Wake-Up Call with Bad Advice

Picture this: a few years back, I was drowning in student loans and stock market hype, thinking I had it all figured out. Then, I met a so-called expert who promised the moon—quick flips on tech stocks that sounded too good to pass up. Selecting a financial advisor felt like picking a partner for life, but this one left me nursing losses that stung for months. It was a personal low point, where I realized, firsthand, that charm doesn’t equal competence. I remember staring at my statements, thinking, «And that’s when it hit me…»—the importance of digging deeper than surface credentials.

This anecdote isn’t just venting; it’s a lesson wrapped in reality. In finance, trust builds on transparency. From my experience, always insist on a fiduciary advisor—one who’s legally obligated to put your interests first, not their commissions. It’s like choosing a doctor who swears by the Hippocratic Oath; anything less is a risk. Opinions vary, but I firmly believe that in the U.S., where Wall Street’s allure often overshadows Main Street needs, demanding this standard isn’t negotiable. To weave in a cultural nod, it’s akin to how Southern folks value a firm handshake—it’s about reliability, not flash.

Unpacking the Credentials That Matter

Beyond the basics, look for certifications like CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst). These aren’t just letters; they’re badges earned through rigorous exams and ethics training, ensuring your advisor isn’t winging it.

Lessons from Wall Street Legends

Ever wonder how icons like Warren Buffett built empires? It’s not magic; it’s strategy honed through wise counsel. Comparing historical figures to modern advisors reveals stark contrasts. Take Buffett’s mentor, Benjamin Graham, whose value investing principles emphasized long-term growth over quick wins. In today’s finance landscape, this historical wisdom clashes with the get-rich-quick vibes of apps like Robinhood, which can lure you into impulsive trades. But here’s the truth: a good advisor acts as your Graham, guiding you through market storms with data-driven advice, not hype.

This comparison isn’t academic—it’s a wake-up call. In American culture, where the «American Dream» often means chasing stocks like in a Hollywood blockbuster, it’s easy to forget that financial planning requires patience. Ironic, isn’t it? We idolize figures from «The Wolf of Wall Street,» yet Jordan Belfort’s downfall shows the perils of unchecked ambition. So, when evaluating advisors, seek those who echo Graham’s prudence, focusing on your risk tolerance and goals. It’s like sifting gold from fool’s gold; the real deal stands the test of time.

The Pitfalls of Hasty Choices and How to Dodge Them

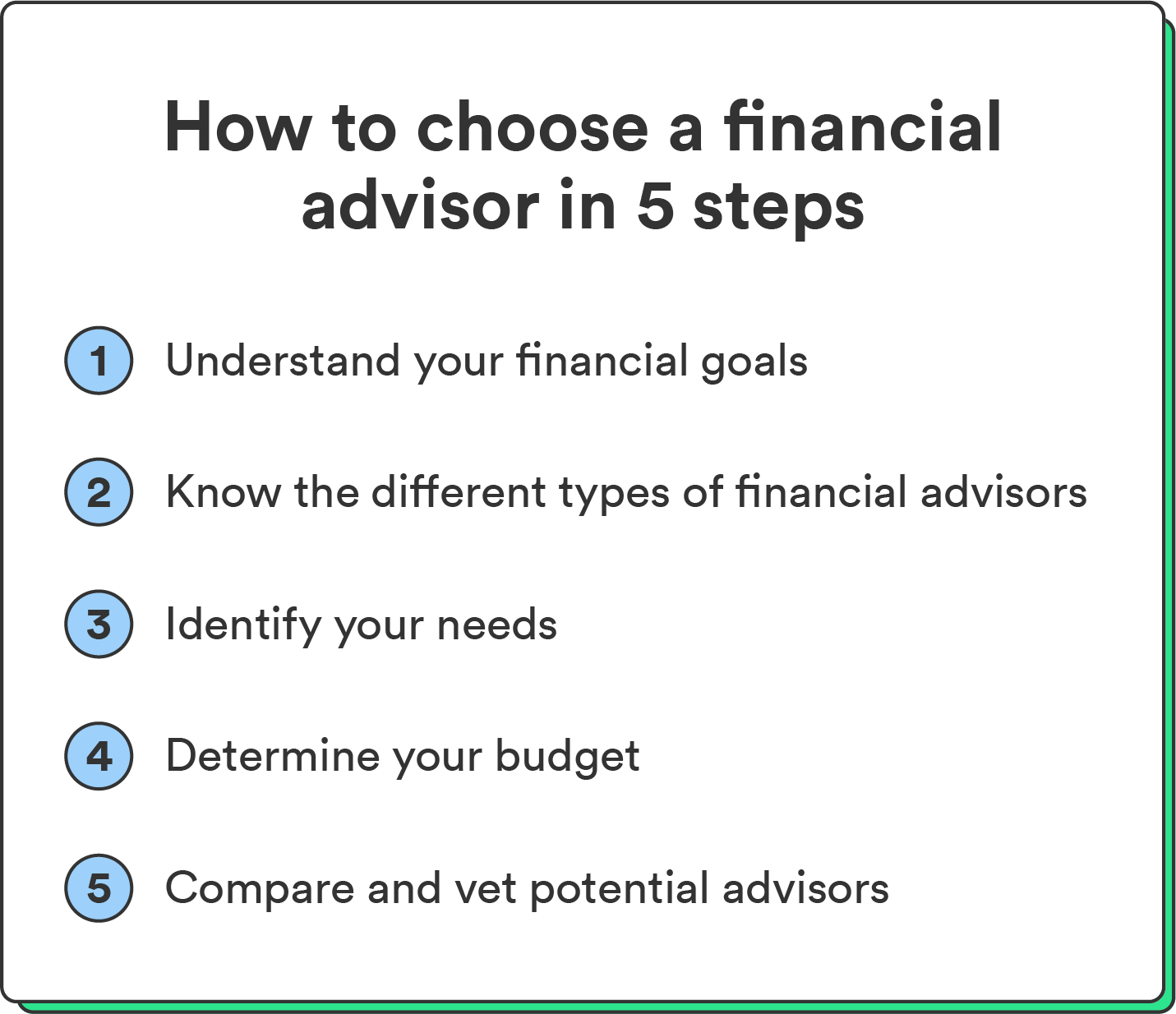

Rushing into an advisor relationship is like buying a house without a home inspection—full of surprises you don’t want. Let’s expose this problem with a touch of irony: in our fast-paced world, we swipe right on financial pros based on reviews alone, only to find they’ve led us astray. The solution? Start with a thorough interview process, where you probe their fee structures and past performance. Fees can break the bank if they’re not transparent; opt for models that align with your success, like fee-only advisors who charge based on assets under management.

To make this practical, consider this mini experiment: Grab a notebook and list three potential advisors. Rate them on factors like communication style and specialization in areas like retirement or estate planning. For instance, if you’re nearing retirement, an advisor versed in investment advice for retirees is on the money. This exercise isn’t fluff; it’s about empowering you to avoid common traps, like overlooking conflicts of interest. And just when you think you’ve got it—bam!—remember, no one advisor fits all, so customize your choice to your life’s unique rhythm.

| Type | Advantages | Disadvantages |

|---|---|---|

| Fee-Only | Transparent costs; client-focused | May lack access to certain products |

| Commission-Based | Potentially lower upfront fees | Conflicts of interest possible |

| Hybrid | Balanced approach | Complexity in fee understanding |

Wrapping It Up with a Fresh Perspective

At the end of the day, choosing a financial advisor isn’t merely about numbers—it’s about building a relationship that secures your legacy. Twist this: What if your advisor becomes the unsung hero of your story, turning financial stress into freedom? So, take action now: Review your current setup and schedule a no-obligation meeting with a potential advisor today. And here’s a reflective question to ponder: How will your choice shape not just your wallet, but your peace of mind? Share your thoughts in the comments; let’s keep the conversation going.