As the clock ticks on tax season, imagine this: overlooked opportunities lurking in your wallet. It’s a stark truth that while HSAs promise tax-free growth, many Americans leave money on the table each year, missing out on thousands in potential savings. But here’s the benefit for you, the reader: by following these steps to maximize HSA contributions, you could turbocharge your financial health, turning what feels like a mundane account into a powerhouse of wealth building. Let’s dive in, drawing from real experiences and practical wisdom to make this journey not just informative, but genuinely transformative.

The Day I Discovered HSA’s Hidden Power

Picture this: five years ago, I was buried under medical bills after a surprise surgery, staring at my HSA statement like it was some foreign language. I’d only contributed the bare minimum, thinking, «Well, that’s enough for now.» Boy, was I wrong. That moment hit me hard—realizing I could have sheltered an extra $1,000 from taxes if I’d maxed it out. It’s a personal anecdote that stings even today, but it taught me a crucial lesson: HSAs aren’t just for emergencies; they’re a strategic tool for maximizing HSA contributions to build long-term wealth.

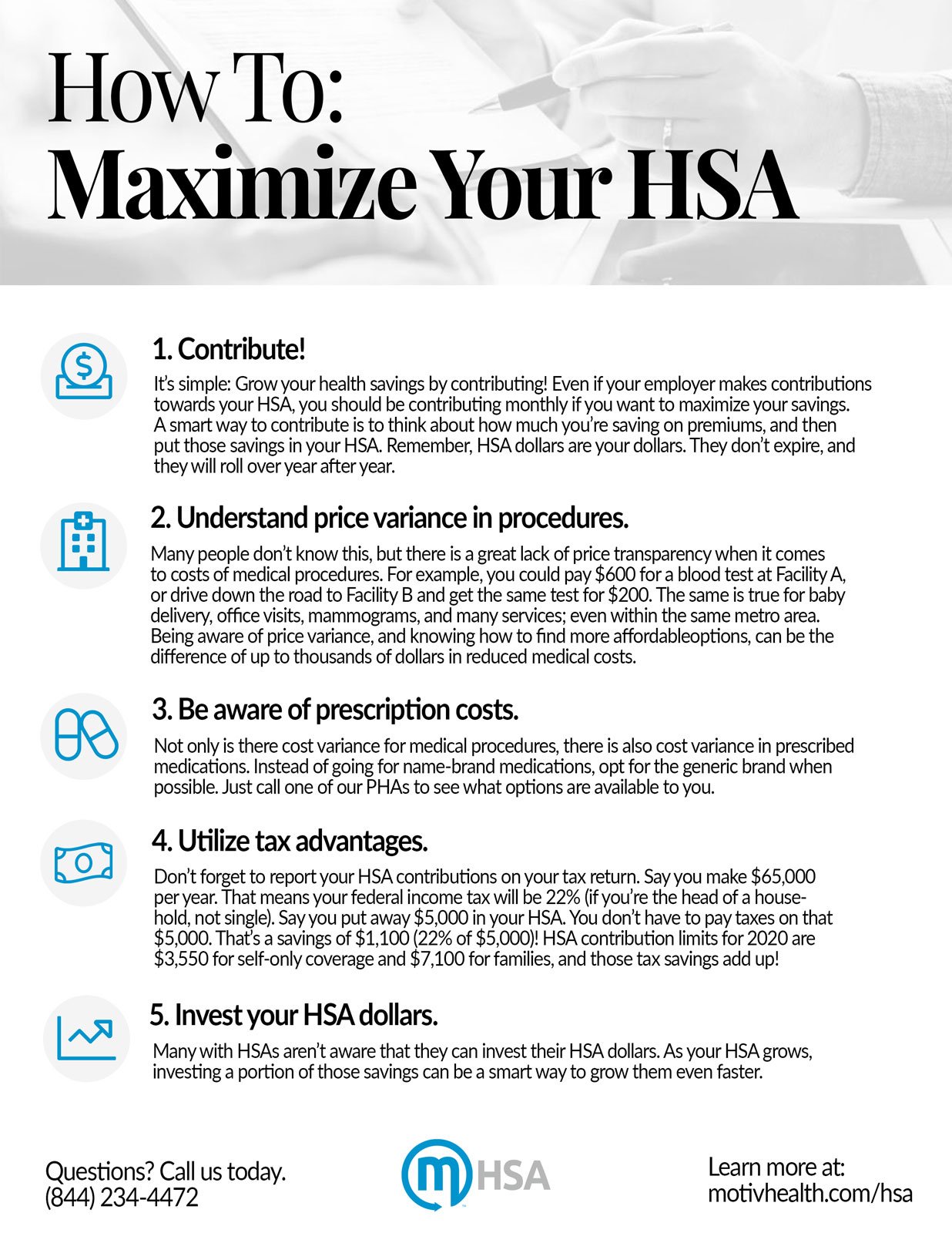

In my case, living in the hustle of New York City, where every dollar feels like it’s slipping away, I started digging deeper. Opinions vary, but mine is straightforward—don’t wait for a crisis to act. The IRS sets annual limits, like $4,150 for individuals in 2023, yet few hit that mark. Why? Life gets in the way, or we undervalue the tax advantages. Think of it as planting seeds in fertile soil; your contributions grow tax-free, and withdrawals for qualified expenses are too. It’s almost like hitting the jackpot, but you have to play smart.

To make this real, consider this unexpected analogy: HSAs are like that reliable old friend who shows up when you need them most, unlike the flashy 401(k) that demands more attention. By front-loading contributions early in the year, you give your money more time to compound. And that’s when it clicked for me—HSA benefits extend far beyond health care, offering a tax deduction that feels like free money.

HSA vs. The Forgotten Vaults of Yesteryear

Ever wonder how our ancestors handled health savings? Back in the 19th century, folks stashed cash in literal vaults or under mattresses, facing inflation and no tax perks. Fast-forward to today, and steps to maximize HSA contributions feel like a modern evolution of that age-old practice, but with safeguards. It’s a cultural comparison that highlights how HSAs blend the thrift of the past with today’s fiscal smarts—offering triple tax advantages that those old-timers could only dream of.

In contrast to a traditional savings account, which might earn a measly 0.01% interest and get taxed to boot, HSAs let your money flourish. Let’s break it down with a simple table to clarify the advantages:

| Feature | HSA | Traditional Savings Account |

|---|---|---|

| Tax Treatment | Contributions tax-deductible, growth tax-free, qualified withdrawals tax-free | Interest taxable as ordinary income |

| Annual Contribution Limit (2023) | Up to $4,150 for individuals | No specific limit, but earnings are taxed |

| Potential Growth | Invested funds can compound significantly | Limited by low interest rates |

This setup isn’t just numbers; it’s a wake-up call. As someone who’s penny wise but pound foolish at times, I see HSAs as the unsung hero in personal finance. By coordinating with your high-deductible health plan, you unlock long-term HSA strategies that beat out historical methods hands down. It’s like comparing a smartphone to a carrier pigeon—both get the job done, but one is infinitely more efficient.

Unpacking the Barriers to Full HSA Potential

What if I told you that the biggest hurdle to maximizing HSA contributions is often our own inertia? It’s an irony that hits close: we chase stock market highs but ignore the steady gains of an HSA. Take my friend’s story—he delayed contributions until December, only to scramble and miss the limit due to employer matching caps. The solution? Start with a plan: 1. Assess your eligible expenses to ensure you’re not over-withdrawing, 2. Automate transfers from your paycheck to hit that annual cap, and 3. Explore investment options within your HSA for better returns.

This approach isn’t rocket science; it’s about shifting perspective. A common myth is that HSAs are too rigid, but the truth is they’re flexible goldmines. For instance, if you’re self-employed, you can deduct contributions directly, turning a potential tax liability into a advantage. And just like in «The Big Short,» where overlooked details led to big wins, paying attention to HSA contribution limits can redefine your financial narrative.

To put this into practice, try a mini experiment: Grab your last tax return and calculate how much you could have contributed last year. See the gap? That’s your opportunity for growth. It’s not about perfection; it’s about progress, even if life throws curveballs.

In wrapping this up, here’s a twist: What if maximizing your HSA isn’t just about money, but about reclaiming control in an uncertain world? So, take action now—review your HSA setup and aim to max out contributions before year-end. And ponder this: How might your future self thank you for these steps today? Share your thoughts in the comments; let’s keep the conversation going.