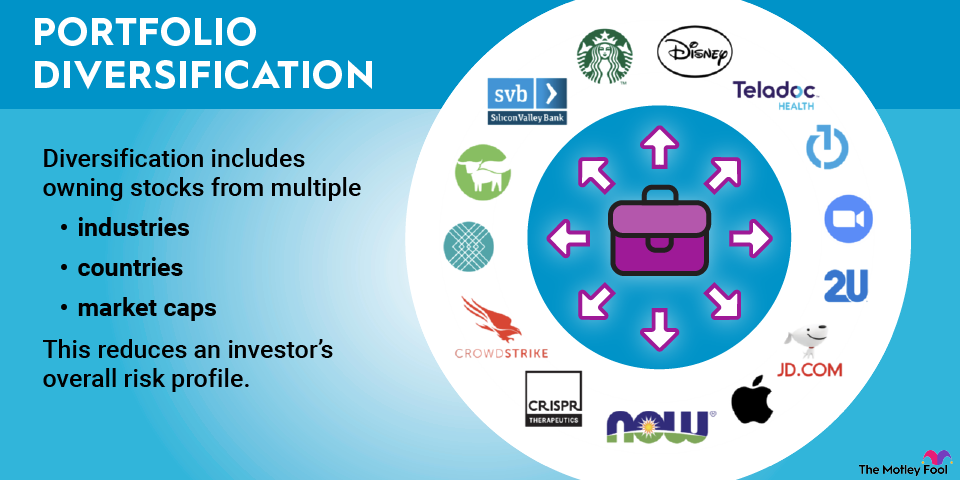

Stocks crash unexpectedly. Economies twist in turmoil, yet savvy investors thrive. Here’s the uncomfortable truth: pouring all your money into a single stock is like betting your life savings on a single roll of the dice. In the world of finance, building a **diversified stock portfolio** isn’t just a strategy—it’s your shield against the unpredictable market waves. By spreading investments across various sectors, you slash risks and boost potential returns, turning what could be a financial nightmare into a story of steady growth. Stick with me, and I’ll share why this approach has been my go-to for years, drawing from real experiences and hard-earned lessons.

A Personal Lesson from the 2008 Crash

Back in 2008, I watched my neighbor’s portfolio evaporate like morning dew under the sun. He’d sunk everything into tech stocks, convinced they were the next big thing. And boy, was he wrong. When the market tumbled, his dreams went with it, leaving him scrambling to recover. That hit close to home for me—Y just like that, I realized how one bad bet can derail everything. Diversification, I thought, might have softened the blow for him. It’s not just about avoiding loss; it’s about creating a buffer that lets you sleep at night.

From my own foray into stocks, I’ve learned that a **diversified stock portfolio** acts as a safety net. Take my early days: I started with a mix of blue-chip stocks, emerging markets, and even some bonds. When one sector dipped, others picked up the slack. My opinion? Diversification isn’t optional; it’s fundamental, especially in volatile times. It echoes that old saying, «Don’t put all your eggs in one basket,» but let’s twist it—it’s like having a fleet of boats instead of a single ship in a storm. This approach, rooted in modern portfolio theory, has saved me from knee-jerk reactions during downturns, proving that spreading out investments can turn uncertainty into opportunity.

The Science Behind Spreading Your Bets

Ever wonder why financial advisors harp on about **stock market diversification**? It’s not hype; it’s backed by numbers. Consider this: a study from Vanguard showed that diversified portfolios historically outperform concentrated ones over the long haul, reducing volatility by up to 30%. But here’s the myth-buster—many think diversification means lower returns, when in reality, it’s about balancing risk and reward. I remember debating this with a skeptical friend over coffee: «Why bother with all those stocks if one could skyrocket?» I countered with a simple truth: what if that star performer crashes instead?

To put it in perspective, let’s compare two paths. On one side, a concentrated portfolio focused on tech giants; on the other, a diversified mix across tech, healthcare, and consumer goods. Here’s a quick breakdown in a table to hit the nail on the head:

| Aspect | Concentrated Portfolio | Diversified Portfolio |

|---|---|---|

| Risk Level | High—One sector fail could wipe out gains. | Lower—Losses in one area are offset by others. |

| Potential Returns | High if it hits, but often inconsistent. | Stable growth, less dramatic ups and downs. |

| Long-Term Suitability | Risky for most investors, like playing high-stakes poker. | Ideal for building wealth, akin to a marathon runner’s pace. |

This isn’t just theory; it’s practical finance. By incorporating synonyms like «investment diversification» or «asset allocation strategies,» we’re talking about the same core idea: protecting your hard-earned money. And in a world where global events can shake markets overnight, this method feels like wearing a financial life vest—essential, not extravagant.

Real-World Applications in a Shifting Economy

What if your favorite stock suddenly tanks due to regulatory changes? That’s the disruptor question keeping investors up at night. During the pandemic, I experimented with tweaking my portfolio, shifting from over-reliance on travel stocks to including essentials like healthcare and tech. The result? My overall returns stayed afloat while others floundered. It’s a mini experiment you can try: list your current holdings and rate their diversity on a scale of 1 to 10. If it’s below 5, you’re exposing yourself unnecessarily.

Diversification isn’t a one-size-fits-all; it’s adaptable, drawing from cultural shifts like how Hollywood blockbusters mix genres to appeal to wider audiences—think of it as your portfolio starring in its own «Avengers: Endgame» ensemble. In finance circles, this means blending growth stocks with value picks, or even dipping into international markets for that extra layer. My take? In an era of economic uncertainty, **portfolio diversification** strategies are the unsung heroes, providing depth and resilience. And just when you think you’ve got it figured out…

As we wrap this up, consider this twist: what if building a **diversified stock portfolio** is less about chasing riches and more about safeguarding your future against the inevitable? Take action now—review your investments and add at least two new sectors to your mix today. How has diversification reshaped your financial journey, or are you still on the fence about spreading your bets? Share your thoughts; it’s a conversation worth having.