Money whispers secrets. In a world where financial independence feels like a distant dream, the truth stings: many folks delay investing because opening a brokerage account seems as daunting as climbing Everest. But here’s the contradiction—it’s often simpler than you think, especially with the right steps. This guide cuts through the noise, offering a straightforward path to get started, empowering you to build wealth without the overwhelm. By following these steps to open a brokerage account easily, you’ll gain control over your financial future, turning potential into profit faster than you imagined.

My First Dive into Investing – A Cautionary Tale

Picture this: back in 2015, I was a wide-eyed newbie staring at my computer screen, overwhelmed by terms like «margin calls» and «asset allocation.» I’d just landed my first real job, and instead of splurging on gadgets, I decided to dip my toes into the stock market. But oh, what a mess. I remember clicking through online forms, only to hit a wall of verification questions that felt like a pop quiz I hadn’t studied for. And that’s when it hit me—preparation is everything. This personal blunder taught me that rushing into a brokerage account without research can lead to costly errors, like picking the wrong platform for your needs.

From my experience, the key is starting small and smart. I opted for a user-friendly broker that matched my beginner status, and it made all the difference. In my opinion, platforms with educational resources aren’t just perks; they’re necessities for folks like us who aren’t born with a silver spoon in finance. To optimize your journey, focus on how to open a brokerage account easily by choosing one with intuitive interfaces—think of it as selecting a reliable co-pilot for your investment flight, not a flashy jet that crashes on takeoff. And just like that American saying goes, «Don’t put all your eggs in one basket,» diversify your options early.

From Wall Street Legends to Everyday Wins: A Historical Shift

Fast-forward from the roaring ’20s, when brokerage accounts were the playground of tycoons like J.P. Morgan, to today, where apps let your neighbor trade stocks from their couch. This evolution highlights a cultural comparison: in the U.S., investing was once an elite club, but now it’s as accessible as grabbing a coffee. I find it ironic that while Wall Street booms with high-frequency trading, the real power lies in individual investors using these tools to level the playing field.

Consider this unexpected analogy: opening a brokerage account is like evolving from a flip phone to a smartphone—once cumbersome, now seamless. A common myth is that you need thousands to start, but the truth is uncomfortable: many brokers allow accounts with just a few dollars, thanks to zero-commission trades. For instance, platforms like those from major firms have democratized access, letting you compare fees and features without the old-school barriers. To illustrate, here’s a simple table to weigh your choices:

| Broker Type | Key Advantages | Potential Drawbacks |

|---|---|---|

| Online Discount Brokers | Low fees, easy access via apps | Limited personal advice |

| Full-Service Brokers | Expert guidance, portfolio management | Higher costs, more paperwork |

This shift isn’t just historical; it’s a wake-up call for anyone pondering easy ways to start investing. By understanding this progression, you’ll appreciate how technology has made the process less about luck and more about informed decisions.

Untangling the Red Tape – Practical Solutions for Smooth Sailing

Now, let’s address the elephant in the room: paperwork. It’s no joke—filling out forms can feel like wading through quicksand, especially if you’re not prepared. I recall a friend who, in his eagerness, skipped verifying his identity and ended up with a frozen account for weeks. The problem? Overlooking basic requirements, which is all too common in our fast-paced world. But with a bit of irony, I say: if even I, a self-proclaimed finance skeptic, can navigate this, so can you.

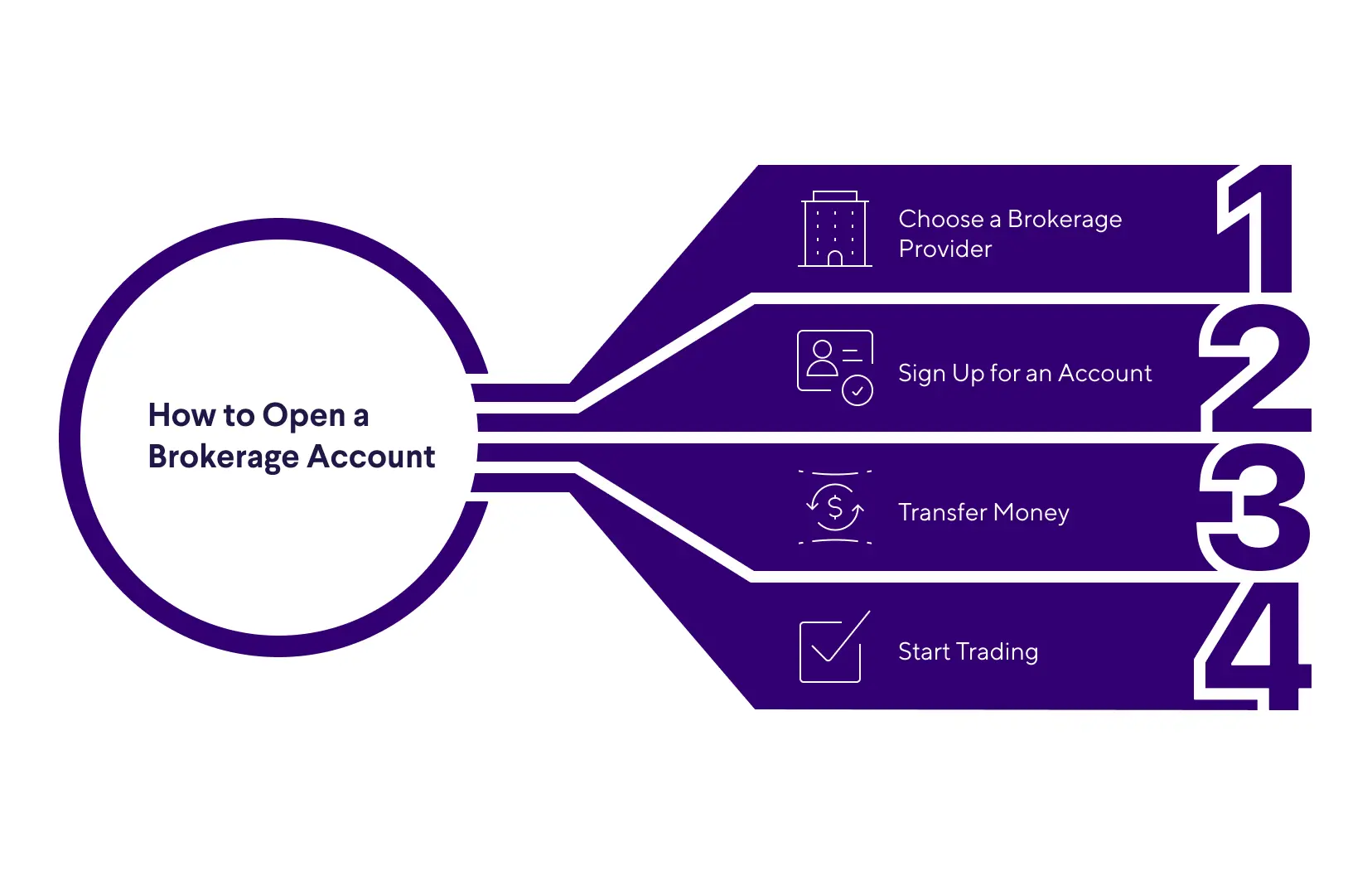

To solve this, break it down into actionable phases. First, gather your documents—think ID, proof of address, and Social Security number if you’re in the U.S. Then, select a broker that aligns with your goals; for example, if you’re aiming for long-term growth, look for one with strong retirement tools. Here’s a step-by-step approach, numbered for clarity, because sometimes lists just work: 1) Research brokers using sites like FINRA’s broker check for credibility. 2) Sign up online, answering questions about your investment experience to get personalized recommendations. 3) Fund your account via bank transfer or debit, keeping an eye on minimum deposits to avoid surprises.

In this section, I’m throwing in a disruptive question: What if opening an account was as straightforward as streaming your favorite show? Well, with modern platforms, it almost is—minus the binge-watching. Try this mini experiment: spend 10 minutes browsing two brokers’ websites and note what stands out. You’ll likely find features like robo-advisors that handle the heavy lifting, making steps to open a brokerage account feel less like a chore and more like a strategic move. And remember that ballpark figure for fees? It’s crucial; don’t overlook it.

In wrapping up this narrative, investing isn’t just about numbers; it’s about securing your tomorrow. That twist: while we often fear the unknown in finance, taking these steps transforms it from a barrier to a bridge. So, here’s your call to action—pick a broker and initiate the process today; your future self will thank you. And finally, a reflective question: What personal milestone are you investing toward, and how will this account help you get there? Share your thoughts in the comments; let’s keep the conversation real.