Hidden costs abound in the world of mortgages, where a simple refinance can turn into a financial minefield if you’re not careful. Think about it: millions of Americans refinance their homes each year, yet many end up paying more than they bargained for due to overlooked fees and poor timing. This guide cuts through the clutter, showing you how to refinance your mortgage successfully without the usual headaches. By the end, you’ll grasp not just the mechanics, but also the emotional and financial peace that comes from making savvy choices—potentially saving thousands in interest and securing better terms for your family’s future.

My Personal Dive into Mortgage Mayhem

I still recall that rainy afternoon in 2018 when I sat at my kitchen table, staring at a stack of mortgage papers, thinking, «This can’t be right.» I’d decided to refinance my home loan to snag a lower interest rate, but what started as a straightforward plan morphed into a lesson in patience and precision. You see, I live in the Midwest, where folks pride themselves on being straightforward, like that old saying «straight as an arrow.» But refinancing? It’s anything but. I ended up dealing with unexpected appraisal delays that pushed back closing by weeks, all while rates ticked up slightly.

This experience taught me a hard lesson: refinancing isn’t just about numbers; it’s about timing and preparation. In my view, the real key is treating it like preparing for a long road trip—check the map, pack essentials, and account for detours. For instance, I wish I’d consulted a local financial advisor earlier, someone who knew the ins and outs of Midwest market fluctuations. If you’re considering refinancing your mortgage, remember this analogy: it’s like sailing uncharted waters; one wrong gust, and you’re off course. Boldly, start by evaluating your current mortgage rates and equity position to ensure you’re in a strong spot—it’s the foundation of successful refinancing.

Echoes from the 2008 Financial Storm

Fast-forward to today, and it’s impossible to ignore the shadows cast by the 2008 crisis, when lax lending practices left homeowners underwater. Back then, refinancing was a lifeline for some, but a trap for others who didn’t scrutinize the fine print. Compare that era to now: interest rates are lower, regulations tighter, thanks to reforms like the Dodd-Frank Act, yet pitfalls persist. In the U.S., where «keeping your ducks in a row» is more than just a phrase, we’ve seen a cultural shift toward financial literacy, with tools like online calculators making it easier to compare options.

But here’s a truth that’s often glossed over: not every refinance saves money. For example, if you’re eyeing a cash-out refinance to fund home improvements, weigh it against historical trends—post-2008, many regretted tapping equity during economic uncertainty. Imagine a conversation with a skeptical friend: «Sure, rates are low now,» they’d say, «but what if inflation spikes?» I’d counter with data showing that, according to the Federal Reserve, strategic refinancing can reduce monthly payments by up to 1-2% for qualified borrowers. To put it in perspective, that’s like comparing a reliable sedan to a flashy sports car—the former gets you there steadily, while the latter might leave you stranded. So, before diving in, conduct a mini experiment: track your current expenses for a month and project savings from potential new terms; it might just reveal if refinancing your mortgage is truly worth it.

The Sneaky Snags and How to Sidestep Them

And just when you think you’ve got it figured out—bam!—hidden fees rear their heads. Take closing costs, for instance; they can eat up 2-6% of your loan amount, turning what seemed like a win into a wash. In finance circles, we’ve all heard stories of borrowers who rushed in, only to face points, origination fees, and appraisal charges that added up faster than a plot twist in «The Wolf of Wall Street.» Seriously, that film’s chaos mirrors the frenzy of poor refinancing decisions.

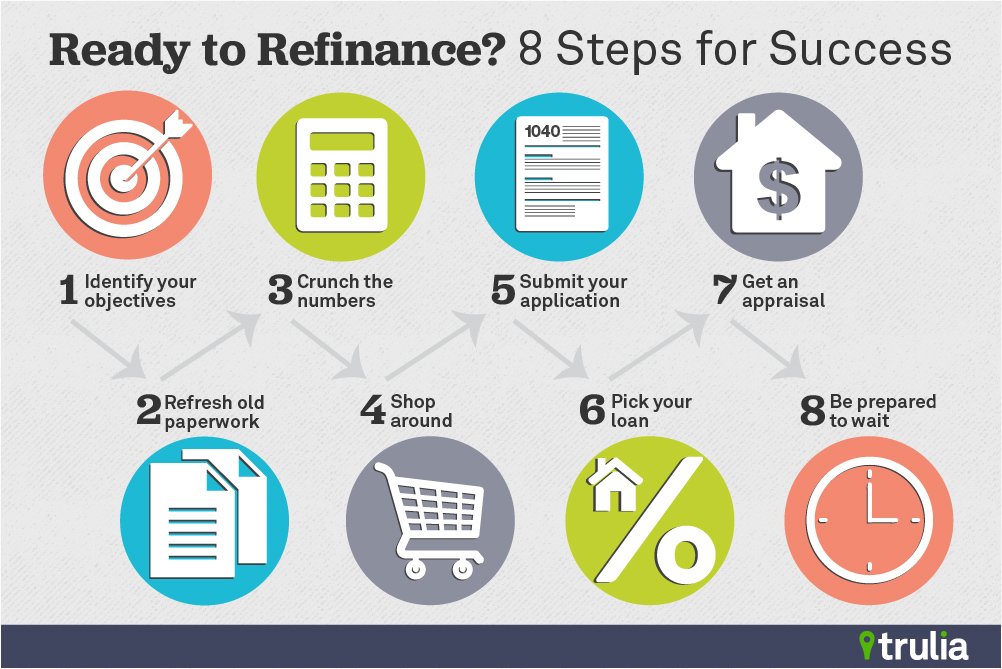

To counter this, let’s break it down without a rigid list—just practical steps woven into real advice. First, gather your documents early; it’s like armoring up before a battle. Number one: review your credit score, as even a few points can sway rates dramatically. Number two: shop around lenders, comparing not just rates but also total refinancing costs and loan terms—think annual percentage rate (APR) versus interest rate. And number three: consider the break-even point, where savings offset fees, which might take years to reach. For a clearer picture, here’s a simple table to compare common refinancing options:

| Option | Advantages | Disadvantages |

|---|---|---|

| Rate-and-Term Refinance | Lowers interest or shortens loan term; straightforward process. | Requires good credit; might not yield cash. |

| Cash-Out Refinance | Provides funds for debt consolidation or renovations. | Increases debt; higher rates possible. |

| FHA Streamline Refinance | Simplified for existing FHA loans; lower costs. | Limited to certain borrowers; insurance premiums apply. |

Y just there, in the details, lies the solution—meticulous planning. By addressing these snags head-on, you’ll navigate refinancing successfully, much like a seasoned captain steering through fog.

A Fresh Lens on Your Financial Horizon

In wrapping this up, refinancing your mortgage isn’t merely a transaction; it’s a pivot toward long-term stability, especially when you consider how economic shifts, like those hinted at in recent Fed reports, could alter the landscape. Here’s the twist: what if the real success comes not from the lowest rate, but from the confidence it builds in your financial future? So, take action now—pull your mortgage statements and run a quick online calculator to estimate potential savings. And think on this: what overlooked aspect of your current loan might be holding you back from true financial freedom? Share your thoughts in the comments; let’s keep the conversation going. After all, in finance, we’re all in this together.