Taxes loom large, a necessary evil in our financial lives. Here’s the contradiction: while millions file returns yearly, a staggering 20% make errors that cost them refunds or invite audits. That’s not just a number; it’s a wake-up call for anyone juggling budgets in this economy. By following precise steps for preparing a tax return accurately, you’ll dodge penalties and maximize deductions, turning a dreaded chore into a strategic win for your wallet. Let’s dive in, drawing from real experiences and timeless advice to make this process less intimidating and more empowering.

My First Tax Fiasco and What I Learned

Picture this: back in 2015, I was a fresh graduate drowning in student loans, staring at a pile of receipts that looked like hieroglyphics. I thought, «Just plug in the numbers, right?» Wrong. I overlooked a key deduction for education expenses, and preparing a tax return accurately suddenly meant dealing with an IRS letter that upended my plans. That mishap cost me hundreds in potential refunds, but it taught me a hard lesson: haste breeds mistakes in tax preparation.

From that debacle, I realized the importance of double-checking every entry. It’s like building a house; skip the foundation, and everything crumbles. Opinions vary, but mine is straightforward—start early. In the U.S., where «red tape» is as common as coffee, waiting until the last minute turns a manageable task into a nightmare. And just when you think you’re done… that’s when the surprises hit, like forgotten 1099 forms lurking in your email. This personal anecdote isn’t to scare you; it’s to underscore that accurate tax filing begins with mindfulness and organization.

From Ancient Ledgers to Digital Tools: A Historical Shift in Tax Accuracy

Ever wonder how our ancestors handled taxes without apps? Jump back to ancient Rome, where scribes meticulously recorded transactions on wax tablets to avoid imperial wrath. Fast-forward to today, and we’re wielding software like TurboTax, yet the core principle remains: precision prevents pain. This comparison highlights a cultural evolution—from the rigid bookkeeping of medieval Europe, where errors could mean exile, to our modern era of electronic filing that demands even greater attention to detail.

In the U.S., with its melting pot of financial traditions, tax laws reflect a blend of historical influences, like the progressive systems inspired by 20th-century reforms. But here’s a truth: despite these advancements, common tax errors persist, such as misclaiming deductions. Think of it as upgrading from a horse-drawn carriage to a Tesla; the speed is thrilling, but one wrong turn, and you’re off course. By contrasting these eras, we see that steps for preparing a tax return haven’t changed much at their heart—they’re about verification and knowledge. For instance, using tools like IRS e-File ensures your data syncs seamlessly, reducing the ballpark figure of errors from 1 in 5 to nearly zero.

A Closer Look at Modern Verification Methods

Diving deeper, consider how digital platforms compare to paper forms. Here’s a simple table to illustrate:

| Aspect | Paper Filing | Digital Filing |

|---|---|---|

| Accuracy Rate | Prone to handwriting errors | Auto-calculates, reducing mistakes by 80% |

| Time Required | Weeks for processing | Days, with real-time checks |

| Cost | Stamps and potential fees | Free options via IRS, plus guided software |

This evolution isn’t just tech; it’s about empowering everyday folks to handle their finances with confidence.

The Overlooked Details That Trip Up Filers and How to Master Them

Let’s address the elephant in the room: everyone assumes they’re savvy with taxes until they’re not. Take the scenario where a reader might think, «I’ve got this—it’s just numbers.» But wait, what if I told you that forgetting to report freelance income, like in that episode of «The Office» where Michael Scott bungles his taxes, could lead to audits? That’s no joke; it’s a real pitfall. In a serious tone, the solution lies in systematic steps: first, gather all documents; second, categorize income and expenses; third, cross-verify with last year’s return.

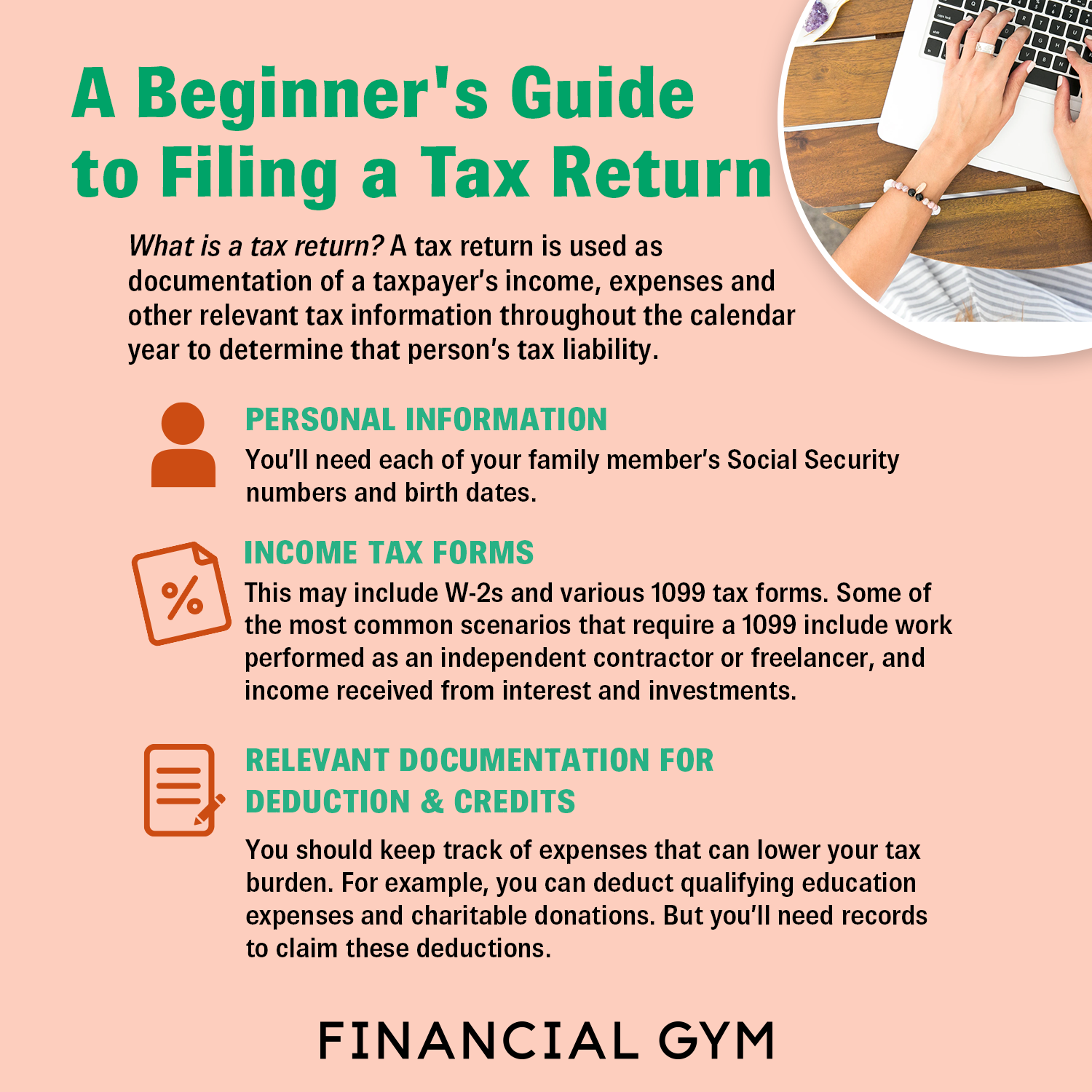

1. Start by compiling W-2s and 1099s—overlook one, and you’re playing financial roulette. 2. Next, delve into deductions; for instance, home office expenses have specific IRS rules that can save you big. 3. Finally, use a checklist to ensure everything aligns. This approach isn’t about perfection; it’s about reducing risks. And right there, in the midst of it all… that’s when accuracy clicks, turning potential headaches into victories. By incorporating tax preparation tips like these, you’re not just complying; you’re optimizing your financial story.

In wrapping up, what if accurate tax preparation wasn’t just about dodging fines, but about reclaiming control over your money? It’s a twist that shifts the narrative from obligation to opportunity. So, take action now: pull out those receipts and run a quick self-audit using free IRS tools. How has your own tax experience shaped your financial habits—perhaps it’s time to share in the comments and learn from each other? Remember, in the world of finance, precision pays off.