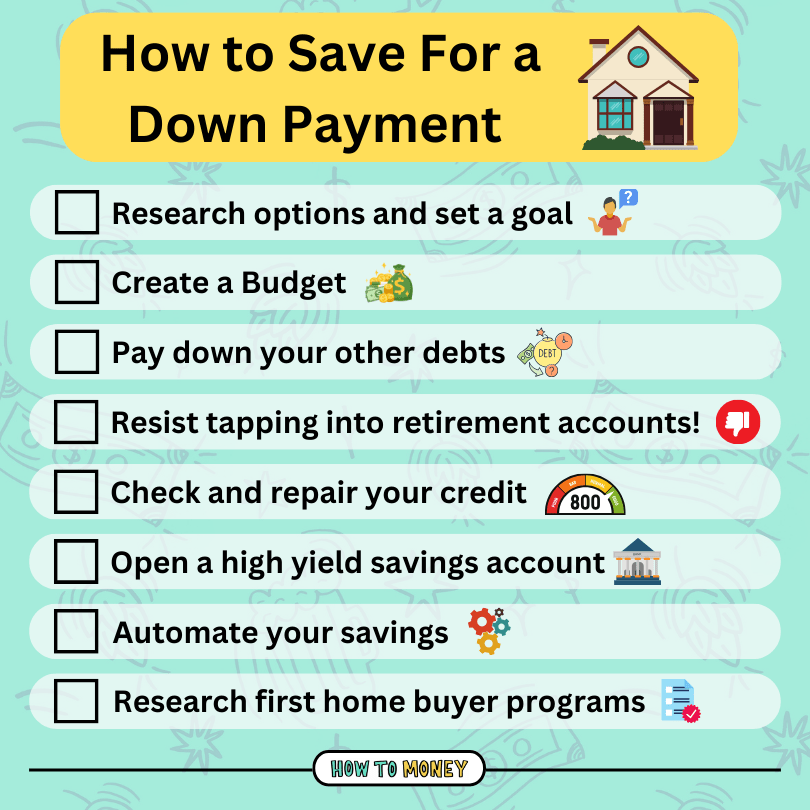

Money slips away, goals crumble, dreams linger. It’s a harsh truth in today’s economy: saving for a house down payment feels like chasing a mirage, especially when the average American needs upwards of $60,000 just to get started. But here’s the contradiction—while housing costs skyrocket, smart financial strategies can turn that impossibility into reality. In this article, we’ll dive into practical tips to save for a down payment on a house, drawing from real experiences and financial wisdom to help you build that nest egg without breaking the bank. By the end, you’ll walk away with actionable steps to secure your future, one dollar at a time.

My Bumpy Road to Homeownership – A Lesson in Grit

Picture this: five years ago, I was glued to my couch, binge-watching Netflix marathons while my bank account whispered warnings. Y justo ahí, when I finally crunched the numbers for a down payment on a modest home in the Midwest, I realized my coffee runs and impulsive online shopping were eating up potential equity. It hit me hard—saving isn’t just about numbers; it’s personal. I remember sitting at my kitchen table, calculator in hand, staring at a spreadsheet that showed I’d wasted over $5,000 on subscriptions and gadgets in a year. That wake-up call, folks, was my turning point.

In my opinion, the key to building savings lies in that initial self-audit, a process I call «financial archaeology»—digging through your habits to uncover buried treasures. For instance, I adopted a «tighten the belt» approach, cutting back on dining out by 50% and redirecting those funds into a high-yield savings account. This isn’t just theory; it’s what helped me accumulate $20,000 in three years. And let’s not forget the cultural nod—here in the U.S., we’re all about that «American dream» narrative, but it often glosses over the grind. Saving for a house down payment is like training for a boxing match; you dodge punches from inflation and jab back with disciplined budgeting. By tracking every expense, I not only saved more but also felt a real sense of control, proving that effective saving strategies for a home purchase start with honest reflection.

The Hidden Truths Behind Down Payment Myths

Now, let’s unpack a common myth: «You need a massive down payment to buy a house.» That’s half-baked advice, straight from the outdated playbook. In reality, programs like FHA loans allow as little as 3.5% down, but here’s the uncomfortable truth—skipping that traditional 20% means shelling out more in mortgage insurance over time, potentially adding thousands to your costs. I once advised a friend who bought into this shortcut; he ended up with higher monthly payments that strained his budget for years. It’s like thinking a shortcut in a video game will win you the level, only to hit a boss fight unprepared—exciting at first, disastrous later.

Drawing from historical context, the post-WWII era pushed the 20% standard as a stability measure, but today’s market demands flexibility. For example, comparing traditional savings versus modern tools: a standard savings account might yield 0.01% interest, while a high-yield option could offer 4-5%. Here’s a simple table to illustrate:

| Option | Interest Rate | Pros | Cons |

|---|---|---|---|

| Traditional Savings Account | 0.01% | Easy access, FDIC insured | Minimal growth, eroded by inflation |

| High-Yield Savings Account | 4-5% | Faster growth, still liquid | Requires online management, potential minimums |

This comparison shows why I advocate for innovative ways to save for a house down payment—it’s not about hoarding cash but smart allocation. And throw in a pop culture reference: remember how Walter White in Breaking Bad built his empire through calculated risks? Well, channel that energy into financial decisions, but keep it legal and ethical. By busting these myths, you’re arming yourself with the truth to make informed choices in your journey to financial independence for home buying.

What If Saving Felt Like a Game You Could Win? – Try This Experiment

Here’s a disruptive question: What if viewing your budget as a video game—complete with levels and rewards—could turbocharge your savings? Too often, people treat finance like a chore, but let’s flip that script. In my experience, gamifying the process made all the difference. Start with a mini experiment: for one week, track every purchase and categorize it as «necessity» or «luxury.» Then, challenge yourself to cut one luxury item per day and reroute that money into your down payment fund.

Take it from me; when I tried this, I uncovered $150 in weekly «luxuries» like fancy lattes and unused apps. The lesson? Small, consistent actions compound over time, much like how compound interest can turn $10,000 into $15,000 in five years at 4% growth. And don’t overlook local quirks—here in the States, we love our «YOLO» moments, but as I see it, true freedom comes from planning ahead. This experiment isn’t just busywork; it’s a practical tip for accelerating savings for a mortgage down payment. By making it interactive, you’re not just saving money—you’re building a habit that sticks, turning abstract goals into tangible wins.

In wrapping this up, here’s a twist: while saving for a down payment might seem like a solo battle, it’s really about creating a support system that includes your own discipline and community resources. So, take action now—grab a notebook and map out your next month’s budget, identifying at least three cuts to boost your savings. What’s one bold step you’ll take today to reshape your financial future? Share in the comments; let’s build that conversation. After all, in the world of finance, every dollar saved is a step closer to home.