Hidden gems await. Yes, in the world of finance, low-interest personal loans aren’t the mythical beasts they seem, but finding them can feel like sifting through a haystack for a needle. Did you know that the average American household carries over $6,000 in credit card debt at sky-high rates, often double digits, while low-interest options could slash that burden? This article cuts through the clutter, showing you where to uncover these financial lifelines without the usual pitfalls. By the end, you’ll gain practical strategies to secure loans that won’t drain your wallet, empowering you to build a more stable future—one where debt serves you, not the other way around.

My Tangled Path to Smarter Borrowing

Picture this: a few years back, I was staring at a pile of medical bills, my savings account whispering threats of emptiness. It was one of those moments where you realize, «Money doesn’t grow on trees, does it?» As a finance enthusiast who’s navigated the U.S. banking labyrinth, I dove headfirst into hunting for a personal loan with rates under 10%. My journey started with a local credit union—places like Navy Federal or PenFed, which often offer perks for members, including low-interest personal loans as low as 7% for good credit scores. Unlike big banks that hit you with fees and rigid terms, these community-focused lenders felt like chatting with a neighbor who actually listens.

I remember the frustration, though. Applying online through their portals, I hit snags with verification processes that dragged on for days. And that’s when it hit me—patience pays off. Through this, I learned a key lesson: always check your credit report first via sites like AnnualCreditReport.com. It’s not just about rates; it’s about positioning yourself for the best deals. In my case, boosting my score by a few points unlocked options from online lenders like SoFi or LightStream, who specialize in personal loans with low interest for debt consolidation. Their platforms are streamlined, almost like swiping through a dating app, but for your finances. This personal anecdote underscores a broader truth: in finance, preparation isn’t boring—it’s your secret weapon.

The Evolution of Lending: From Barter Systems to Budget-Friendly Loans

Fast-forward from ancient Mesopotamia, where loans were as basic as trading grain, to today’s digital age—it’s a wild transformation. Back then, interest was a king’s decree; now, it’s algorithm-driven. In the U.S., this shift highlights how best places for personal loans have democratized access, especially for those with solid credit. Compare that to historical practices, like the Medici family’s banking empire in Renaissance Italy, which charged exorbitant rates to the elite. Today, platforms like LendingClub or Prosper use peer-to-peer models, cutting out middlemen to offer rates around 6-8% for qualified borrowers.

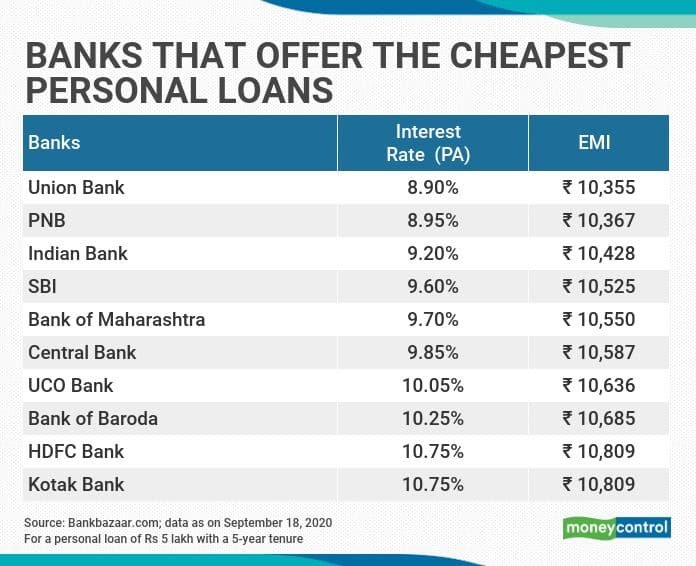

But here’s an unexpected analogy: seeking low-interest loans is like foraging for truffles in a forest—rare, but rewarding if you know where to dig. Federal programs, such as those from the Small Business Administration for personal use, or even state-specific initiatives in places like California, provide subsidized options. For instance, if you’re in a high-cost area, exploring credit unions versus traditional banks reveals stark differences. A simple table might clarify:

| Lender Type | Average Interest Rate | Key Advantages | Disadvantages |

|---|---|---|---|

| Credit Unions | 7-9% | Member perks, lower fees | Limited branches |

| Online Lenders | 6-12% | Fast approval, flexible terms | Variable rates |

| Traditional Banks | 10-15% | Widespread access | Hidden charges |

This comparison isn’t just numbers; it’s about choosing wisely in a market where, as they say, «Don’t put all your eggs in one basket.» My opinion? Online lenders win for convenience, but they require vigilance against predatory practices—something the Consumer Financial Protection Bureau warns about regularly.

Untangling the Web: Real Challenges and Straightforward Fixes

Let’s get real—nobody enjoys the loan application process, especially when high-interest offers pop up like unwanted pop-ads. In finance, it’s easy to fall into the trap of «quick fixes» that balloon your debt, much like how credit cards in the ’80s lured folks into overspending, a la the excesses in «Wall Street» films. But here’s a disruptive question: What if you flipped the script and viewed loans as tools, not crutches? For me, experimenting with rate comparison tools on sites like Bankrate.com revealed hidden gems, like how to get low-interest loans through secured options backed by savings.

Step 1: Audit your finances—list debts and income to gauge affordability. Step 2: Shop around, targeting lenders who prioritize low-interest personal loans for specific needs, such as education or home improvements. And just when you think it’s straightforward, remember: eligibility often hinges on factors like employment stability. In the U.S., with economic fluctuations, this means leveraging resources from the Federal Reserve’s website for current trends. My take? It’s not rocket science, but it demands honesty with yourself. Y’know, that moment when you realize, «If I don’t plan, I’m planning to fail.» By addressing these head-on, you sidestep common errors and secure terms that align with your life.

As we wrap this up, here’s a twist: Low-interest loans aren’t just about borrowing; they’re about reclaiming control in an unpredictable world. So, take action now—pull your credit report and compare at least three lenders today. What’s one change you’re making to your financial habits that could lead to lasting security? Share in the comments; let’s keep the conversation going.