Money slips away. That’s the harsh reality many face when emergencies strike, leaving wallets empty and stress levels soaring. Did you know that over 50% of adults in the U.S. couldn’t cover a $400 unexpected expense from their savings? It’s a stark contradiction to the American dream of financial security, where we’re told to chase opportunities but often forget the safety net. This article dives into practical strategies to boost your emergency fund, turning that nagging worry into a pillar of peace. By the end, you’ll grasp how small, consistent steps can shield you from life’s curveballs, empowering you to build a buffer that works for your real-life budget.

A Wake-Up Call from My Own Wallet Woes

Picture this: I was cruising along in my career, thinking I had it all figured out, when bam—layoffs hit my company harder than a winter storm in Chicago. Suddenly, bills piled up, and my so-called emergency fund was more like a puddle than a pool. It was a gritty lesson, one that taught me the value of preparation in the most unforgiving way. In my view, ignoring this fund is like skipping the spare tire on a road trip; you might get by, but when trouble arrives, you’re stranded.

Back then, I juggled freelance gigs just to keep the lights on, and that’s when it hit me—hard. Automating transfers to a dedicated savings account became my lifeline. It’s not just about stashing cash; it’s about creating habits that stick. For instance, I started with a modest goal: sock away 10% of each paycheck. Over time, that built up to cover three months of expenses, which experts call the gold standard for emergency fund strategies. Think of it as planting seeds in a garden; with regular care, they grow into something substantial. And boy, was that a game-changer when medical bills rolled in unexpectedly.

Echoes of the Past: How Economic Turbulence Shapes Savings Today

Fast-forward to history’s lessons, where the Great Depression of the 1930s serves as a sobering comparison. Families back then learned the hard way that a rainy day fund isn’t a luxury—it’s survival. In contrast, today’s gig economy, with its unpredictable income streams, mirrors that era’s instability, yet we often overlook it. As someone who’s crunched the numbers in personal finance, I find it ironic how modern tools like budgeting apps make saving easier, but cultural shifts toward instant gratification pull us the other way.

Consider this: During the 2008 financial crash, households with robust savings weathered the storm better than those living paycheck to paycheck. It’s a truth that’s uncomfortable, especially in a society that celebrates splurging on the latest gadgets. To bridge that gap, I recommend exploring high-yield savings accounts—think of them as the unsung heroes, offering better interest rates than traditional ones. For example, while a standard account might yield a measly 0.01%, high-yield options can push 4-5%, helping your build emergency fund efforts compound over time. This isn’t just theory; it’s backed by data from financial institutions showing faster growth for dedicated savers.

An Unexpected Ally: The Role of Side Hustles

Digging deeper, side gigs have become a modern twist on historical resilience. Whether it’s driving for a ride-share or freelancing online, these can funnel extra cash into your fund without derailing your main income. It’s like adding a second engine to your financial plane—just ensure it’s sustainable.

Outsmarting the Savings Saboteurs with Calculated Moves

Here’s the rub: Many folks sabotage their emergency funds with impulsive buys, thinking «I’ll start saving next month.» But what if I told you that delay is the enemy of security? In a serious tone, let’s address this head-on—overspending on non-essentials, like that impulse coffee run, chips away at your future stability. The solution? Implement a «pause button» strategy: Wait 48 hours before any non-essential purchase over $50. This simple hack has helped me redirect funds effectively, turning potential regrets into reinforced savings.

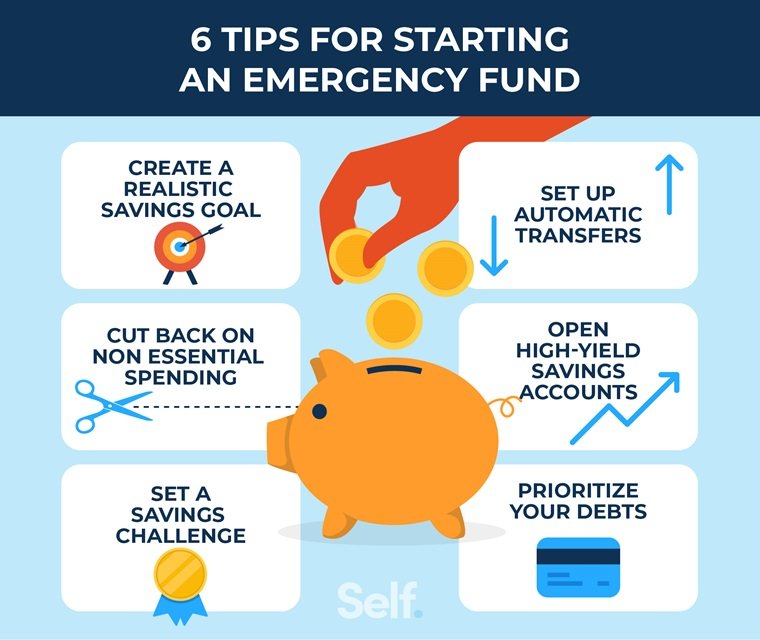

To make it actionable, let’s break it down. First, track your spending for a week using a free app; you’ll uncover leaks you didn’t know existed. Second, set up automatic deductions from your checking account to your emergency fund—out of sight, out of mind. Third, consider windfalls like tax refunds as bonus boosts; direct them straight to your savings. It’s like fortifying a dam against floods; each layer adds protection. And for a cultural nod, remember the old American adage, «A penny saved is a penny earned»—it’s more relevant than ever in our era of economic uncertainty.

Comparatively, here’s a quick table to weigh your options:

| Strategy | Pros | Cons |

|---|---|---|

| High-Yield Savings | Earns interest passively, easy access | Rates can fluctuate with market changes |

| Side Hustle Income | Immediate cash infusion, skill-building | Takes time and energy, potential taxes |

| Automated Transfers | Builds habit without effort, consistent growth | Requires initial setup and discipline |

Wrapping It Up: Your Financial Twist of Fate

What if the key to true freedom isn’t in earning more, but in securing what you have? That’s the twist—boosting your emergency fund isn’t about restriction; it’s about reclaiming control. So, take this step right now: Open a high-yield account and automate a small transfer, say $20 a week, to kickstart your journey. It’s a move that could save you from future headaches.

And finally, reflect on this: How has a solid emergency fund—or the lack of one—shaped your own financial story? Share your thoughts in the comments; let’s build a community of wiser savers. After all, in the words of that iconic line from «It’s a Wonderful Life,» every person’s choices ripple outward—make yours count for security.