Sudden diagnoses strike, upending lives and wallets alike. Here’s a truth that stings: in the United States, medical debt burdens over 100 million people, often leading to bankruptcy or lifelong financial strain. Yet, while healthcare costs spiral out of control, you don’t have to let them dictate your future. This article dives into how to handle medical expenses financially, offering practical strategies to safeguard your budget without sacrificing your health. By the end, you’ll gain tools to turn overwhelming bills into manageable steps, empowering you to protect what’s most important—your financial stability and peace of mind.

My Friend’s Wake-Up Call: The Hidden Cost of a Routine Check-Up

Picture this: a close friend of mine, let’s call him Alex, thought he was just heading in for a simple annual physical. But what started as a quick visit turned into a cascade of tests, and suddenly, he was staring down a five-figure medical bill that threatened to break the bank. Alex, a teacher in the Midwest, had always been frugal, squirreling away savings for his kids’ college funds. Yet, that one unexpected expense wiped out months of careful planning. And that’s when the real trouble started—late payments, mounting interest, and the stress that kept him up at night.

This anecdote isn’t just a story; it’s a stark reminder of how managing healthcare costs requires foresight. In my opinion, based on years of observing friends navigate these waters, the key lesson is preparation over reaction. If Alex had reviewed his insurance policy earlier, he might have spotted gaps—like the high deductibles that left him exposed. Drawing from this, I often think of medical expenses as that uninvited guest at a family dinner: they show up without warning, but with the right financial buffers, you can handle them without derailing everything. It’s like building a dam before the flood—proactive and essential in today’s unpredictable economy.

From Ancient Remedies to Modern Policies: A Cultural Shift in Financial Safeguards

Step back in time, and you’ll see how societies have wrestled with health costs long before our era of soaring premiums. In medieval Europe, guilds provided a rudimentary form of insurance, pooling resources to cover members’ medical needs—almost like a precursor to today’s health savings accounts. Fast-forward to Japan, where universal healthcare keeps out-of-pocket expenses low, contrasting sharply with the U.S. system that often leaves individuals footing the bill. This cultural comparison highlights a uncomfortable truth: while some countries bake financial protection into their social fabric, many Americans are left piecing together solutions on their own.

Personally, I find it ironic that in a nation obsessed with innovation—like the tech booms we’ve seen—our approach to financial planning for healthcare still lags. Take the Affordable Care Act as an example; it’s evolved, but gaps persist, much like how Walter White in «Breaking Bad» scrambled to cover his cancer treatments, exposing the raw vulnerability of medical finances. By examining these historical and cultural threads, we uncover a vital strategy: diversify your financial toolkit. Whether it’s negotiating bills—a common practice that’s saved people thousands—or exploring HSAs (Health Savings Accounts), which offer tax advantages, the goal is to adapt lessons from the past to build a more resilient present.

The Overlooked Financial Pitfalls and a Path to Recovery

Ever wondered why budgeting for health expenses feels like navigating a minefield? It’s because hidden fees and surprise charges lurk everywhere, turning a necessary procedure into a financial nightmare. Let’s say you’re dealing with ongoing treatments; the costs add up, from co-pays to medications, and before you know it, you’re dipping into retirement funds. But here’s where we pivot: instead of succumbing to the overwhelm, consider this as an opportunity for empowerment.

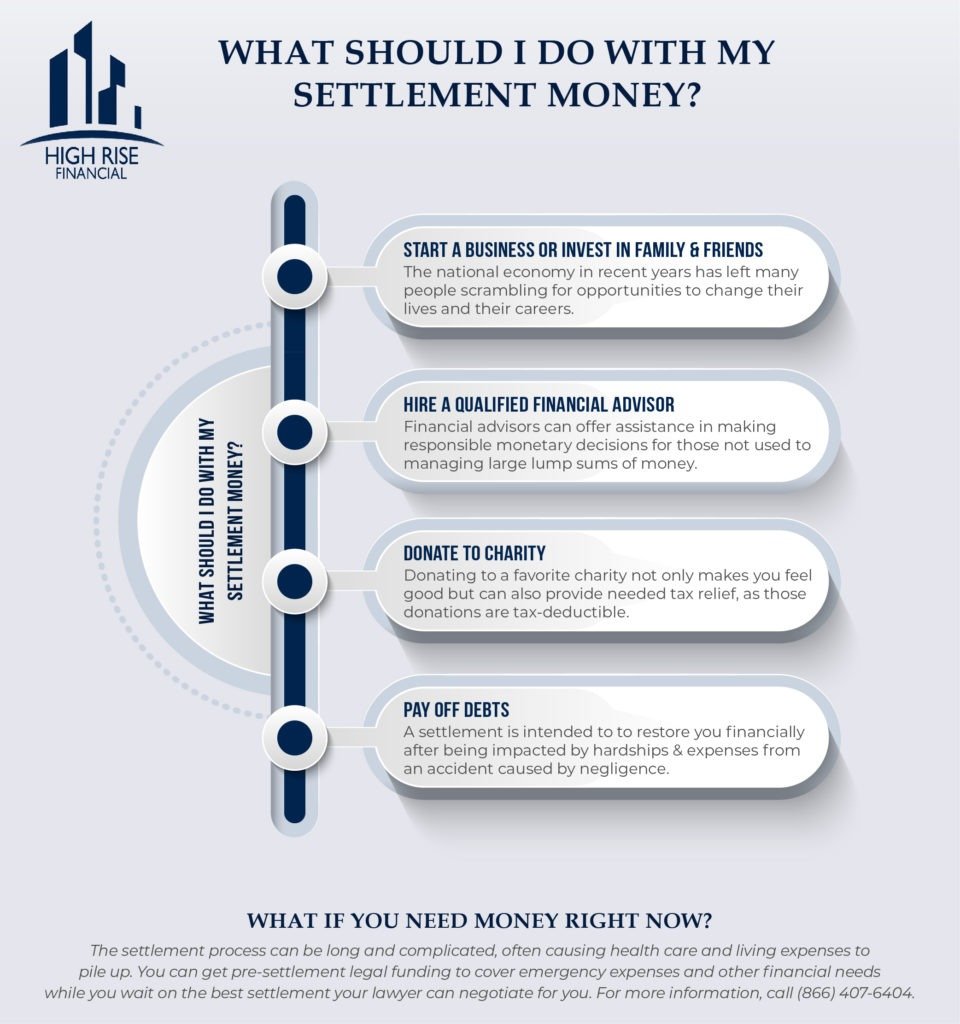

To tackle this, start with a simple exercise—grab a notebook and list your monthly expenses versus potential medical outlays. For instance, 1. Review your current insurance coverage to identify weaknesses. 2. Build an emergency fund specifically for health-related surprises, aiming for three to six months of essential costs. 3. Explore options like payment plans or debt consolidation to ease the burden. This approach isn’t just theory; it’s drawn from real financial advisors who emphasize that handling medical expenses means treating them as a core part of your budget, not an afterthought. And just when you think it’s all too much, remember: small, consistent actions can turn the tide.

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Health Savings Accounts (HSAs) | Tripple tax advantages; funds roll over yearly | Must have a high-deductible plan; contributions limited |

| Negotiating Bills | Potential for significant reductions; no cost to try | Requires time and persistence; not always successful |

| Emergency Funds | Provides immediate access; reduces debt risk | Opportunity cost of tying up money elsewhere |

Why Timing Matters in Financial Defense

In this section, timing your financial moves can make all the difference, as delays often compound costs—just like how interest on unpaid bills can snowball.

Wrapping Up with a Fresh Perspective: Your Financial Shield Awaits

Here’s the twist: what if viewing medical expenses not as threats, but as catalysts for stronger financial habits could actually fortify your life? By implementing the strategies we’ve covered, you’re not just surviving; you’re thriving against the odds. So, take action now—review your insurance options today and set aside a dedicated health fund. How has managing healthcare costs reshaped your own financial journey, and what steps will you take next to stay ahead? Share your thoughts in the comments; your story might just help someone else navigate these choppy waters.