Life’s cruel twists. Ever thought you’re cruising financially, only to have the rug pulled out? It’s a harsh reality: one in six Americans face an unexpected expense over $1,000 in a blink, according to recent surveys. Yet, many skip building an emergency fund, thinking it’ll never happen to them. That’s where the trouble starts, leaving you stressed and scrambling. But here’s the benefit—maintaining an emergency fund isn’t just about money; it’s your ticket to financial security and peace of mind, acting as a buffer against life’s uncertainties. In this article, we’ll dive deep into why you need one, drawing from real insights and personal reflections to make it stick.

The Time I Faced the Abyss Alone

Picture this: I was in my mid-30s, coasting through a stable job in New York, when layoffs hit like a thunderbolt. One Friday evening, «You’re let go» echoed in my ear, and suddenly, bills were mounting while job prospects vanished. It was 2018, right after that infamous market dip—remember how everyone was quoting «The Wolf of Wall Street» memes about easy money? Well, reality bit hard. I had zilch saved for emergencies, naively thinking my paycheck was eternal. That mistake cost me sleep and dignity, forcing me to borrow from family and skip meals. But through that mess, I learned a profound lesson: an emergency fund isn’t luxury; it’s a lifeline. Emergency funds provide a safety net, letting you handle job loss, medical bills, or car repairs without derailing your life. In my opinion, based on that raw experience, ignoring it is like walking a tightrope without a harness—foolish and unnecessary.

And just when I thought I’d never recover… I did, by starting small. Saving even $500 felt empowering, a quiet rebellion against chaos. This isn’t some polished tale; it’s messy, with late-night worries and second-guessing. If you’re in a similar spot, especially in high-cost areas like the US coasts, weave in cultural nods—think of it like the American dream’s fine print, where resilience beats luck every time.

Unraveling the Savings Myths That Bite Back

Here’s a truth that stings: the myth that «young people don’t need an emergency fund» is pure fiction, peddled by outdated advice. I remember chatting with a friend over coffee, him scoffing, «Why tie up cash when investments boom?» He’s not alone; social media floods with get-rich-quick vibes, echoing that «YOLO» mentality from Instagram influencers. But let’s get real—the uncomfortable truth is, inflation and economic volatility can erode your portfolio faster than you think, leaving you exposed if a crisis hits.

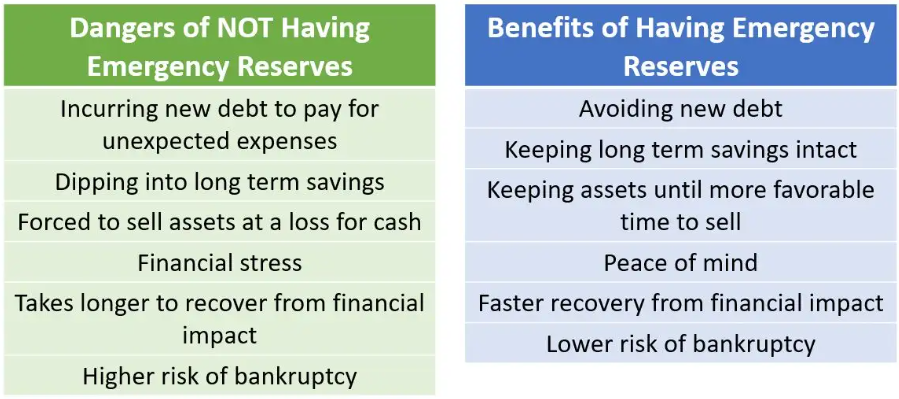

Compare this to historical patterns: in the 2008 recession, households with emergency savings weathered the storm better, data from the Federal Reserve shows. Think of it like comparing a sturdy oak to a flimsy reed in a storm—both face gales, but only one stands. For instance, a basic table might clarify:

| Aspect | Without Emergency Fund | With Emergency Fund |

|---|---|---|

| Stress Levels | High, with debt risks | Lower, more control |

| Financial Recovery Time | Months or years | Weeks, if planned |

| Long-term Impact | Credit damage, lost opportunities | Stability, growth potential |

This comparison isn’t exhaustive, but it highlights how building an emergency fund acts as a shield. In my view, it’s not about hoarding; it’s strategic, like reserving fuel for a road trip’s detours. And across cultures, from the UK’s «rainy day fund» ethos to American pragmatism, the idea holds—prepare or pay later.

Imagine Waking Up to Chaos: A Quick Reality Check

What if your car breaks down tomorrow, or worse, a health scare empties your wallet? That’s a disruptor of a question, isn’t it? It forces you to pause and reflect, much like that plot twist in «Breaking Bad» where plans unravel instantly. To make this hit home, try a mini experiment: grab a notebook and jot down your monthly essentials—rent, groceries, utilities. Now, multiply by three to six months; that’s your target emergency fund size, experts say. Do this now, and you’ll see the gap staring back, perhaps making you mutter, «How did I overlook that?»

This exercise isn’t fluff; it’s a wake-up call to the importance of emergency funds in personal finance. In my experience, starting with automated transfers—say, $50 a paycheck—turns abstract advice into action. It’s like planting seeds in a garden; initially, nothing shows, but growth comes. And for those in bustling cities, where life’s pace mimics a non-stop subway, this habit builds quiet strength against the unexpected.

Wrapping this up with a twist: while we’ve talked about funds as protection, they’re also about freedom—enabling choices, like pursuing a dream job without panic. So, take action—set aside something today, even if it’s modest. What’s stopping you from securing your future? Share in the comments: how has an emergency fund changed your financial story, or what barrier holds you back?