Sudden setbacks strike hard. Imagine losing your job overnight or facing a medical bill that dwarfs your monthly paycheck—it’s not just a statistic; it’s a gut-wrenching reality for millions. According to a Federal Reserve survey, 37% of adults in the U.S. couldn’t cover a $400 emergency expense without selling something or borrowing. That’s a stark contradiction to the American dream of financial independence. But here’s the silver lining: by preparing smartly for these storms, you can safeguard your peace of mind and build a buffer against life’s curveballs. In this article, we’ll dive into practical ways to prepare for financial emergencies, blending real stories, historical insights, and actionable advice to help you stay ahead. Let’s explore how **emergency fund essentials** can turn uncertainty into opportunity.

That Rainy Day I Never Saw Coming

Picture this: I was cruising along in my career, thinking I had it all figured out, when bam—layoffs hit my department out of nowhere. It was 2012, and the economy was still shaky from the Great Recession. My savings? A measly couple of thousand bucks, which I thought was plenty. Boy, was I wrong. Suddenly, bills piled up, and I had to dip into what little I had just to keep the lights on. That experience taught me a hard lesson: preparation isn’t about predicting the future; it’s about respecting the unknown. I remember sitting at my kitchen table, staring at spreadsheets, thinking, «And that’s when it hit me—without a solid plan, you’re just one bad day away from trouble.»

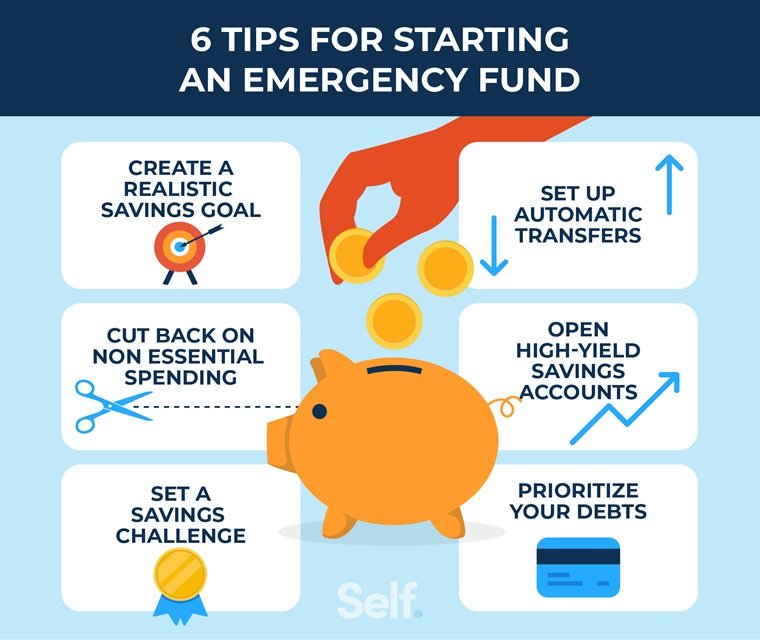

In my opinion, building an **emergency fund** starts with honesty about your spending. I started tracking every expense, from coffee runs to car repairs, and realized how those small leaks can sink your ship. This isn’t just financial advice; it’s a personal wake-up call. Drawing from my U.S.-centric view, where phrases like «tighten your belt» are common, I suggest aiming for three to six months’ worth of living expenses. It’s like creating a financial lifeboat—unassuming until you need it. And here’s a twist: incorporate unexpected analogies, like comparing your fund to a hidden compartment in a spy novel, always there but rarely discussed. By sharing this story, I hope to inspire you to start small, perhaps by automating transfers to a high-yield savings account, ensuring your money works for you when storms brew.

A Personal Twist on Building Resilience

Fast-forward to today, and I’ve rebuilt stronger. The key? Consistency and a dash of creativity. For instance, I treated saving like a game, challenging myself to cut unnecessary subs—like that streaming service I barely used. It’s not about deprivation; it’s strategic. This approach not only bolstered my **financial planning** but also gave me a sense of control, something we all crave in uncertain times.

Echoes of Economic Turmoil: What History Teaches Us

Fast-forward from my personal mishap to the broader stage: the 2008 financial crisis wasn’t just headlines; it was a masterclass in vulnerability. Back then, families across America watched their 401(k)s evaporate, much like characters in «The Big Short» unraveling Wall Street’s facade. That film, with its sharp critique of unchecked greed, mirrors how ignoring warning signs can lead to disaster. Historically, events like the Great Depression of the 1930s forced people to adapt, emphasizing the need for diversified income and community support—ideas that feel eerily relevant today.

A cultural comparison reveals stark differences: in Japan, the concept of «yutori,» or having a cushion for life’s uncertainties, has roots in post-war resilience, whereas in the U.S., we’re often caught in a hustle culture that dismisses saving as boring. This irony underscores a universal truth: **preparing for financial emergencies** means learning from the past to avoid repeating it. For example, during the 2008 meltdown, those with emergency funds weathered the storm better, maintaining stability while others scrambled. It’s like comparing a well-anchored ship to one adrift—history shows the anchored ones fare better. By examining these parallels, we see that strategies like investing in low-risk assets or building multiple income streams aren’t new; they’re time-tested defenses.

Bridging Past and Present Safeguards

In modern terms, this translates to tools like budgeting apps that track your cash flow, much like how families in the 1930s meticulously recorded every penny. The benefit? A clearer path to **handling sudden expenses**, preventing history from repeating itself in your life.

The Overlooked Trap: Why We Procrastinate and How to Break Free

Here’s the uncomfortable reality: many of us know we should prepare, yet we don’t—it’s like ignoring that creaky roof until the rain pours in. In finance, this procrastination often stems from overconfidence, where we assume «it won’t happen to me.» But statistics from the Consumer Financial Protection Bureau show that unexpected events affect nearly 60% of households annually. The irony? By delaying, we amplify the impact, turning a manageable issue into a crisis. Yet, the solution lies in simple, actionable steps that demystify the process.

To counter this, start with a straightforward assessment: list your essential expenses and multiply by three months to gauge your target fund. Number them out for clarity: 1) Calculate your monthly necessities, like rent and groceries; 2) Set a realistic savings goal, perhaps $1,000 initially; 3) Automate contributions to avoid temptation. This method, which I swear by, transforms abstract advice into tangible progress. Think of it as fortifying a castle—each brick (or dollar) adds strength. And for a cultural nod, in the U.S., we often say «don’t put all your eggs in one basket,» reminding us to diversify beyond just cash, maybe into a mix of savings and insurance.

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Building an Emergency Fund | Provides quick access to cash, reduces stress | Requires discipline and time to build |

| Insurance Coverage | Protects against specific risks like health issues | May involve premiums that cut into savings |

Turning Insight into Action

By addressing this trap head-on, you’re not just preparing; you’re reclaiming control. Remember, it’s about balance—like in that iconic «Moneyball» scene, where smart plays win the game.

In wrapping this up, here’s a twist: even with the best preparations, life throws curveballs, but that’s what makes us resilient. So, take this step right now—review your budget and stash away your first $100 towards an emergency fund. What measures have you implemented for your financial security, and how has it changed your perspective? Share in the comments; let’s build a community of preparedness.