College costs soar, leaving dreams deferred. Imagine pouring thousands into education only to face crippling debt—it’s a reality for millions. Yet, here’s the twist: a 529 college savings plan isn’t just another financial tool; it’s your shield against that future regret. In this guide, we’ll dive into how to start a 529 college savings plan, blending practical steps with real insights to make saving for education feel less daunting and more empowering. By the end, you’ll grasp why starting a 529 plan early could be the smartest move for your family’s future, turning abstract numbers into actionable peace of mind.

My Wake-Up Call with 529 Plans

Picture this: a few years back, I was chatting with my sister over coffee, and she dropped a bomb about college tuition hitting her like a freight train. We’d always assumed scholarships would cover it all, but reality? Not quite. That’s when I decided to help with a 529 plan for her kid—my nephew, little Alex. I remember scouring websites late at night, feeling that familiar knot in my stomach as I realized how quickly savings could compound if we started now. It wasn’t just about the money; it was personal, like building a safety net for the family barbecues we’d share years down the line.

This experience taught me a key lesson: 529 college savings plans aren’t impersonal accounts; they’re lifelines. Originating in the U.S. under the Internal Revenue Code, these state-sponsored education savings plans offer tax advantages that can make your contributions grow faster than a kid’s height spurt. I opted for a straightforward plan from my home state, blending it with federal perks like tax-free withdrawals for qualified expenses. And boy, was that a wake-up call—delaying meant missing out on potential growth, much like skipping the first chapters of a gripping novel. If you’re on the fence, consider this: according to the College Board, the average cost of a four-year public university is over $10,000 a year for in-state students. Starting early, as I did, turns that overwhelm into a manageable journey, fostering a sense of control in an unpredictable world.

The Truth Behind Common 529 Myths

Let’s cut through the noise—many folks think 529 plans are only for the wealthy or that they’re too rigid. But hold on, that’s a myth wrapped in outdated advice. For instance, you might’ve heard that these plans lock you into one school, but the truth is far more flexible: funds can roll over to another institution or even a sibling’s education. I recall debating this with a friend who swore by traditional savings accounts, arguing they were «safer.» Yet, when we dug deeper, the tax-free growth of a 529 plan outshines that approach, especially with state tax deductions available in places like New York or Illinois.

Another uncomfortable truth: not all 529 plans are created equal. Some states offer better investment options or lower fees, which is why a quick comparison can save you headaches. Take this simple table, for example, to weigh your choices:

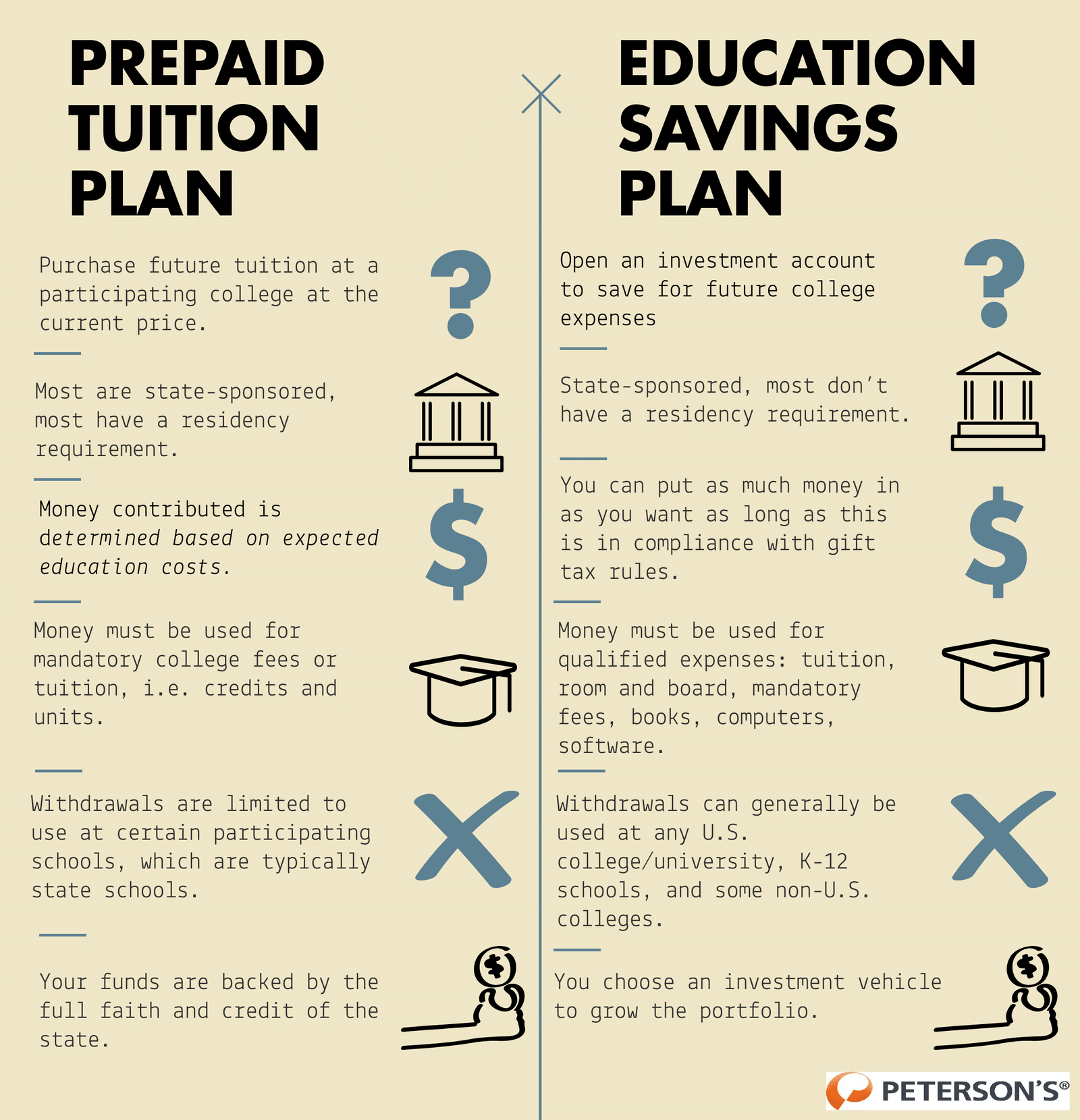

| Feature | Prepaid 529 Plan | Education Savings Plan |

|---|---|---|

| Flexibility | Locks in today’s tuition rates | Invests in market-based options |

| Tax Benefits | Federal tax-free withdrawals | Potential state tax deductions |

| Best For | Those certain about in-state schools | Long-term growth seekers |

As you can see, an education savings plan might hit the ground running for dynamic families, offering diverse investments like mutual funds. This isn’t just finance talk; it’s about real advantages, like avoiding the «opportunity cost» that sneaks up when inflation eats into regular savings. In my opinion, debunking these myths empowers you to act with confidence, much like uncovering the plot twist in a classic like «The Godfather»—what seems rigid at first reveals layers of opportunity.

Ever Wonder: What Happens If You Procrastinate?

Here’s a disruptive question: What if waiting on your 529 plan meant sacrificing your child’s future opportunities? Let’s turn this into a quick experiment—grab a calculator and project how $100 monthly contributions could grow over 10 versus 18 years at a modest 6% return. You’d be shocked; in 18 years, that adds up to over $37,000, compared to just $16,000 in 10 years. It’s not hypothetical; it’s the compound interest magic that Wall Street pros harp on, yet so many overlook.

In my circle, I’ve seen friends delay, only to play catch-up later, echoing that meme from «The Office» where Michael Scott says, «I’m not superstitious, but I am a little stitious.» The parallel? Procrastination feels harmless until it isn’t. To start a 529 plan, follow these clarified steps: First, research state options via portals like Savingforcollege.com; second, choose a plan that aligns with your risk tolerance; and third, open an account online, often in minutes, by linking your bank. This exercise isn’t about guilt; it’s a nudge to envision the ripple effects, like how early planning could fund not just tuition but experiences that shape a lifetime.

As we wrap this up, remember: starting a 529 college savings plan isn’t merely about finances; it’s about rewriting the narrative of opportunity for the next generation. That twist? The real wealth lies in the choices you make today, not the regrets of tomorrow. So, take action now—visit your state’s 529 website and set up an account today. It’s that straightforward. And here’s a reflective question: How will you ensure your family’s educational dreams don’t fade into debt? Share your thoughts in the comments; let’s build a community around smart saving.