Whispers of regret, empty pockets, and lingering debt. That’s the harsh reality for many trying to navigate the choppy waters of personal finance. Did you know that according to a recent Federal Reserve survey, nearly 40% of Americans couldn’t cover a $400 emergency with cash on hand? It’s a stark contradiction: we earn money, yet it slips through our fingers like sand. This article dives into the steps to create a personal budget plan, not as a rigid chore, but as a lifeline to financial stability and peace of mind. By the end, you’ll have a clear path to take control, turning chaos into confidence without breaking the bank.

That Time I Nearly Derailed My Finances – A Wake-Up Call

Picture this: a few years back, I was juggling freelance gigs and a full-time job, thinking I had it all under control. But then, one unexpected car repair wiped out my savings faster than a plot twist in a thriller movie. And that’s when it hit me – no plan, no safety net. I remember staring at my bank statements, feeling that gut punch of realizing how much coffee runs and impulse buys had added up. It wasn’t just numbers; it was my future at stake.

This personal blunder taught me a profound lesson: a personal budget plan isn’t about pinching pennies; it’s about intentional choices. In my opinion, based on years of trial and error, skipping this step is like driving without a map – you might get somewhere, but it’s probably not where you want to be. Drawing from American cultural norms, where «keeping up with the Joneses» often leads to overspending, I urge you to reflect on your own habits. Maybe it’s that subscription you forget about every month. By humanizing your finances – treating them as part of your story – you build resilience. Think of it as crafting a narrative where you’re the hero, not the villain in your own tale.

From Ancient Ledgers to Digital Dashboards – A Historical Lens

Fast-forward from the clay tablets of ancient Mesopotamia, where early civilizations tracked grain and goods to ensure survival, to today’s sleek budgeting apps. It’s a fascinating comparison: back then, a king’s treasurer might have used abacuses to balance the realm’s coffers, preventing famines and funding wars. Now, in our modern world, tools like Mint or YNAB (You Need A Budget) do the heavy lifting, syncing with your bank accounts in real-time. But here’s the truth that’s often overlooked – technology alone won’t save you if you don’t understand the principles.

In my view, this evolution highlights a cultural shift: from communal, village-level money management to individualized financial planning. Just as the Industrial Revolution transformed economies, our digital age demands adaptability. For instance, compare the rigidity of a handwritten ledger, which forced discipline through manual entry, to the flexibility of apps that categorize expenses automatically. Here’s a simple table to break it down:

| Aspect | Traditional Ledgers | Modern Apps |

|---|---|---|

| Accessibility | Requires physical books and time | Always on your phone, instant updates |

| Advantages | Builds mental discipline, less tech dependency | Real-time alerts, visual graphs for motivation |

| Disadvantages | Easily lost or forgotten, prone to errors | Potential for data breaches, over-reliance on tech |

This isn’t just history; it’s a roadmap. As someone who’s switched from spreadsheets to apps, I find the latter a game-changer for steps to create a personal budget plan, but with a caveat – always back it up manually, like an old-school safety net.

The Sneaky Traps of Budgeting and How to Outsmart Them

Ever feel like your money has a mind of its own, vanishing into thin air? That’s the irony of ignoring a budget – it promises freedom but delivers chains. Take the common pitfall of underestimating daily expenses; you think a latte here and there won’t hurt, but suddenly, you’re wondering where half your paycheck went. In a serious tone, this isn’t funny, but it is avoidable with straightforward strategies.

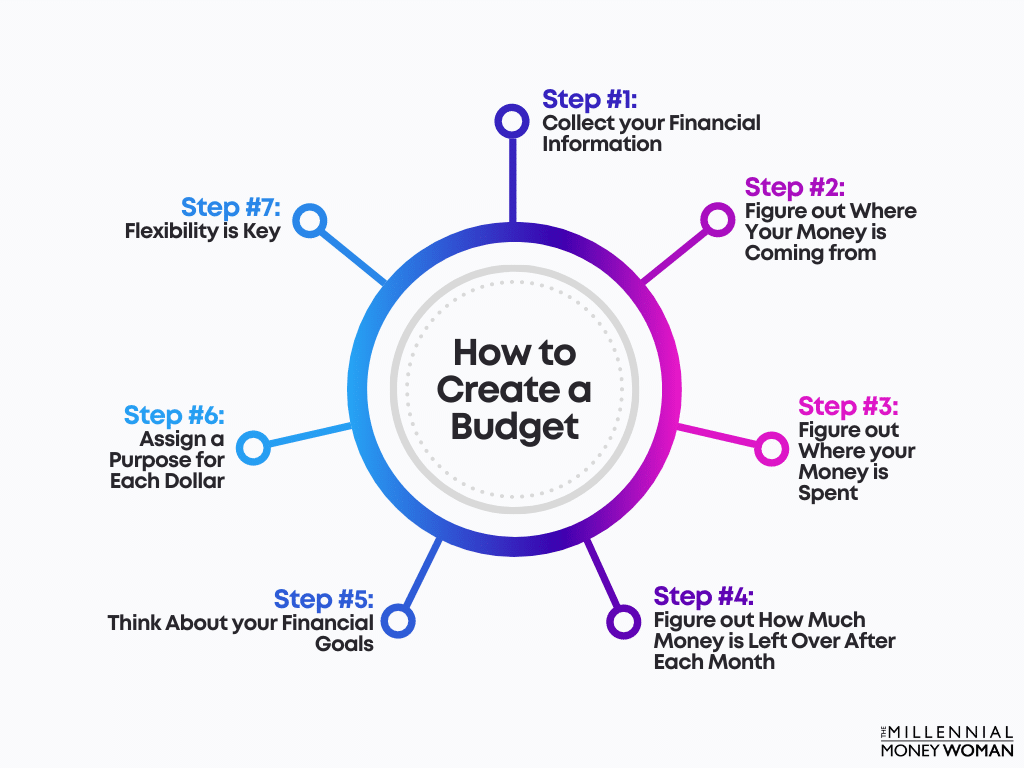

Let’s tackle it step by step, because clarity matters. First, identify your income streams – salary, side hustles, investments. Number two, track every outflow for a month; it’s eye-opening, trust me. And three, allocate percentages: 50% for necessities, 30% for wants, 20% for savings, adapting the classic 50/30/20 rule to your life. But here’s where it gets real – what if life’s curveballs, like a sudden job loss, throw it off? That’s the uncomfortable truth: flexibility is key. In my experience, building in a 10% buffer for emergencies isn’t just smart; it’s essential, drawing from cultural wisdom like «tighten your belt» during tough times.

To make this actionable, imagine a conversation with a skeptical reader: «But isn’t budgeting boring?» I’d counter, not if you frame it as a puzzle to solve, like piecing together a financial mosaic. Reference that iconic scene in «The Wolf of Wall Street» where excess leads to downfall – a pop culture nod to how unchecked spending spirals. By addressing these traps head-on, you transform budget management from a chore into empowerment.

A Final Twist: Budgeting as Your Financial Freedom Ticket

Here’s the twist: what if creating a personal budget plan isn’t about restriction, but unlocking doors you never knew existed? It’s not just about surviving; it’s thriving, turning pennies into possibilities. So, take this actionable step right now: grab a notebook or app and track your expenses for the next seven days. You’ll be amazed at the insights.

And one more thing – how has a simple budget reshaped your financial journey? Share your thoughts in the comments; let’s keep the conversation going, because real change starts with reflection.