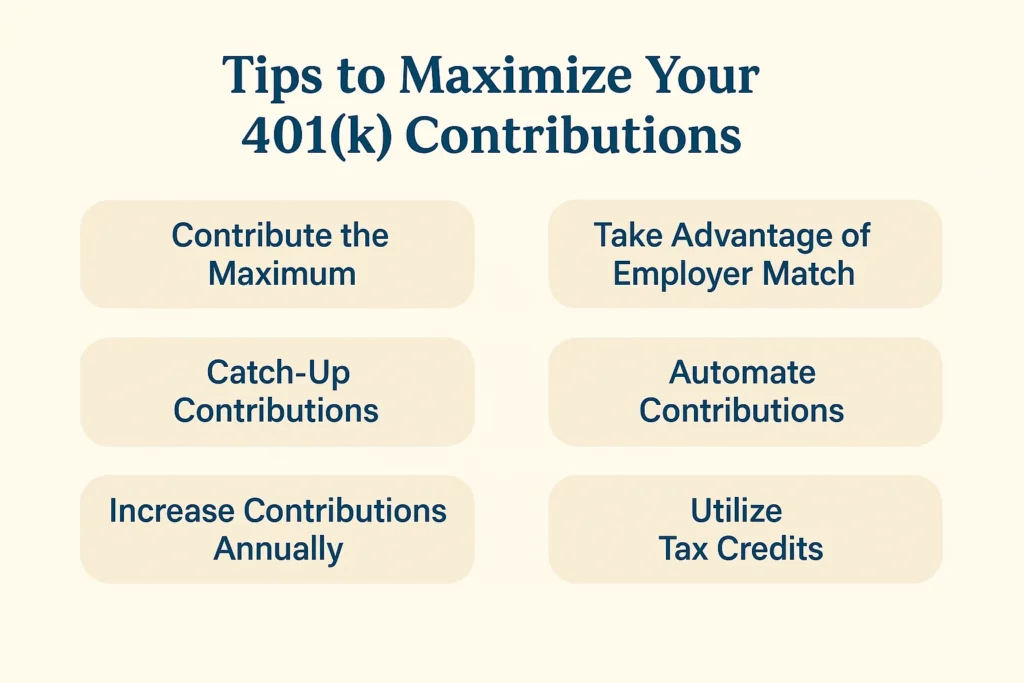

Silent fiscal guardians. That’s what 401k plans often are—overlooked powerhouses in a world obsessed with quick wins, yet they hold the key to a secure retirement. Here’s the contradiction: while millions chase get-rich-quick schemes, studies from the Employee Benefit Research Institute show that only about 30% of eligible workers max out their contributions, leaving billions on the table in potential growth and tax savings. If you’re not optimizing your 401k, you’re basically handing free money back to your employer and Uncle Sam. This article dives into practical steps to boost your contributions, turning your retirement fund into a robust wealth-building engine that works for you, not against you.

My Unexpected 401k Awakening

Picture this: back in 2015, I was grinding away at a mid-level job in Chicago, living paycheck to paycheck, and barely glancing at my employee benefits packet. It wasn’t until a routine review with a financial advisor—over coffee, no less—that I stumbled upon the employer match. «You’re leaving money on the table,» he said, and boy, was he right. I had been contributing just enough to get the match, but not a penny more, thinking it was all I could afford. And that’s when I realized… how shortsighted that was. Fast forward, and that extra 2% I bumped up to has compounded into thousands, thanks to market growth.

This personal anecdote isn’t just feel-good fluff; it’s a grounded lesson in human behavior. We all have that voice saying, «I’ll deal with it later,» but in finance, delay is the enemy. From my Midwest roots, where folks prize a solid «nest egg» over flashy spending, I’ve learned that optimizing 401k means treating it like a long-term partnership. Sure, it’s subjective, but I firmly believe that starting small, as I did, builds discipline. Think of it as planting an oak tree—it starts as an acorn but shades your future. By weaving in lifestyle adjustments, like cutting that daily latte, you free up funds without feeling the pinch.

401k Through the Lens of American Savings History

Let’s shift gears and compare: in the 1970s, when 401k plans emerged as an alternative to traditional pensions, they were revolutionary, offering workers more control amid economic uncertainty. Fast-forward to today, and it’s like pitting a smartphone against a rotary phone—both serve a purpose, but one is infinitely more efficient. Traditional savings accounts might feel safe, with their FDIC insurance, but they pale against 401k’s tax-deferred growth. For instance, contributing to a 401k can reduce your taxable income immediately, whereas a standard savings account just sits there, earning peanuts in interest.

Dig deeper, and you’ll see cultural echoes. In the U.S., where the «American Dream» often means self-reliance, 401k embodies that spirit by letting you dictate your destiny. But here’s a truth that’s hard to swallow: many still favor high-risk stocks, inspired by pop culture hits like «The Big Short,» without grasping the steady gains of a diversified 401k portfolio. It’s not about being boring; it’s about smart, strategic allocation. Consider this: if your employer matches up to 6%, that’s essentially free money—better than any historical bank rate. By maximizing contributions, you’re not just saving; you’re outpacing inflation and building a buffer against life’s curveballs.

The Hidden Traps in 401k Optimization and How to Sidestep Them

Now, let’s get real about the roadblocks. Irony alert: in a country that celebrates innovation, we often stick to outdated habits, like not adjusting contributions after a raise. «Why bother?» you might think, but that’s where the trap lies—procrastination costs you compound interest over decades. Take vesting schedules, for example; if you switch jobs frequently, you could forfeit unmatched funds. My advice? Treat it like a game of chess: plan ahead. First, audit your current contributions against your salary; second, factor in life changes, like marriage or kids, which might qualify you for catch-up contributions if you’re over 50.

To make this concrete, here’s a simple table to compare common 401k pitfalls and fixes:

| Pitfall | Why It Hurts | Fix |

|---|---|---|

| Under-contributing | Misses out on employer match and tax benefits, potentially costing thousands in lost growth. | Automate increases with each paycheck; aim for at least 10-15% of income. |

| Ignoring fees | High administrative costs can erode returns by 1-2% annually. | Review plan documents and opt for low-cost index funds. |

| Poor asset allocation | Overexposure to stocks in volatile markets can lead to panic selling. | Use a balanced portfolio; rebalance yearly to maintain your risk tolerance. |

This isn’t just theory; it’s actionable insight from real financial landscapes. And just when you think you’ve got it figured out… wait for the twist in the conclusion.

A Final Twist on Your Financial Future

In wrapping this up, consider this perspective flip: what if optimizing your 401k isn’t just about numbers, but about reclaiming control in an unpredictable world? By now, you’ve seen how small tweaks can lead to monumental gains. So, here’s your call to action—pull up your 401k statement right now and adjust your contributions to hit that employer match threshold. You won’t regret it; trust me, it’s like locking in a winning lottery ticket without the luck.

And one last question to ponder: if securing your retirement means sacrificing a few luxuries today, what story do you want to tell yourself in 20 years? Share your thoughts in the comments—let’s keep the conversation going on real financial wins. Ballpark figure, it’s worth it.