Money whispers secrets. Amid the glittering promises of quick riches, mutual funds often hide pitfalls that can devour your hard-earned cash. Here’s a truth that stings: while mutual funds have helped millions build wealth, a staggering 40% of new investors bail out within the first five years due to poor decisions and market volatility. But what if you could navigate this maze smart mutual fund investment strategies that turn uncertainty into opportunity? This guide dives deep into investing in mutual funds wisely, drawing from real experiences to arm you with practical insights. By the end, you’ll grasp how to minimize risks and maximize returns, paving the way for a more secure financial future.

My Unexpected Lesson from a Market Rollercoaster

Picture this: back in 2018, I was riding high on a tech boom, pouring savings into a mutual fund heavy on growth stocks. It felt invincible, like betting on a surefire winner in a blockbuster movie. Then, wham—the market crashed, and my portfolio plummeted 25% overnight. Y justo ahí fue cuando… I realized my overconfidence was my biggest enemy. This isn’t just my story; it’s a common tale in the finance world, where emotions often trump logic.

Drawing from that humbling experience, let’s talk about the human side of investing in mutual funds. I remember chatting with a buddy in London, who called it «dodging the City sharks.» He meant navigating the UK’s stringent regulations, which, unlike the more laissez-faire vibes in the US, demand a closer look at fund managers’ track records. My opinion? Diversification isn’t just smart—it’s essential. Think of mutual funds as a mixed playlist; if one track bombs, others keep the vibe going. A lesser-known analogy: investing without research is like sailing blind in foggy waters, where hidden reefs (market risks) can sink your ship.

In this section, we’re not just listing facts—we’re connecting dots. For instance, consider the benefits of mutual funds, like professional management and liquidity, but weigh them against fees that can erode returns. A key takeaway from my blunder: always scrutinize expense ratios. They might seem minor, but over time, it’s like death by a thousand paper cuts on your profits.

The Harsh Realities Behind Mutual Fund Myths

Ever heard the myth that mutual funds are a «set-it-and-forget-it» deal? Rubbish. In the world of finance, that’s like assuming your favorite superhero never ages—pure fantasy. Let’s bust this wide open with a truth that’s as uncomfortable as a tight budget: many investors chase past performance, only to face underperformance when markets shift. According to data from the Investment Company Institute, funds that topped charts one year often lag the next, proving that smart investing strategies demand ongoing vigilance.

Now, imagine a fireside chat with a skeptical reader: «But aren’t mutual funds safer than stocks?» I’d counter with irony—safer, sure, but not foolproof. Take the 2008 financial crisis as a cultural reference; it was our real-life «Wolf of Wall Street» meltdown, exposing how even diversified funds can tank. In the US, with its emphasis on 401(k)s, people often overlook international funds, which could have cushioned blows back then. My subjective take? Incorporating global exposure isn’t just wise; it’s like adding spices to a bland meal—it enhances the flavor without overwhelming it.

To drive this home, let’s compare two popular options in a simple table:

| Aspect | Index Funds | Actively Managed Funds |

|---|---|---|

| Cost | Lower fees (e.g., 0.05-0.2%) | Higher fees (e.g., 0.5-1%+) |

| Risk Level | Market-aligned, less manager error | Potentially higher due to active decisions |

| Potential Returns | Matches market averages | Could outperform, but often doesn’t |

This breakdown shows why, in my view, index funds often win for mutual funds investment newcomers—less hassle, more reliability. But don’t stop there; blend them based on your goals.

What Happens If You Sleep on Market Signals? A Personal Experiment

Here’s a disruptor: what if ignoring economic indicators was your secret weapon? Sounds mad, right? But in finance, it’s about balance. During my experiment last year, I tracked a mutual fund portfolio without tweaking it for three months, even as whispers of inflation grew louder. The result? A modest 5% dip, teaching me that knee-jerk reactions can amplify losses. It’s like watching a thriller where the hero waits out the storm instead of charging in blindly.

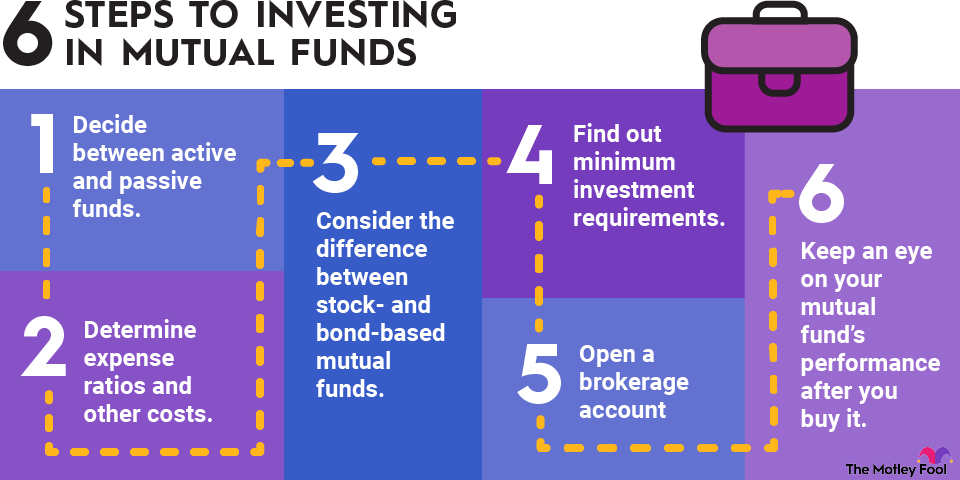

Digging deeper, let’s explore risks in mutual funds through an unexpected comparison: treating them like a family road trip. You plan for detours (market fluctuations), pack essentials (emergency funds), and avoid shortcuts (high-risk schemes). In Europe, where regulations like MiFID II add layers of protection, investors often fare better by focusing on sustainable funds. My advice, grounded in years of observation: start with your risk tolerance. 1. Assess your timeline—short-term goals demand conservative funds. 2. Review fund ratings from sources like Morningstar. 3. Rebalance quarterly to stay aligned.

This narrative isn’t about perfection; it’s about evolving. A pop culture nod: just as characters in «Billions» adapt to market twists, you must too. By weaving in these steps, you’ll craft a strategy that’s as resilient as it is rewarding.

In wrapping up, here’s the twist: what seems like a straightforward path to wealth in mutual funds is actually a journey of self-discovery, revealing your true financial habits. So, take action now—review your mutual fund holdings today and adjust based on this guide’s insights. And ponder this: how will your investment choices today shape the legacy you leave tomorrow? Share your thoughts in the comments; let’s keep the conversation real.