Debt strikes hard, doesn’t it? Just when you think you’re in control, that credit card statement arrives like an unwelcome guest at a party, revealing balances that make your stomach churn. Here’s a truth that’s as uncomfortable as a tight shoe: over 50% of Americans juggle credit card debt, often paying more in interest than they ever planned. But here’s the silver lining—this guide isn’t about quick fixes or empty promises; it’s about real, effective strategies to reclaim your financial peace. By the end, you’ll walk away with actionable steps to manage and conquer that debt, turning what feels like a mountain into manageable hills.

My Wake-Up Call: When Credit Cards Turned into Chains

Picture this: a few years back, I was that guy who thought, «What’s one more purchase? I can handle it.» But oh boy, was I wrong. After a surprise car repair ate into my budget, my credit card balance ballooned to over $5,000, with interest rates nibbling away like termites on wood. And that’s when it hit me, you know? Managing credit card debt effectively isn’t just about numbers; it’s about breaking free from the cycle that keeps you up at night.

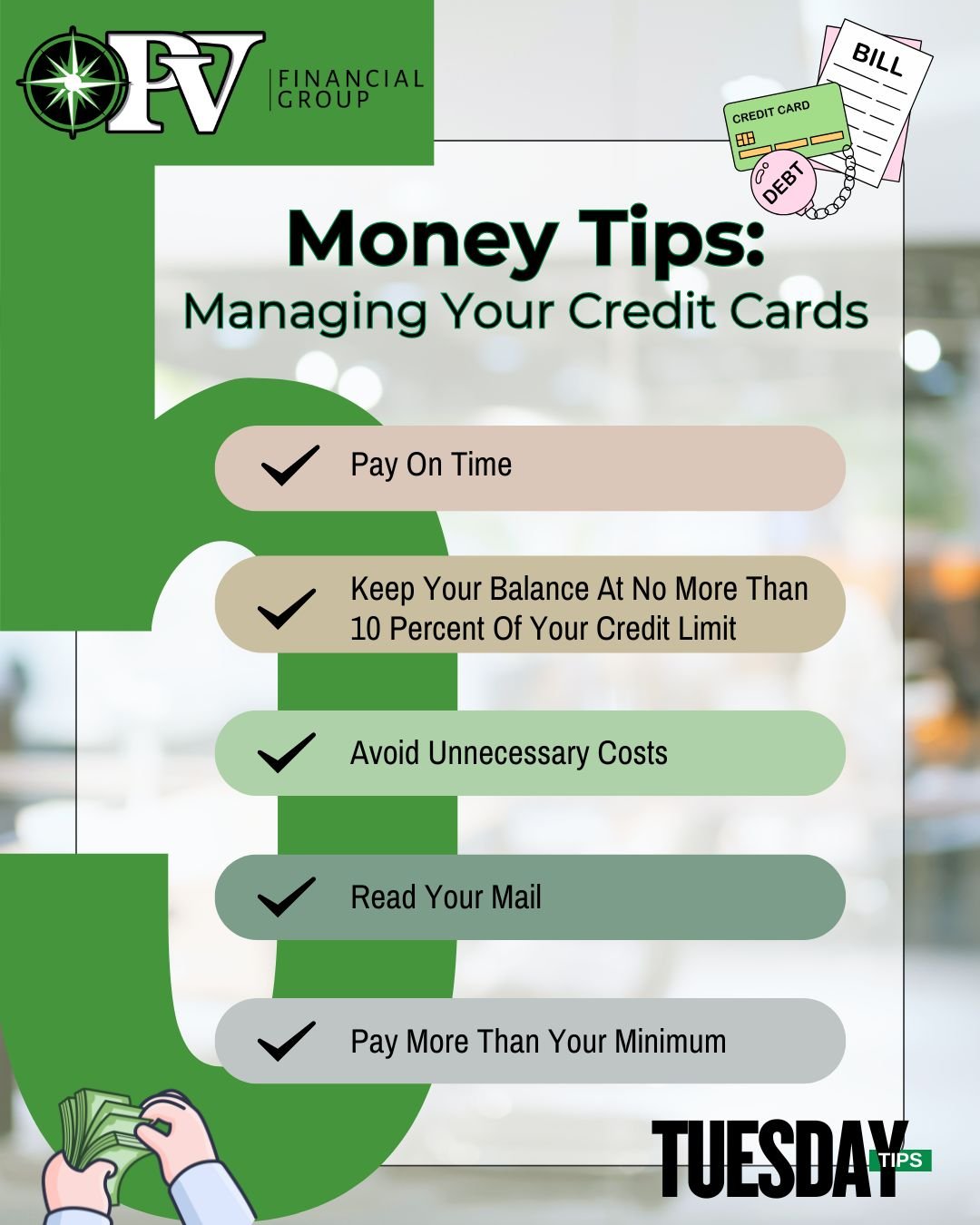

In my view, based on what I’ve learned through trial and error, the key is starting with awareness. I began by tracking every swipe, which revealed how those «little» indulgences added up faster than a plot twist in a thriller movie. Think of credit card debt as a shadow that stretches longer as the sun sets on your finances—always present, always growing if ignored. To tackle it, focus on debt repayment strategies like the snowball method, where you pay off smaller balances first for that quick win, building momentum like a rolling stone.

Locally, in the U.S., where «keeping up with the Joneses» often means maxing out cards, I’ve seen friends bite off more than they can chew with holiday spending. My lesson? Don’t wait for a crisis; start small. Review your statements monthly, and consider negotiating with creditors—it’s not as daunting as it sounds, and it can lower those high-interest rates that compound your problems.

Shattering Illusions: The Harsh Realities of Credit Card Traps

Let’s dive into a common myth: «As long as I make the minimum payment, I’m good.» Oh, if only that were true. The reality is, minimum payments on credit cards can stretch your debt out for decades, costing you thousands in interest. It’s like trying to bail out a boat with a sieve—you’re working hard, but you’re not getting anywhere fast. In finance circles, this truth is as stark as the crash in «The Big Short,» where unchecked debt led to chaos.

Comparatively, think about historical financial missteps, like the 2008 recession, where unchecked borrowing mirrored today’s credit card woes. The inconvenient truth? Managing credit card debt requires confronting interest rates that can hit 20% or more, turning a $1,000 balance into a $1,500 headache in just a year. But here’s where it gets better: by opting for balance transfer cards with 0% introductory rates, you can pause that interest clock, giving you breathing room to pay down the principal.

To make this concrete, let’s compare two approaches in a simple table:

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Balance Transfer | Avoids high interest for 12-18 months; accelerates payoff | Balance transfer fees (3-5%); risk of new debt |

| Debt Consolidation Loan | Lowers overall interest rate; simplifies payments | Requires good credit; might extend repayment time |

This isn’t just theory; it’s about choosing tools that fit your life, like picking the right key for a lock.

Are You Really in Control? Test Your Debt Defenses

What if I asked: Is your credit card debt silently dictating your choices, or are you the one calling the shots? This question disrupts the complacency many fall into, especially when «emergency» purchases become routine. Let’s try a mini experiment right now—grab your latest statement and jot down your total balance, then calculate how much interest you’re paying monthly. Eye-opening, isn’t it?

In this exercise, you’ll see how effective debt management strategies can shift the power back to you. For instance, if you’re carrying high-interest debt, consider the avalanche method: prioritize debts with the highest rates first, much like prioritizing a leaking roof over a squeaky door. It’s not always straightforward, and sometimes, as in pop culture references to «breaking bad» habits in shows like «Billions,» it takes tough decisions to regain control.

From my experience, adding a buffer like an emergency fund—aim for three months’ expenses—prevents new debt from piling on. And just between us, it’s okay to feel overwhelmed; that’s human. The trick is to take that first step, like cutting up a card that’s tempting you too much.

Wrapping this up with a twist: while credit card debt might seem like an inescapable fog, even the smallest, consistent actions can clear it, leading to a freedom you didn’t think possible. So, here’s your call to action—pull out your budget app or notebook right now and outline a plan to tackle one debt source today. What’s one bold change you’ll make to your financial habits, and how will it reshape your future? Share in the comments; let’s turn this conversation into real progress.