Wealth waits nowhere. That’s the harsh truth about money in today’s fast-paced world—it’s either growing or shrinking, rarely standing still. You might think tucking your cash under the mattress or in a basic savings account is safe, but with inflation creeping in like an uninvited guest, you’re actually losing ground. This guide dives into short-term investment options, those nimble financial tools that can help you earn returns in months, not years, while keeping risk in check. By the end, you’ll grasp how to bolster your portfolio without gambling your hard-earned dollars, turning passive savings into active growth.

My Unexpected Dive into Quick Cash Builders

Picture this: a few years back, I was staring at my bank statement, grumbling about how my emergency fund was just sitting there, earning peanuts. «Why not put it to work?» I thought, and that’s when I dipped my toes into short-term investments for the first time. It wasn’t some grand plan; it started with a high-yield savings account that promised better returns than my regular bank. I remember the exact moment—logging in and seeing that first interest deposit, small but satisfying, like finding an extra twenty in your coat pocket. But here’s the thing: I almost backed out, worried about market fluctuations eating into my gains.

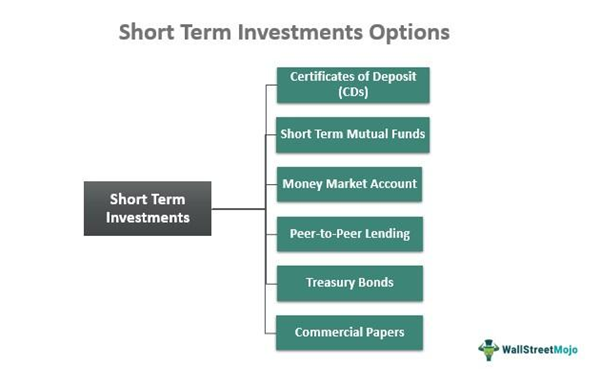

Short-term investment options, such as high-yield savings accounts or money market funds, aren’t about getting rich overnight—they’re about smart, steady growth. From my experience, these tools helped me beat inflation without the rollercoaster of stocks. I mean, who needs the drama of Wall Street when you can park your money in something stable? In the U.S., where I’m based, options like Treasury bills have become a go-to for folks like me, offering government-backed security. And just to add a personal spin, I once compared it to that episode in «The Office» where Michael Scott tries day trading—hilarious, but a reminder that quick moves can backfire if you’re not prepared. The lesson? Start small, research thoroughly, and focus on low-risk short-term investments to build confidence.

When History Repeats: Lessons from Past Financial Waves

Ever wonder why some swear by short-term bonds while others chase certificates of deposit? It’s like peering into a financial history book, where events like the 2008 recession serve as stark warnings. Back then, many got burned chasing high returns in volatile markets, only to realize that short-term strategies could have cushioned the blow. I have to admit, as someone who’s seen friends lose big on overhyped stocks, it’s frustrating how myths persist—people thinking all short-term options are risky gambles. But let’s set the record straight: tools like commercial paper or short-term corporate bonds often provide reliable returns with minimal volatility, especially in stable economies.

In Britain, for instance, where I’ve followed market trends, gilts (that’s their version of Treasury bonds) offer a cultural nod to prudent investing, much like how tea is a staple for a calm afternoon. The truth is, not every short-term investment is created equal; some, like peer-to-peer lending platforms, can yield higher rates but come with strings attached. And that’s when risks creep in… if you’re not careful. By contrasting these with traditional options, you see the value: a certificate of deposit might lock your money for a few months but guarantees a fixed return, whereas money market accounts let you dip in and out. It’s not about avoiding history’s pitfalls but learning from them to make informed choices in your own short-term financial strategies.

Imagining the Skeptic’s Challenge: Is This Really Worth It?

Okay, let’s say you’re skeptical—like that voice in my head when I first considered short-term investment options. «Why bother with all this when I can just leave my money in the bank?» you’d argue. Fair point, but hear me out: in a world where interest rates fluctuate, sticking solely to low-yield accounts is like watching your savings erode slowly. Picture a quick experiment: take $1,000 and split it—one half in a standard savings account, the other in a short-term bond fund. Track it over six months. You’d likely see the difference, with the bond fund outpacing inflation-driven losses.

This isn’t just theory; it’s backed by real data from financial reports, showing how options like ultra-short ETFs can offer liquidity and modest gains. And don’t forget, in places like Canada, where GICs (Guaranteed Investment Certificates) are popular, people use them to bridge short gaps without much fuss. But here’s where it gets ironic—many overlook these because they seem «boring,» yet that’s their strength. A simple comparison:

| Option | Potential Return | Risk Level | Liquidity |

|---|---|---|---|

| High-Yield Savings Account | 1-2% | Low | High |

| Certificate of Deposit | 2-4% | Low | Medium |

| Money Market Fund | 1-3% | Low | High |

As you can see, the trade-offs make sense for different needs. In my opinion, it’s about aligning with your goals, not chasing the next big thing.

A Final Twist on Your Financial Journey

Just when you think you’ve got short-term investments figured out, remember: even the pros slip up, like when market shifts turn expected gains into lessons learned. The real twist? These options aren’t just about money—they’re about reclaiming control in an uncertain world. So, take action now: open a high-yield account today and watch your savings grow without the wait. And here’s a reflective question to ponder: what hidden opportunities in short-term finance have you overlooked that could reshape your future? Share your thoughts in the comments; let’s keep the conversation going.