Whispers of debt. That’s how it starts—the subtle, nagging pull that can upend your financial world without a second glance. Here’s a truth that’s hard to swallow: while you might think your credit report is just a boring document, it’s actually a powerful gatekeeper to loans, jobs, and even apartments. Misunderstanding it could cost you thousands in higher interest rates or denied opportunities. But here’s the silver lining: by mastering this guide to understanding credit reports, you’ll gain the tools to protect and boost your financial health, turning confusion into confidence. Let’s dive in, shall we?

My Unexpected Financial Awakening

Picture this: five years ago, I was that guy—buried in bills, oblivious to the numbers lurking in my credit file. It hit me hard during a routine mortgage application. Understanding credit reports suddenly became urgent when the bank flagged errors that inflated my debt. I remember staring at the report, thinking, «Wait, that can’t be right.» Turns out, a mix-up from an old utility bill had dragged my score down by 50 points. This personal fiasco taught me a vital lesson: your credit report isn’t just data; it’s a reflection of your life’s choices, for better or worse.

In my case, digging into the details revealed how factors like payment history and credit utilization really work. Opinions vary, but I firmly believe that ignoring this is like driving blindfolded—eventually, you’ll crash. Drawing from U.S. financial norms, where credit scores dictate everything from car loans to insurance premiums, I see parallels in everyday American culture. It’s akin to that unexpected plot twist in «Breaking Bad,» where Walter White’s life spirals from one bad decision. Except here, a single late payment can echo for seven years. To make it relatable, try this mini experiment: pull your free annual credit report from AnnualCreditReport.com and spot one unfamiliar entry. That small step could uncover issues before they snowball.

The Layers Beneath the Surface

And just like peeling an onion, there’s more depth than you expect. We’ll get to that shortly, but first, let’s build on this foundation.

From Medieval Tallies to Today’s Digital Scores

Shift gears for a moment: imagine ancient merchants in medieval Europe scratching tallies on wooden sticks to track debts—that’s the historical root of what we now call credit reports. Fast-forward to modern America, and it’s evolved into a sophisticated system overseen by agencies like Equifax and TransUnion. This comparison highlights a cultural shift: in the U.S., where individualism reigns, your credit score is almost a badge of personal responsibility, unlike in some European countries that emphasize collective financial safety nets.

But here’s an inconvenient truth: myths abound. For instance, many assume a high income guarantees a stellar score, yet that’s far from accurate. In reality, credit history weighs heavier, making it a humbling reminder that wealth isn’t always about earnings. Think of it as comparing a shiny new car to a well-maintained classic—surface appeal versus enduring value. This historical lens shows how understanding credit reports has become essential in our consumer-driven society, where a «FICO score» can make or break deals. To add perspective, consider how post-Great Recession reforms tightened regulations, forcing transparency that benefits savvy consumers like you.

| Aspect | Historical Context | Modern Relevance |

|---|---|---|

| Tracking Method | Manual ledgers and tallies | Digital algorithms and reports |

| Key Factors | Repayment promises | Payment history, utilization (aim for under 30%) |

| Advantages | Simple, community-based trust | Access to better rates, personalized financial advice |

| Disadvantages | Easily manipulated or lost | Errors that persist without vigilant checks |

This table isn’t just filler; it’s a quick way to grasp how far we’ve come, emphasizing why personal finance demands active engagement.

The Overlooked Pitfalls and How to Dodge Them

Now, let’s address the elephant in the room: so many folks breeze past their credit reports, thinking, «Eh, it’ll sort itself out.» Irony alert—that’s precisely what keeps financial advisors up at night. In a serious tone, I’ll admit, ignoring discrepancies is like leaving your front door unlocked in a sketchy neighborhood; it’s an invitation for trouble. But here’s the fix: start by verifying every entry annually. For example, if you spot an erroneous charge, dispute it promptly through the credit bureau’s portal.

Building on that, consider long-tail keywords like «how to improve your credit score» organically weave in. One effective strategy? Pay bills on time—it’s the backbone of a strong report, as I learned the hard way. And that’s when it hit me: small, consistent actions, such as reducing high-interest debt, can turn things around. In a nutshell, treat your credit like a garden; neglect it, and weeds take over, but nurture it, and you’ll reap rewards. For those in the U.S., remember that state-specific laws, like California’s consumer protection acts, add layers of defense.

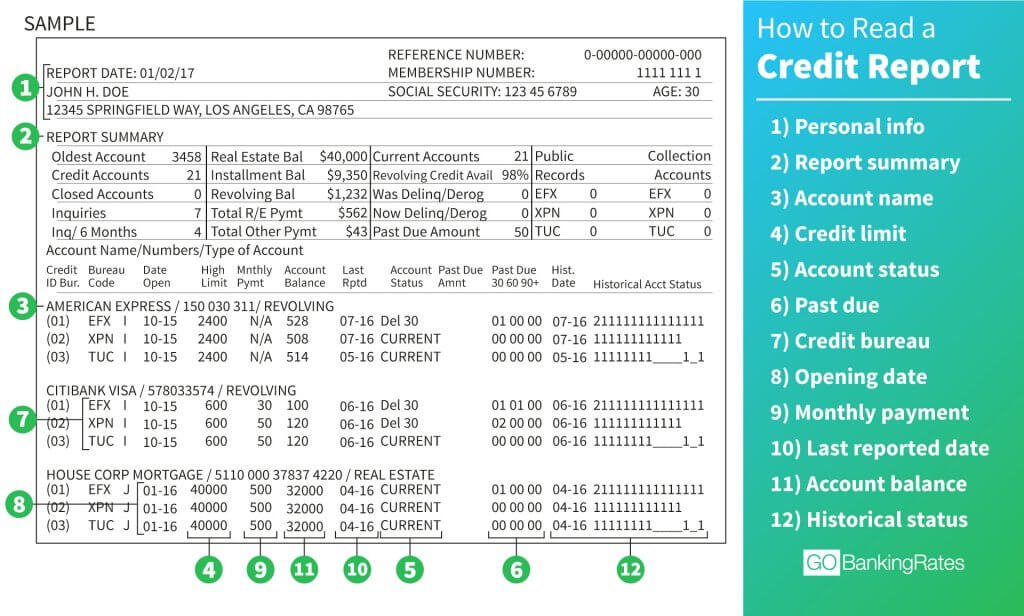

To wrap this section, propose a simple exercise: grab your report, list out the five key components—accounts, inquiries, public records, and more—and rate your own habits. It’s not about perfection; it’s about progress, hitting the nail on the head for better financial stability.

A Fresh Perspective on Your Financial Future

In closing, what if I revealed that understanding your credit report isn’t just about avoiding pitfalls—it’s about reclaiming control and opening doors you never knew existed? We’ve journeyed through personal stories, historical insights, and practical solutions, all pointing to one truth: your credit is a dynamic story you’re writing daily.

So, take action now: log into your credit monitoring service or request a free report and spend 15 minutes reviewing it for inaccuracies. You’ll thank yourself later. And on a reflective note, how has delving into your credit report reshaped your view of personal finance—has it exposed vulnerabilities you weren’t aware of? Share your thoughts in the comments; let’s keep the conversation going.