Money slips away silently. In a world obsessed with instant gratification, ignoring tomorrow’s storms feels almost natural. Yet, here’s the uncomfortable truth: one flat tire, a sudden job loss, or a medical bill can wipe out your finances faster than you can say «budget.» Building an emergency fund quickly isn’t just smart—it’s your ticket to real peace of mind, shielding you from debt spirals and sleepless nights. Through personal stories and practical steps, this guide will show you how to stash away that safety net without derailing your daily life. Let’s dive in, because financial security starts with action, not just wishes.

My Unexpected Breakdown: A Personal Tale of Financial Jitters

Picture this: I was cruising through life in my mid-30s, thinking I had it all figured out. Then, boom—my car’s engine gave out on a rainy Chicago evening, leaving me stranded with a repair bill that hit like a freight train. That moment, with tow trucks beeping and rain soaking my shoes, taught me a harsh lesson. I had zilch in savings, relying on credit cards that only dug me deeper into debt. It’s embarrassing to admit, but there I was, a so-called «financially responsible» adult, panicking over a few thousand bucks.

I firmly believe that emergencies don’t wait for your permission; they crash in when you’re least prepared. In the U.S., where we’re always chasing the next big thing, it’s easy to fall into this trap—spending on lattes or gadgets while ignoring the basics. Drawing from that Chicago fiasco, the key takeaway is simple: start small, but start now. Building an emergency fund isn’t about perfection; it’s about creating a buffer against life’s curveballs. Think of it like planting seeds in a garden—you water them daily, and eventually, they grow into something sturdy. And just like that rainy night, when I finally set aside my first $100, it felt like regaining control. Y’know, that ballpark figure of three to six months’ worth of expenses? It’s not a myth; it’s a lifeline.

Historical Echoes: How Past Crises Shape Modern Savings Wisdom

Fast-forward from my personal mess to the broader stage: remember the Great Depression? Folks back then didn’t have apps or online banking; they learned the hard way that quick savings tips could mean the difference between eating and starving. In those days, families stashed cash under mattresses or in community jars, a cultural norm born from scarcity. Compare that to today, where we’re bombarded with buy-now-pay-later schemes—it’s almost ironic how we’ve circled back to needing that same prudence.

But let’s get real: in countries like the U.S., where consumerism is king, this historical lesson often gets lost. A rainy day fund isn’t just about money; it’s about resilience, much like how immigrants in the early 20th century built networks to weather economic storms. I often ponder how, if we adopted a fraction of that mindset, we’d avoid the modern pitfalls of living paycheck to paycheck. For instance, the 2008 financial crash showed us that even stable jobs aren’t foolproof—millions lost everything overnight. This comparison isn’t to scare you; it’s to highlight a truth: personal finance advice rooted in history works. So, why not blend the old with the new? Use tech to track your spending, but remember the Depression-era wisdom of prioritizing necessities over luxuries.

A Fresh Angle on Budgeting Basics

Shifting gears, ever wondered how a simple budget tweak could accelerate your emergency fund building? It’s not as dry as it sounds. Take my experiment: I tracked every expense for a month, uncovering hidden leaks like unused subscriptions. The result? I freed up an extra $200 without feeling deprived.

The Paycheck Cycle Trap: Ironing Out Financial Wrinkles with Strategy

Here’s the problem that keeps me up at night: too many people are stuck in the tight spot of paycheck-to-paycheck living, where one hiccup derails everything. It’s not funny—it’s frustrating—but addressing it head-on can turn things around. I mean, who hasn’t thought, «I’ll save next month,» only to repeat the cycle? The solution lies in deliberate steps, like automating transfers to a high-yield account before temptations hit.

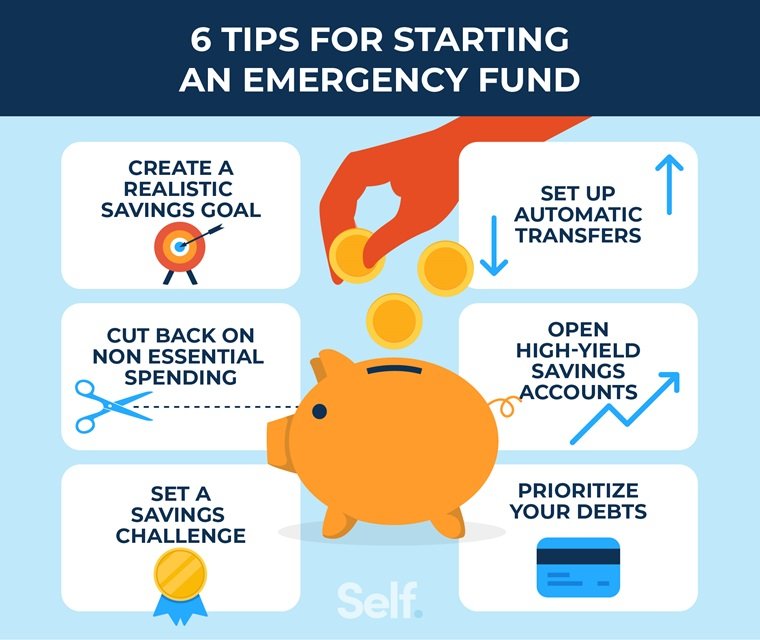

To break free, let’s outline a practical plan. First, assess your current situation: calculate your monthly essentials—rent, groceries, utilities—and subtract that from your income. That gap? That’s your potential savings pool. Number two, cut non-essentials strategically; for example, if dining out is your weakness, aim for home-cooked meals twice a week. And three, leverage tools like apps that round up purchases to an emergency fund—it’s painless and effective. Here’s a quick comparison to clarify:

| Strategy | Pros | Cons |

|---|---|---|

| Automate Savings | Builds habit without effort; earns interest quickly | May require initial setup; overlooks irregular income |

| Cut Expenses | Immediate cash flow boost; empowers control | Can feel restrictive; needs discipline to sustain |

| Side Hustles | Fast income growth; flexible options like freelancing | Takes time; might lead to burnout if not managed |

By tackling this seriously, you’ll see progress. And that’s when it clicks—your fund growing, month by month.

Imagining Doubts: A Chat with Your Inner Skeptic

Okay, you’re probably thinking, «But how can I build an emergency fund quickly when inflation is eating my budget?» It’s a valid point, especially with rising costs. Imagine we’re chatting over coffee: I’d say, «Sure, it’s tough, but let’s test a mini experiment. For one week, track your spending and redirect just 10% to savings. You’ll be surprised how financial planning for emergencies becomes second nature.» This approach flips the script, turning doubt into doable action, much like how characters in «The Office» improvise their way out of messes—except here, it’s your real-life finances at stake.

Wrapping up, while we’ve covered the nuts and bolts, remember this twist: building that fund isn’t just about money; it’s about reclaiming your freedom. So, take this actionable step—open a dedicated savings account today and deposit whatever you can, even if it’s just $20. What if an emergency hit tomorrow—would you be ready? Share your thoughts in the comments; let’s keep the conversation going on real emergency savings strategies. After all, in the game of life, you’re the one holding the cards.