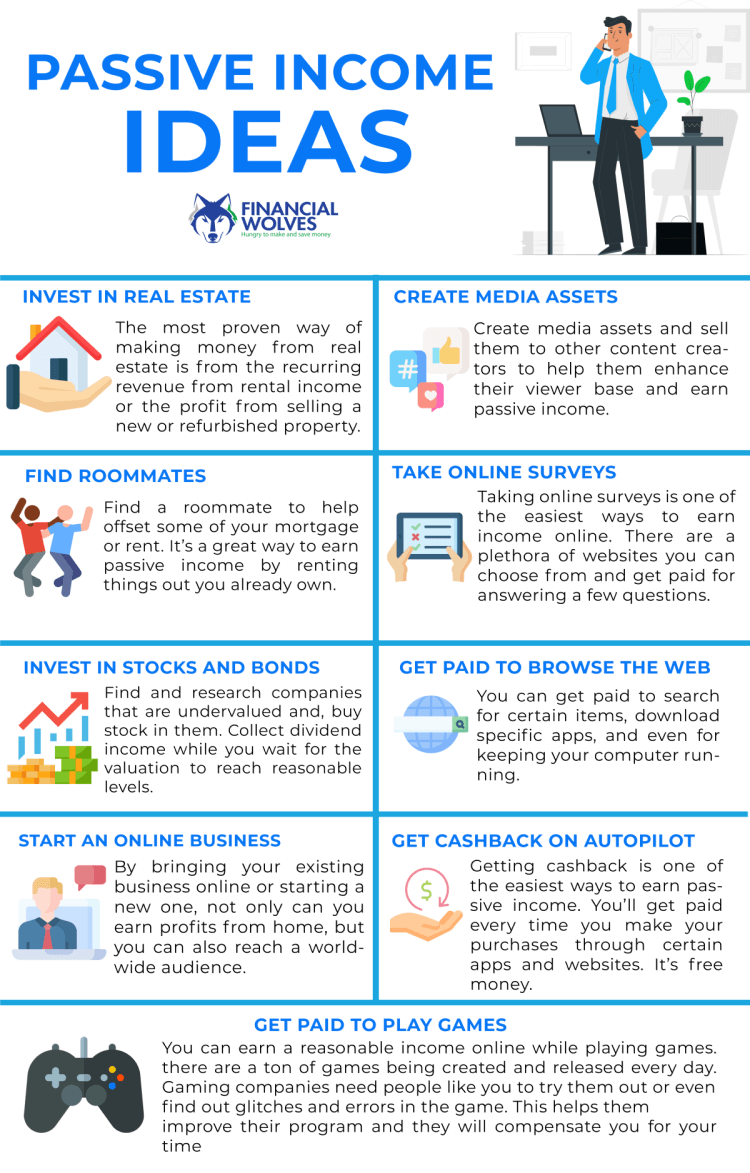

Wealth builds quietly, often in the shadows of daily hustle. Yet, here’s the kicker: while we chase paychecks that vanish into bills, a staggering 70% of self-made millionaires credit passive income for their financial freedom, according to a study by Ramsey Solutions. That’s right—it’s not about working harder, but smarter. If you’re tired of the nine-to-five grind and dreaming of streams that flow without constant effort, this article unveils practical ideas for passive income streams. By the end, you’ll grasp how these strategies can bolster your finances, offering security and growth in an unpredictable economy.

My Unexpected Dive into Dividend Stocks

Picture this: a few years back, I was drowning in debt, juggling side gigs just to make ends meet. Then, almost by accident, I stumbled upon dividend stocks—those reliable corporate shares that pay you simply for owning them. It started with a modest investment in a blue-chip company, something like generating passive income from everyday brands we all know. Fast forward, and those quarterly dividends added up, turning into a steady trickle that covered my utilities without lifting a finger.

But let’s get real; it’s not all sunshine. I remember the first market dip—heart pounding, second-guessing every buy. My opinion? It’s like planting a garden; you nurture it initially, but then nature takes over. This isn’t just finance talk; it’s a life lesson on patience. In the U.S., where I’m from, we often say «don’t put all your eggs in one basket,» and boy, did that ring true when diversifying my portfolio saved me from a total wipeout. Yet, here’s an unexpected analogy: investing in dividends is like brewing coffee—best passive income ideas start slow but deliver that warm, energizing payoff. And that’s when it hit me… the power of compounding, quietly building wealth over time.

Lessons from History’s Wealth Builders

Ever wonder how ancient traders amassed fortunes without modern tools? Take the Medici family in Renaissance Italy; they didn’t just paint masterpieces—they mastered lending and investments, creating passive income streams through interest and trade shares. Fast-forward to today, and it’s eerily similar to how real estate syndicates work, where you pool resources for property investments and reap rental income without managing tenants yourself.

This historical lens exposes a truth: wealth accumulation has always hinged on leverage. In contrast to the industrial era’s labor-intensive paths, modern passive income echoes the Medici’s strategy—using others’ efforts for your gain. For instance, creating an online course once and selling it repeatedly mirrors how authors like J.K. Rowling earn royalties indefinitely, much like in the Harry Potter series where magic multiplies. But here’s a subjective take: in our fast-paced world, ignoring these parallels is like skipping the foundation of a house; it might stand briefly, but it’ll crumble. To make this tangible, let’s compare two popular streams in a simple table:

| Stream | Advantages | Disadvantages |

|---|---|---|

| Rental Properties | Potential for appreciation and steady cash flow | Requires upfront capital and maintenance hassles |

| Affiliate Marketing | Low entry cost and scalable online reach | Depends on audience building and market fluctuations |

This isn’t just history repeating; it’s a blueprint for ideas for passive income that adapt to your life, whether you’re in a bustling city or a quiet suburb.

Navigating the Risks with Calculated Moves

Alright, let’s address the elephant: not every passive idea pans out. I once dabbled in peer-to-peer lending, lured by high returns, only to face defaults that stung my wallet. It’s ironic how something so «hands-off» demands upfront research. In finance circles, we joke that it’s like fishing—you cast the line, but if you don’t check the weather, you might go home empty-handed.

To counter this, start with a mini experiment: pick one stream, say dividend investing, and allocate a small budget for six months. Track your progress, adjust as needed. For example, if you’re eyeing ways to generate passive income through e-books, write one on a niche topic you’re passionate about, then automate sales via platforms like Amazon. The solution lies in diversification—don’t rely on a single source. In American finance lingo, «making it rain» means steady inflows, but remember, even rain can flood if not managed. And just when you think you’ve got it figured… life throws a curveball, emphasizing the need for resilience.

In wrapping this up, here’s a twist: what if passive income isn’t just about money, but reclaiming your time? By implementing even one of these ideas, you’re not chasing wealth—you’re building a legacy. So, take action now: choose a passive income stream like affiliate marketing and set up your first campaign today. It’s that simple start that could transform your finances. Finally, I leave you with this: what’s the one passive income idea you’ve overlooked that could change your financial story? Share in the comments; let’s keep the conversation going.