Bills lurking everywhere. That’s the uninvited truth for most of us—those monthly demands that pile up like uninvited guests at a dinner party. Did you know that the average household in the US wastes nearly 15 hours a month on bill payments, according to a recent survey by the Consumer Financial Protection Bureau? It’s a staggering contradiction: in an age of instant gratification, we’re still chained to outdated routines that drain time and energy. But here’s the benefit—by streamlining your bill payments, you can reclaim those hours, reduce stress, and even spot savings opportunities you never knew existed. In this article, we’ll dive into practical ideas to streamline bill payments, drawing from real experiences and smart strategies to make your financial life smoother and more efficient.

My Personal Tug-of-War with Bills: Lessons from the Trenches

Let me take you back to early 2020, when I was juggling freelance gigs and a growing family. Picture this: every first of the month, I’d spend hours sifting through emails, logging into different portals, and scribbling notes on a cluttered desk. One particularly chaotic evening, I missed a utility payment deadline because, well, life happened—a kid’s fever and a deadline at work. And that’s when it hit me, the frustration boiling over. It wasn’t just about the late fee; it was the mental load, like carrying a backpack of rocks uphill.

My opinion? Manual bill tracking feels heroic at first, like you’re in control, but it’s a fool’s errand in the long run. I finally switched to auto-pay for my utilities and subscriptions, and it was a game-changer. Drawing from that mess, the key lesson is automation’s power—it’s not lazy; it’s smart. Think of it as planting a garden instead of hunting for food every day; you set it up once and reap the benefits. For SEO enthusiasts, terms like automated bill management aren’t buzzwords; they’re lifelines for folks drowning in administrative tasks. In the US, where financial independence is almost a cultural rite, tools like bill consolidation apps have become essential, much like how coffee shops popped up in every corner for our caffeine needs.

The Illusion of Control: Debunking Manual Payment Myths

Here’s a truth that’s hard to swallow: many people cling to manual bill payments thinking it builds character or prevents oversights. But let’s unpack that myth with some cold, hard facts. In reality, manually handling bills increases the risk of errors—studies from the American Bankers Association show that up to 20% of payments made this way are late or incorrect. It’s like believing you can outrun a storm by walking faster; you’re just inviting more chaos.

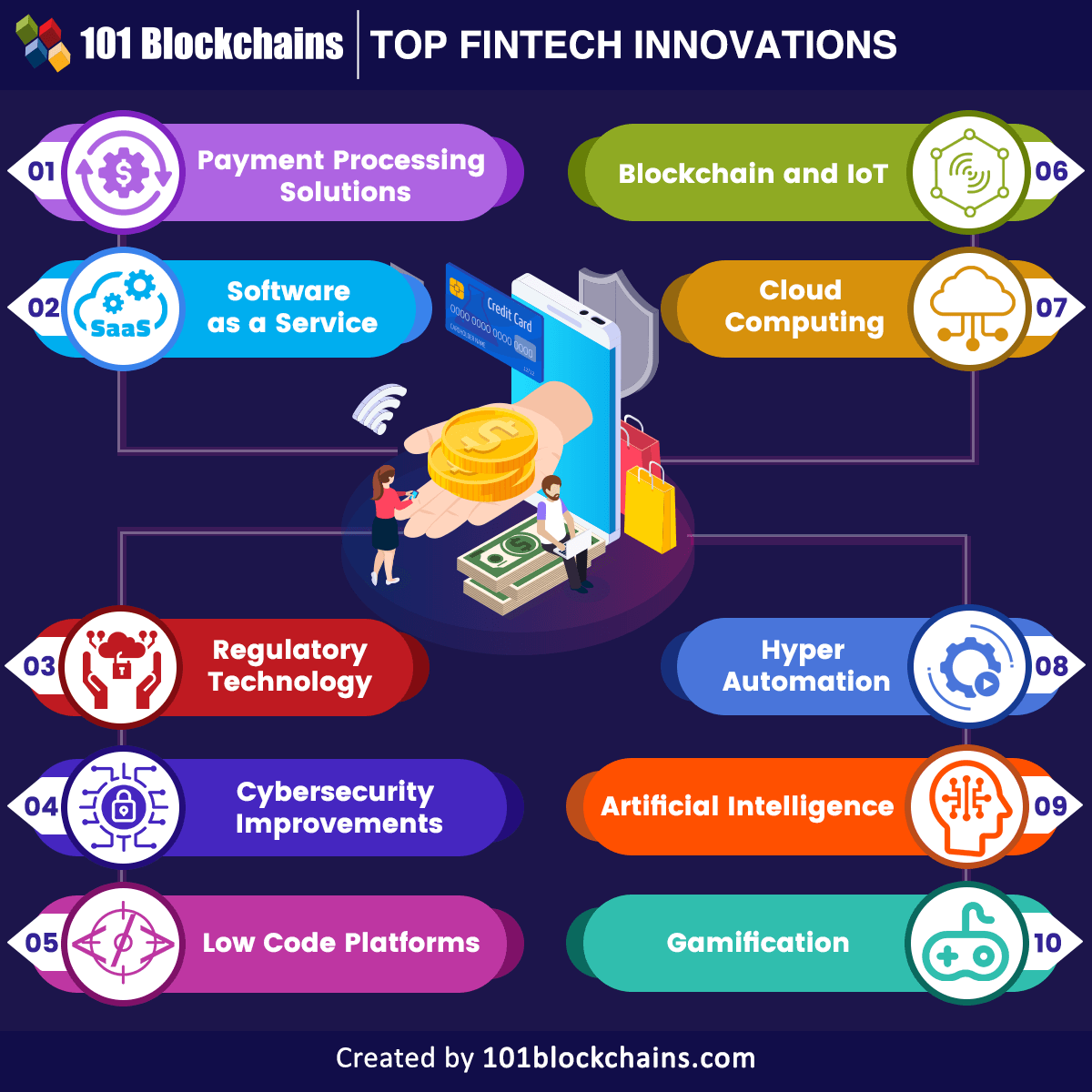

Comparatively, automated systems are the unsung heroes. Take a look at this simple breakdown to see why:

| Aspect | Manual Payments | Automated Payments |

|---|---|---|

| Time Investment | High—often 5-10 hours monthly | Low—setup once, then minimal effort |

| Error Rate | Increased due to human oversight | Minimal, with built-in reminders and alerts |

| Cost Savings | Potential late fees add up | Often includes discounts for auto-pay |

| Peace of Mind | Constant worry, like a ticking clock | Freedom to focus on what matters |

This comparison isn’t just numbers; it’s about real financial health. As someone who’s been there, I find it ironic that we romanticize the struggle when tools like online banking dashboards can streamline everything. In American culture, where «pulling yourself up by the bootstraps» is a modism we live by, admitting that automation is a no-brainer feels almost rebellious. Yet, the uncomfortable truth is that sticking to old ways can cost you in hidden fees and missed opportunities, like ignoring a stock tip because it seems too easy.

Imagine Reclaiming Hours: A Disruptive Question and Your Quick Trial

What if bill payments didn’t dictate your schedule—what if they worked for you instead? That’s the disruptive question that changed how I approach finances. To test this, try a mini experiment: over the next week, track how much time you spend on bills and then simulate switching one key payment to auto-pay. For instance, set up your internet bill through your bank’s app and note the difference in your routine. It’s not rocket science; it’s about small shifts that add up.

In my case, after experimenting with a budgeting app, I discovered I could redirect that saved time toward investments—think of it as turning bill management into a side hustle opportunity. This isn’t just theory; financial experts often reference how streamlined processes, like those in bill payment strategies, correlate with better long-term savings. And here’s a nod to pop culture: remember how Tony Stark in the Iron Man series automates his suits for efficiency? You can do the same with your bills, without the high-tech flair. By the end of your experiment, you might find that phrases like manage bills efficiently become part of your everyday vocabulary, proving that proactive finance is within reach.

Wrapping this up with a twist: while streamlining bills might seem like just another chore, it’s actually the key to unlocking a more empowered financial future—one where you’re not reacting to demands but anticipating them. So, take action now: pick one bill and automate it today; you’ll thank yourself later. And on a reflective note, how has streamlining your payments reshaped your financial habits? I’d love to hear your thoughts in the comments—let’s keep the conversation going.