Bills piling up? In a world where financial freedom feels like a distant mirage, it’s ironic that over 78% of Americans are living with debt, according to recent surveys from the Federal Reserve. Yet, amidst this chaos, a simple tool—a debt payoff calendar—can turn the tide, offering not just organization, but a clear path to reclaiming your wallet and peace of mind. Imagine slicing through that mountain of credit cards and loans with a strategy that actually works. In this article, we’ll dive into the steps for creating a debt payoff calendar, blending real-life insights with practical advice to help you master your finances without the overwhelm.

That Time Debt Nearly Derailed My Dreams

Picture this: fresh out of college, I thought I had it all figured out, only to watch my student loans and credit card bills multiply like rabbits in a field. It was back in 2015, right after the economy had stabilized from the Great Recession, and I was juggling payments that felt like an endless game of Whac-A-Mole. Creating a debt payoff calendar wasn’t on my radar then; I just winged it, paying whatever I could each month. And that’s when it hit me—late one night, staring at a stack of envelopes, realizing my dream vacation was slipping away because of interest charges eating my budget alive.

This personal fiasco taught me a hard lesson: without a structured plan, debt doesn’t just linger; it sabotages your future. I remember thinking, «Why didn’t anyone tell me about this?» It’s like trying to navigate a foggy road without headlights—futile and frustrating. By adopting a debt calendar, I shifted from reactive to proactive, prioritizing high-interest debts first, much like how a gardener prunes the weeds before they choke the flowers. If you’re in a similar spot, know that this isn’t just about numbers; it’s about regaining control and, dare I say, a bit of self-respect in your financial journey.

From Ancient Empires to Your Checking Account

Ever wonder how the mighty Roman Empire crumbled under its own weight? Historians point to excessive debt as a key factor, with emperors borrowing wildly and defaulting on loans, leading to economic collapse. Fast-forward to today, and it’s a stark reminder that steps to create a debt calendar aren’t just modern advice—they’re timeless survival tactics. In the U.S., where consumer debt hits record highs, it’s like we’re replaying history on a personal scale, with credit cards acting as the empire’s unchecked spending.

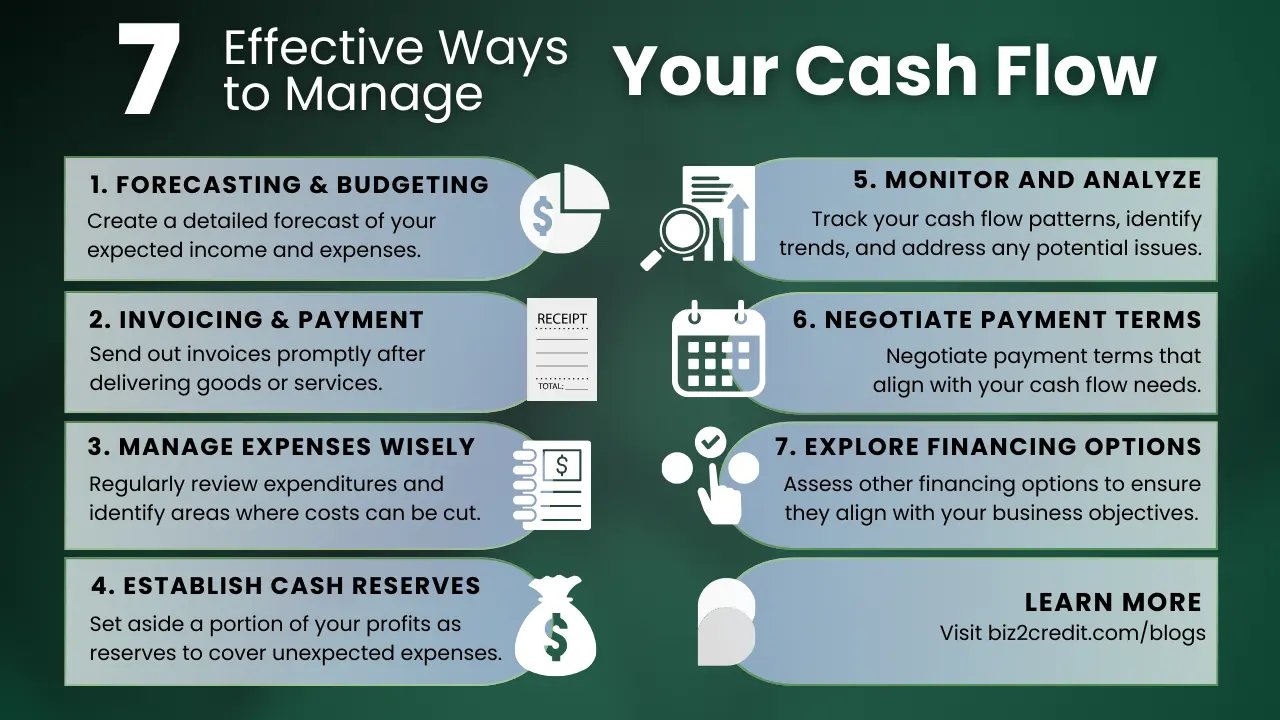

Compare that to cultures like the Japanese, who emphasize «kakeibo,» a budgeting method that tracks every yen, promoting mindful spending over impulsive buys. It’s a subtle nod to how different societies handle financial burdens, yet the core idea aligns: mapping out debts forces accountability. Think of your debt payoff plan as a bridge between ancient wisdom and today’s digital tools—apps like Mint or Excel spreadsheets can mimic that structured approach, turning abstract numbers into a visual timeline. This comparison isn’t to overwhelm you, but to highlight how, across eras, debt repayment strategies have evolved from papyrus scrolls to smartphone screens, always aiming for the same goal: stability.

A Twist on Traditional Tools

What if I told you that your grandma’s envelope system could beat out fancy fintech? In practice, combining old-school methods with a digital calendar creates a hybrid powerhouse, cutting through the noise of modern finance apps.

Tackling the Debt Beast with Calculated Moves

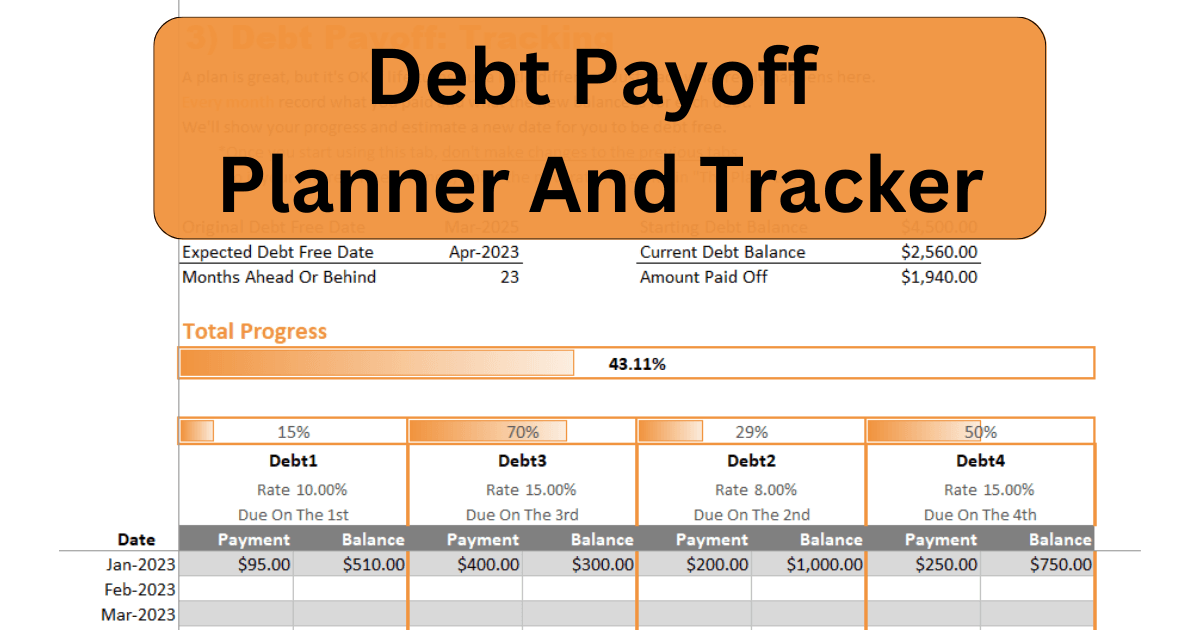

Here’s the irony: many folks know they have debt, but ignore it like that unopened bill in the junk drawer, hoping it’ll vanish. The truth is, procrastination only amps up the interest, turning a molehill into a mountain. Let’s cut through that with a no-nonsense look at building your debt payoff calendar, starting with identifying your debts—list them out, from the smallest credit card balance to that looming mortgage. 1. Gather all statements to see the full picture; 2. Calculate interest rates because, as they say, time is money slipping away; 3. Set realistic monthly payments based on your budget.

Now, for the fun part—or as fun as finance gets—visualize this as wrangling a wild horse: you need to break it down. Use a spreadsheet or a dedicated app to plot monthly targets, marking milestones like «Pay off Card A by June.» It’s like plotting a road trip; you wouldn’t drive cross-country without a map, right? And just when you think it’s straightforward, remember the unexpected curveballs—life events that throw off your plan. That’s where flexibility shines, adjusting your calendar without losing momentum. By front-loading high-interest debts, you’re not just saving cash; you’re building a narrative of triumph over financial chaos.

| Debt Type | Interest Rate | Recommended Strategy |

|---|---|---|

| Credit Card | 18-24% | Avalanche method: Pay aggressively to minimize interest |

| Student Loan | 4-7% | Snowball method: Build momentum with smaller wins |

| Mortgage | 3-5% | Long-term calendar: Focus on extra payments post-high-interest debts |

In wrapping this up, even the pros in «The Big Short» movie got caught off guard by debt’s domino effect, but you don’t have to. By crafting your calendar, you’re flipping the script from victim to victor.

Wrapping It Up with a Fresh Perspective

What if I told you that your debt isn’t just a burden, but a teacher in disguise, pushing you toward smarter choices? After all this, imagine looking back in a year, debt-free and empowered—that’s the real twist. So, take action now: grab a notebook or open that app and sketch out your first debt payoff calendar today. It might feel daunting, but start small, and watch the chains loosen.

And one last thing: what’s the one debt habit that’s holding you back the most? Share in the comments; let’s turn insights into collective wisdom.