Money whispers secrets. In a world where financial markets swing like pendulums, Exchange-Traded Funds (ETFs) stand as both a beacon and a trap for everyday investors. Yet, here’s the uncomfortable truth: many dive into investing in ETFs without a solid plan, only to face volatile returns or missed opportunities. This article outlines practical steps for investing in ETFs effectively, drawing from real experiences to help you build a resilient portfolio. By the end, you’ll gain actionable insights that could safeguard your finances and amplify growth, all while navigating the complexities of modern finance.

My First Dive into ETFs – A Lesson in Patience

Picture this: back in 2015, I was a wide-eyed analyst staring at my computer screen, convinced that effective ETF investment was as straightforward as picking the hottest stock tip. Fresh out of a finance course, I plunked down money into a broad market ETF without much thought. And just like that, the market dipped – Brexit happened, and my portfolio took a hit. It was messy, full of second-guessing and late-night spreadsheets. But here’s the raw opinion I formed: rushing in without understanding the basics is like building a house on sand. In my view, ETFs aren’t just passive investments; they’re tools that demand respect for their underlying assets and market dynamics.

To tie this back, let’s talk about a personal anecdote with specifics. I recall analyzing the SPDR S&P 500 ETF (SPY) during that turbulent time, expecting steady gains based on historical data. Instead, I learned the hard way that diversification isn’t optional – it’s essential. This experience ties into broader how to invest in ETFs strategies, where starting with education prevents costly errors. Think of it as planting seeds in different soils; some will flourish, others won’t, but the mix keeps your garden alive. And that’s when it hit me – wait, no, it was more like a slow realization over coffee – that ETFs effectively require a foundation in risk assessment.

ETFs Through the Lens of Financial History

Ever compare investing in ETFs to the resilience of ancient trade routes? Just as the Silk Road adapted to empires rising and falling, ETFs have evolved since their inception in the 1990s, offering a modern twist on diversification. Historically, investors relied on individual stocks, much like merchants betting on single spices, only to face ruin if one failed – think the 1929 crash that wiped out fortunes. ETFs, by contrast, bundle assets into a single, tradable package, mirroring the balanced portfolios of Renaissance bankers who spread risks across ventures.

This cultural parallel highlights a key advantage: in the U.S., where I’m based, ETFs have become a staple for retail investors, much like apple pie at a family gathering. But let’s get real – not all ETFs are created equal. A comparison might help: traditional mutual funds often carry higher fees and less flexibility, whereas ETFs trade like stocks with lower costs and intra-day pricing. Here’s a simple table to break it down:

| Feature | ETFs | Traditional Mutual Funds |

|---|---|---|

| Trading Flexibility | Buy/sell anytime during market hours | End-of-day pricing only |

| Fees | Typically lower (e.g., 0.05-0.25% expense ratio) | Often higher (e.g., 0.5-1% or more) |

| Diversification | Easy access to broad markets | Possible, but with potential overlaps |

As you can see, steps for investing in ETFs effectively often start with recognizing these edges, drawing from historical lessons to avoid repeating past mistakes. In my subjective take, this historical context adds depth, making ETFs not just a product, but a smart evolution in finance.

The Hidden Traps of ETF Investing and Smart Workarounds

Now, let’s address the elephant in the room: even with their benefits, ETF investment strategies can lead to pitfalls if you’re not careful. Take overtrading, for instance – it’s like chasing shadows in a foggy market, where fees eat into your returns faster than you realize. I remember debating a colleague about this; he was skeptical, saying, «ETFs are too passive for real gains.» My response? That’s a myth; the truth is, poor timing can turn a solid ETF into a liability.

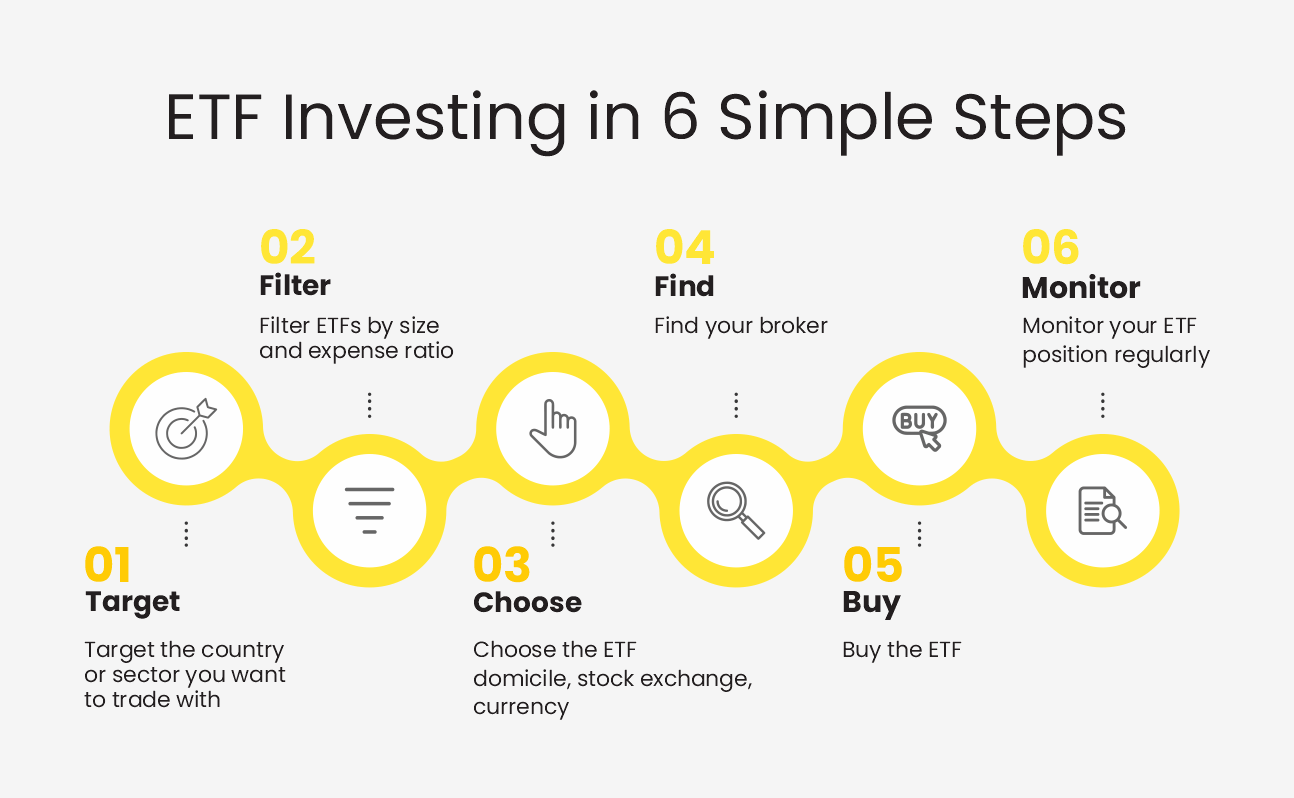

To counter this, consider a mini experiment: track your chosen ETF’s performance against benchmarks for a month. You’ll likely uncover patterns, like how sector-specific ETFs (e.g., tech-focused ones) react to news cycles. In a serious tone, I’d argue that best ways to invest in ETFs involve numbered steps for clarity: 1. Assess your risk tolerance first, perhaps by journaling your financial goals; 2. Research thoroughly, focusing on metrics like the ETF’s tracking error; 3. Allocate based on a balanced portfolio, say 60% in broad indices and 40% in targeted funds. This approach, drawn from real-world application, sidesteps common errors with a dose of irony – after all, who knew that skipping homework could cost you in the market?

And just to nod at pop culture, think of it like Warren Buffett’s famous bets; he’s often quipped about the markets being a wealth creator, but only for the prepared. By incorporating these workarounds, you’re not just investing; you’re crafting a narrative of financial savvy.

A Final Twist on Your Financial Journey

In wrapping up, while investing in ETFs effectively promises diversification and ease, it’s no silver bullet – markets can still surprise, much like that plot twist in a thriller novel. The real twist? Your mindset might be the biggest asset. So, take this CTA seriously: review your current holdings and adjust based on today’s economic signals, starting with a quick audit of your ETF expenses.

And here’s a reflective question to ponder: What overlooked factor in your ETF investment strategy could change everything? Share your thoughts in the comments; let’s keep the conversation going. Across the pond or stateside, every insight counts.