Silent giants slumber. Real estate investment trusts, or REITs, aren’t the flashy stars of Wall Street like crypto booms or tech IPOs, but they’ve quietly built fortunes for savvy investors. Here’s the uncomfortable truth: while everyone chases the next big stock tip, REITs offer a steady path to passive income without the hassle of managing properties yourself. Imagine turning your savings into a portfolio that generates cash flow like a well-oiled machine—all while dodging the pitfalls of direct real estate ownership. In this guide, we’ll walk through the essential steps for investing in real estate investment trusts, helping you build wealth that’s resilient in turbulent markets. By the end, you’ll grasp not just the how, but why this strategy could be your ticket to financial stability.

My First Dive into REITs: A Personal Wake-Up Call

Let me take you back to 2015, when I was knee-deep in my first real job, staring at a modest 401(k) that felt more like a safety net than a springboard. I’d always dreamed of owning property, but the down payments and maintenance? Forget it—that’s where REITs entered the picture for me. Picture this: I poured a few thousand dollars into a equity REIT focused on commercial spaces, thinking it was a no-brainer. And it was, until market volatility hit and I realized I hadn’t diversified enough. That misstep taught me a hard lesson—REITs aren’t get-rich-quick schemes; they’re about long-term real estate investment strategies that demand patience and research.

From my experience, the key is starting small. Begin by educating yourself on how REITs work: they’re companies that own, operate, or finance income-producing real estate, and they must distribute at least 90% of their taxable income as dividends. That’s a game-changer for folks like me who crave that steady cash flow. But here’s my subjective take—don’t just chase high yields; look for funds with strong management teams and solid occupancy rates. I remember thinking, «If I can pick a reliable landlord, why not let them handle the dirty work?» It’s like hiring a property manager without the fees. And just when I thought I’d nailed it, a dip in retail REITs reminded me that even these giants can stumble in economic shifts.

Unpacking the Basics: Why It Clicked for Me

Diving deeper, my early blunder highlighted the importance of understanding REIT types. Whether it’s equity REITs, which own properties, or mortgage REITs that lend money, each has its quirks. For instance, I focused on equity ones for their tangible assets, but overlooked how interest rate hikes could squeeze profits. That personal anecdote underscores a broader truth: successful investing in real estate investment trusts starts with self-education, not blind leaps.

REITs vs. Traditional Real Estate: Echoes from History

Fast-forward to the Roaring Twenties or the post-WWII housing boom, and you’ll see parallels in how people built wealth through property. But here’s the twist—traditional real estate demanded deep pockets and endless oversight, whereas REITs democratized access since their inception in the 1960s. Think of it as the Ford Model T of finance: suddenly, investing in prime locations like Manhattan skyscrapers or suburban malls was possible without breaking the bank.

To put this in perspective, let’s compare the two in a simple table. On one side, you’ve got the hands-on drama of buying a rental property; on the other, the streamlined efficiency of REITs.

| Aspect | Traditional Real Estate | REITs |

|---|---|---|

| Initial Investment | High (e.g., down payment of 20%+ on a property) | Low (shares often under $50, via brokerage accounts) |

| Management Effort | Intensive (repairs, tenants, taxes) | Minimal (professionals handle operations) |

| Liquidity | Low (selling a property can take months) | High (trade like stocks on exchanges) |

| Income Potential | Variable dividends from rentals | Consistent payouts, often 4-6% yield |

This comparison isn’t just numbers—it’s about real-world choices. As an investor, I’ve seen how REITs shine in diversification, spreading risk across multiple properties without me lifting a finger. Sure, traditional routes build equity, but in today’s fast-paced economy, who has time for that? It’s like choosing a bicycle over a car for a cross-country trip; both work, but one gets you there faster.

Navigating the Risks: From Hurdles to Horizons

Alright, let’s get real—every investment has pitfalls, and REITs are no exception. I once overheard a skeptical friend say, «REITs? That’s just Wall Street’s way of selling you someone else’s headache.» He’s not entirely wrong; market downturns can hit hard, especially for mortgage REITs sensitive to interest rates. But here’s the irony: by understanding these risks, you turn them into opportunities. For example, during the 2008 crash, resilient REITs rebounded strongly, proving their long-term value.

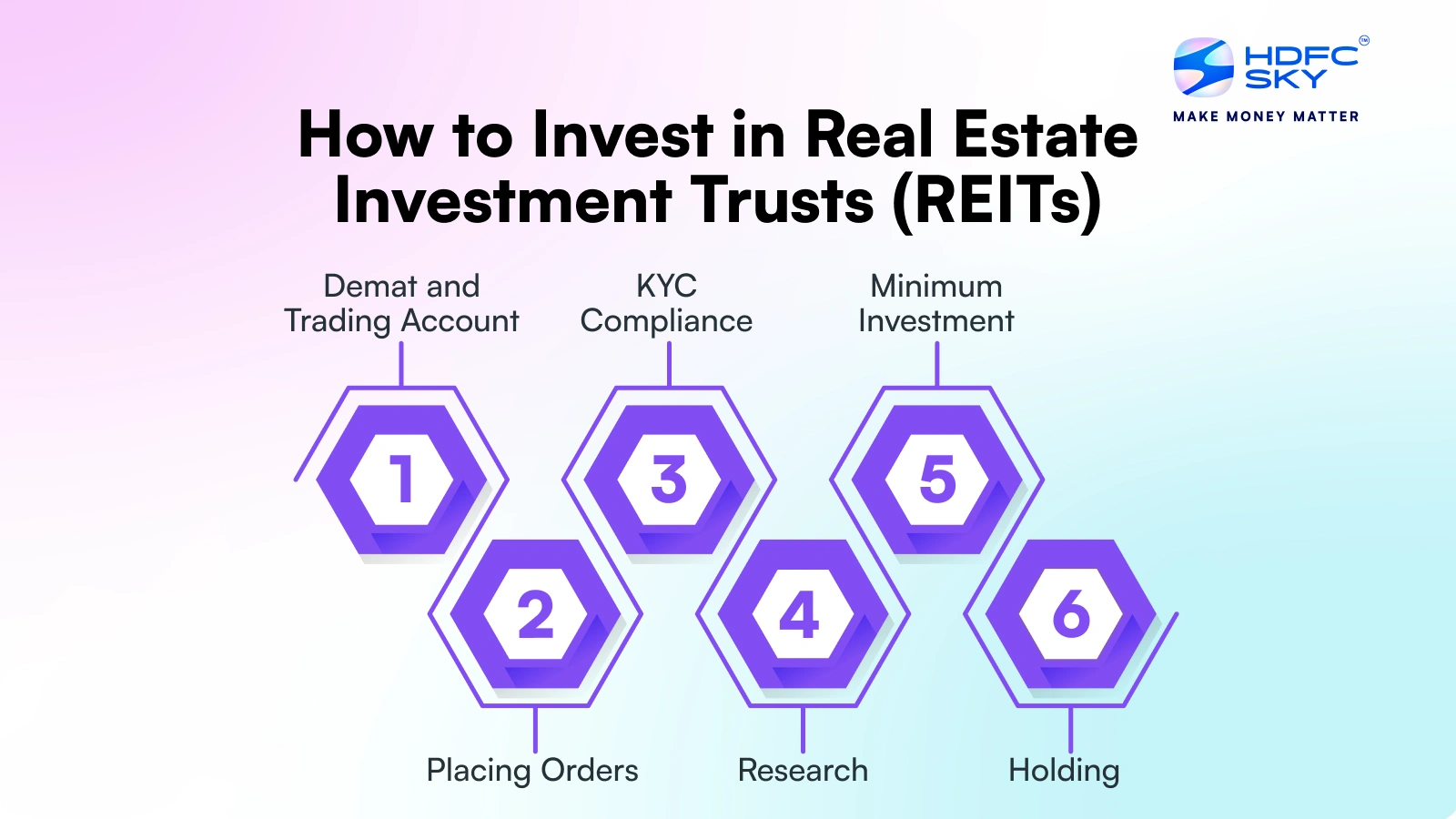

To tackle this, follow these steps: 1. Assess your risk tolerance—start with a small allocation if you’re cautious. 2. Research thoroughly, focusing on metrics like funds from operations (FFO) and debt levels. 3. Diversify across sectors, like healthcare or industrial REITs, to buffer against slumps. And that’s when it hits you—investing in real estate investment trusts isn’t about avoiding risks; it’s about managing them smartly. In my view, this approach builds a portfolio that’s as sturdy as a New York brownstone.

A Quick Experiment for You

Try this: Pull up a REIT tracker online and compare a few options’ dividend yields versus their price volatility. You’ll see how some, like those in essential services, offer stability amid uncertainty. It’s a eye-opener, trust me.

Here’s the plot twist: while REITs promise growth, they’re not a cure-all; they’re a piece of the puzzle in a balanced finance strategy. So, take action now—open that brokerage account and start with a modest investment in a diversified REIT fund. What’s your biggest hesitation when it comes to diving into real estate trusts? Share in the comments; let’s discuss how to overcome it.