Shadows of debt haunt many, but wait—thousands escape early. It’s a stark contradiction: student loans, often painted as a lifelong shackle, can actually be shattered with smart moves. Picture this: in 2023, over 40 million Americans carried student debt, racking up $1.6 trillion in total, yet savvy borrowers shaved years off their payments. The problem? Interest piles on like unchecked weeds, stealing your future earnings. But here’s the benefit for you: following these steps could save you thousands in interest and gift you financial freedom sooner. Let’s dive into practical, real-world strategies to **pay off student loans early**, blending my own bumpy path with actionable finance wisdom.

My Accidental Victory Over Student Loans

Back in 2015, when I landed my first job post-grad, that loan statement hit like a ton of bricks—$45,000 staring back, with interest ticking away. I remember thinking, «This is my ball and chain, dragging me down.» But here’s a personal anecdote that changed everything: one rainy evening in Chicago, I sat crunching numbers on a beat-up laptop, inspired by a friend’s quick payoff story. She, a teacher in the Midwest, had thrown extra at her loans after a side gig, and boom—debt-free in five years. My lesson? It’s not about giant leaps; it’s the small, consistent pushes. For instance, I started by auditing my budget, cutting out frivolous coffee runs, which freed up $200 a month. This humanizes finance: it’s messy, full of trial and error, but rewarding. To **optimize student loan repayment**, focus on high-interest loans first—the avalanche method, as I call it, borrowing from debt snowball tactics. And just like that unexpected windfall from a tax refund, I doubled payments, chipping away faster. Don’t overlook federal programs; I consolidated mine, locking in a lower rate that saved me over $5,000 in interest.

Historical Echoes in Modern Debt Battles

Ever wonder how figures like Benjamin Franklin navigated financial pitfalls? In the 18th century, he preached frugality, comparing debt to «a current that sweeps one away.» Fast-forward to today, and it’s eerily similar: the average borrower faces rates up to 7%, eroding wealth like Franklin’s famous kite experiment zapped electricity. But let’s twist this culturally— in the U.S., we idolize rags-to-riches tales, from Horatio Alger stories to modern memes like «hustle culture» on TikTok. Yet, the truth is uncomfortable: many chase side hustles without a plan, missing out on **early student loan payoff strategies**. Compare that to Japan’s «kakeibo» budgeting method, which emphasizes tracking every penny—a historical nod to mindful spending that could slash your debt timeline. In my opinion, based on years of finance tinkering, this approach beats flashy apps. For example, I once compared loan repayment plans in a simple table:

| Plan Type | Interest Savings Potential | Best For |

|---|---|---|

| Standard 10-Year Plan | Minimal | Stable income earners |

| Income-Driven Repayment | Up to 20% if income drops | Variable earners, like freelancers |

| Refinancing for Early Payoff | 30% or more with extra payments | Aggressive savers |

This comparison shows refinancing isn’t always the hero, but for me, it was a game-changer, especially with rising rates. And that’s when the metaphor hits: treating loans like a garden, you prune the weeds (interest) before they overrun.

The Subtle Traps of Interest and Smart Evasions

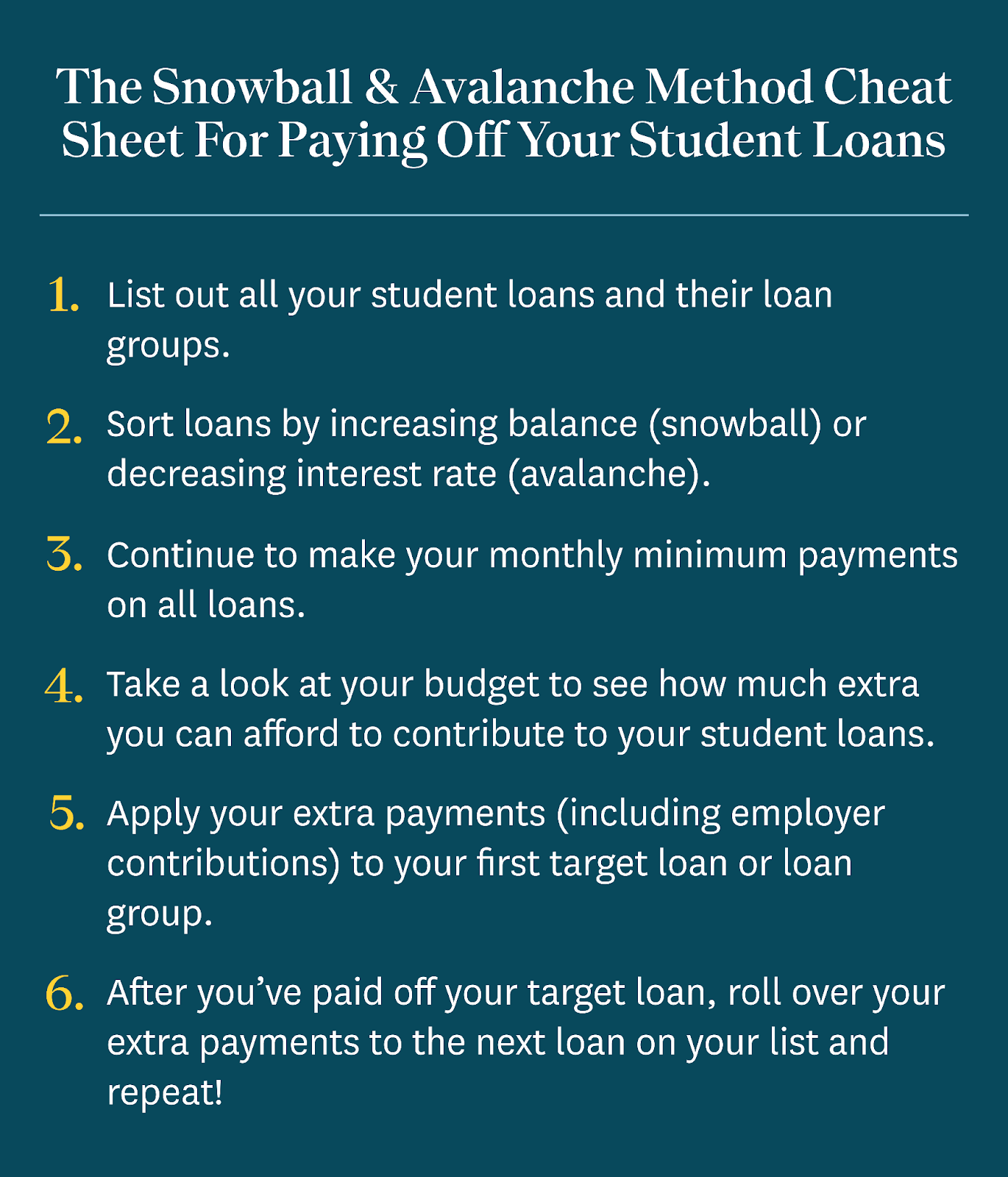

Here’s a disruptive question: Why do we let interest compound like a villain in a thriller, such as the plot twists in «The Big Short»? It’s ironic— we know it’s eating our money, yet inertia wins. In finance circles, this is the «interest accrual trap,» where deferring payments balloons your balance. But let’s solve it practically. Start by 1) Calculating your total interest over time using free online calculators— I did this and nearly choked at the projection. 2) Then, automate extra payments toward the principal, which I learned from a finance podcast, effectively starving the interest beast. 3) Finally, leverage employer matching on retirement accounts to free up cash flow; it’s like killing two birds with one stone, as the old saying goes. My subjective take? This isn’t just numbers; it’s reclaiming your life. I once tried an experiment: for a month, I lived on 80% of my income, directing the rest to loans. The result? A palpable sense of control, proving **tips to eliminate student debt** don’t need to be revolutionary—just intentional.

And wrapping this up with a twist: while debt feels eternal, it’s often just a phase you can flip. So, take this CTA seriously—review your loan statements and make one extra payment this week. It’ll snowball from there. Finally, reflect on this: What hidden expense in your life is secretly feeding your loans, and how might cutting it reshape your financial story? Share your thoughts in the comments; let’s keep the conversation real.