Taxes, the inevitable headache. Wait a minute, who said taxes have to derail your life? Every year, millions dodge the April 15th bullet by filing for extensions, yet many still view it as a last-ditch scramble. Here’s the contradiction: while procrastinating on taxes can lead to fines and stress, requesting an extension is a legitimate, IRS-approved strategy that buys you breathing room without penalties. In this article, we’ll walk through the steps to file for tax extensions, helping you avoid the panic and focus on accuracy. By the end, you’ll see how this simple move can turn tax season from a foe into a manageable ally, saving you time and potential headaches in the finance world.

My Own Tax Tangle and the Lesson That Stuck

Picture this: last year, I was knee-deep in a sea of crumpled receipts and forgotten deductions, staring down the tax deadline like a deer in headlights. And that’s when it hit me, right in the middle of a coffee-fueled all-nighter. As a freelance consultant, my finances are a wild ride—think unpredictable income streams and that red tape we all love to hate. I decided to file for a tax extension, not out of laziness, but because I knew rushing would mean errors. In my opinion, it’s like navigating a storm; sometimes, you need to batten down the hatches and extend your timeline for clearer skies.

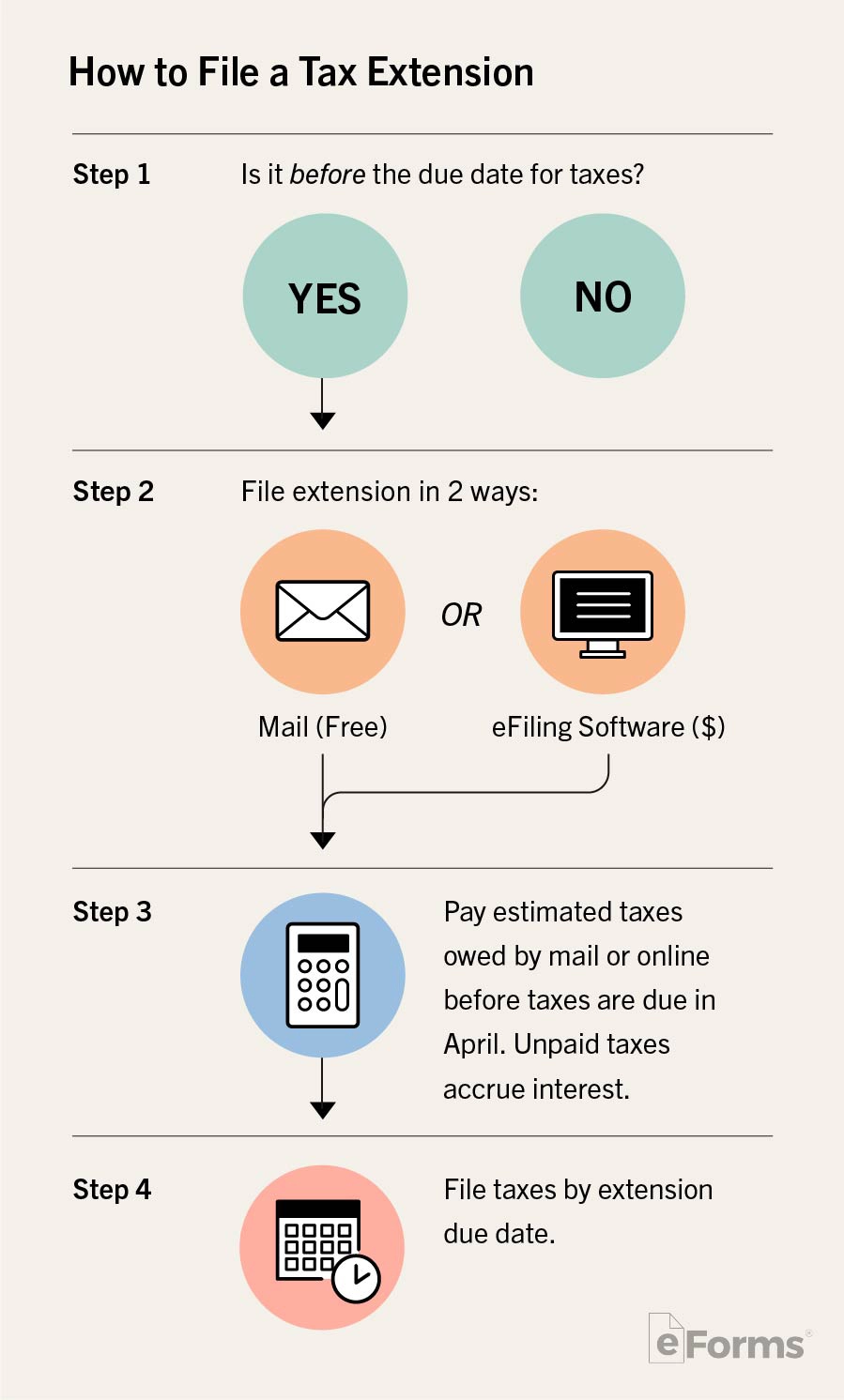

The process started with a simple Form 4868 for my federal taxes. I remember thinking, «This is easier than I expected—almost a piece of cake once you get past the initial nerves.» By sharing this, I’m not glorifying delays; rather, I’m emphasizing how an extension can be a strategic tool. For instance, if you’re in the U.S., like I am, the IRS allows you to push the deadline to October 15th, giving you extra months to gather documents. Key benefit: no late-filing penalty if you pay any owed taxes by the original date. This personal anecdote underscores that extensions aren’t just for the disorganized; they’re for anyone seeking accuracy in their financial reporting.

Busting the «Extension Equals Audit» Myth with Some Hard Truths

Let’s get real—there’s a pervasive myth floating around finance circles that filing for a tax extension flags you for an IRS audit. I call that nonsense; it’s like saying wearing a seatbelt invites accidents. In truth, extensions are routine; the IRS processes millions annually without batting an eye. But here’s the uncomfortable reality: while an extension doesn’t increase audit risk, it does mean you have to be vigilant about meeting the new deadline, or you could face interest on unpaid taxes.

To compare, let’s look at federal versus state extensions in a quick table. This isn’t just filler; it’s a practical breakdown to help you plan better.

| Aspect | Federal Extension (IRS Form 4868) | State Extension (Varies by state) |

|---|---|---|

| Deadline Extension | From April 15 to October 15 | Often aligns with federal, but check locally (e.g., California uses FTB Form 3516) |

| Cost | Free to file | Usually free, but may require separate filing |

| Advantages | Gains time for accurate filing; e-file option is straightforward | Can coordinate with federal for ease; some states offer automatic extensions |

| Disadvantages | Must estimate and pay taxes owed upfront | Not all states follow federal rules, leading to potential oversights |

As someone who’s navigated this, I firmly believe that understanding these differences can save you from unnecessary stress. For example, if you’re in a high-tax state like New York, don’t assume your state extension is automatic—double-check to avoid that ballpark figure of penalties adding up.

Why Procrastinate When You Can Plan? A Disruptive Question and Your Quick Experiment

Ever asked yourself, «What if I just ignored the deadline altogether?» Sounds reckless, I know, but let’s use that as a springboard for a mini experiment. Grab a pen and paper—or your phone notes—and jot down: 1) Your current tax readiness on a scale of 1-10, 2) The potential financial hit from late filing (penalties can reach 5% per month), and 3) One action you’d take with an extra six months. This isn’t fluff; it’s a way to confront the finance reality head-on.

Now, applying this to filing for extensions, the steps are straightforward but require attention. First, estimate your tax liability and pay any amount due when you file the extension form—think of it as front-loading your finances to avoid interest. Second, use IRS tools like the Free File program if your income is under a certain threshold; it’s surprisingly user-friendly, almost like binge-watching a Netflix series without the spoilers. And third, keep records meticulously because, as we all know from that episode of «The Office» where Michael Scott bungles his taxes, disorganization leads to comedy in TV but disaster in real life.

In essence, this experiment highlights how extensions empower you to turn potential pitfalls into opportunities for better financial health. By questioning your habits, you’re already a step ahead in the tax game.

Wrapping this up with a twist: what if filing for an extension isn’t just about dodging deadlines, but about reclaiming control in your financial narrative? Take action now—head to the IRS website, download Form 4868, and file electronically before the clock runs out. It’s that simple, and you’ll thank yourself later. Finally, here’s a thought to ponder: how has your approach to taxes evolved, and what one change could make next year less taxing? Share in the comments; I’d love to hear your stories.