Money’s quiet revolution. Amid the hustle of daily life, many overlook how a simple Roth IRA can transform future security into a tangible reality. Here’s the contradiction: while everyone dreams of a comfortable retirement, only a fraction actually take the first step, often due to overwhelming jargon and perceived complexity. But wait—starting a Roth IRA isn’t just about stashing cash; it’s your ticket to tax-free growth and peace of mind. In this guide, I’ll walk you through the essential steps, drawing from my own experiences in the finance world, to help you sidestep common pitfalls and build a nest egg that works for you. Let’s dive in, because ignoring this could mean leaving thousands on the table.

My Unexpected Roth IRA Wake-Up Call

Picture this: back in my early thirties, I was glued to my desk job, thinking retirement was eons away. Then, one rainy afternoon in Chicago—where the Windy City lives up to its name—I stumbled upon an old colleague’s story. He had started a Roth IRA right after college, and now, years later, it was funding his dream travels. Me? I had delayed, assuming it was too complicated. Key takeaway: the first step to opening a Roth IRA is understanding eligibility, which hit me like a sudden gust off Lake Michigan.

I remember poring over IRS guidelines, realizing that if you’re under a certain income limit—typically single filers under $144,000 in 2023—you’re in the game. It’s not just about age; it’s about foresight. In my opinion, waiting until you’re older is like postponing an umbrella until the storm breaks—foolish. Drawing from that, let me share a metaphor: think of a Roth IRA as planting an acorn in fertile soil. Unlike traditional IRAs, where taxes bite upon withdrawal, Roth lets you grow tax-free, provided you meet the rules. And that’s when it hit me—starting early compounds your efforts, turning small contributions into a mighty oak.

Roth IRA Through the Lens of History’s Savers

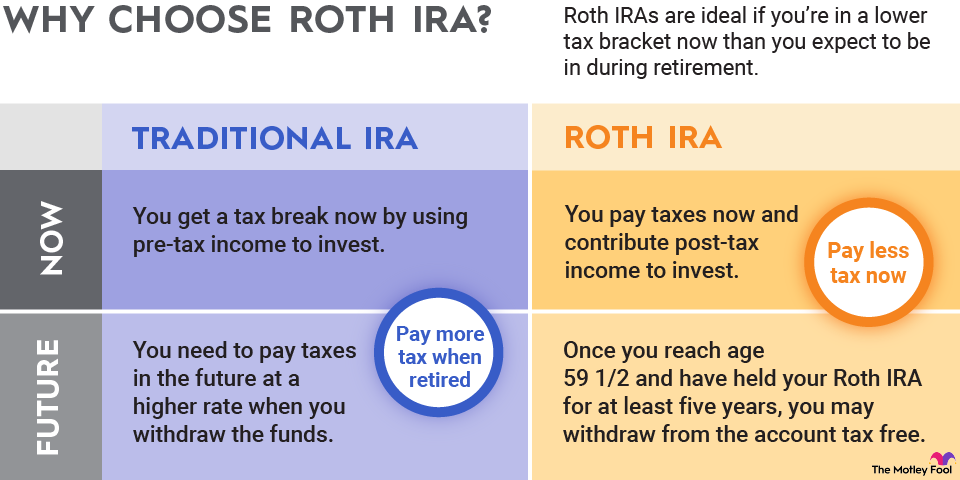

Fast-forward to the Great Depression era, when folks like my grandparents scrimped every penny, drawing parallels to today’s Roth IRA setup. Back then, saving meant hiding cash under the mattress; now, it’s about leveraging government-backed vehicles for growth. Here’s a stark comparison: a traditional IRA is like a history book, taxed when you turn the pages, whereas a Roth IRA is more like a forward-looking sci-fi novel, where your story ends tax-free. This isn’t just finance trivia—it’s a cultural shift from reactive saving to proactive planning.

In the U.S., where the American Dream often involves financial independence, Roth IRAs shine as a modern tool. Consider how, post-2008 financial crisis, millions turned to these accounts for stability. A quick table might help clarify the differences:

| Feature | Roth IRA | Traditional IRA |

|---|---|---|

| Tax Treatment | Contributions with after-tax dollars; withdrawals tax-free | Contributions often tax-deductible; withdrawals taxed |

| Income Limits | Phase-outs for high earners | Generally more flexible |

| Best For | Younger savers expecting higher taxes later | Those in higher tax brackets now |

This historical lens underscores why, in my view, a Roth IRA isn’t just an account—it’s a legacy. If you’re skeptical, imagine a conversation with a doubting friend: «But what if taxes drop?» I’d counter, it’s a bet on your future self, much like betting on tech stocks in the ’90s. No pie in the sky here; it’s grounded in real economic trends.

Tackling the Roth IRA Setup Maze with Straight Talk

Now, let’s get down to brass tacks—the actual steps to open a Roth IRA, because let’s face it, the process can feel like wandering through a bureaucratic labyrinth. Irony alert: while Wall Street throws around terms like «diversification,» the real barrier is often just paperwork overload. But don’t sweat it; I’ll break it down without the fluff.

First off, step one is choosing a provider: Think big names like Vanguard or Fidelity, where low fees won’t break the bank. I once picked a provider based on a friend’s tip, and it paid off with easy online tools. Next, verify your eligibility—check that modified adjusted gross income threshold. If you qualify, gather your details: Social Security number, employment info, and initial funding source.

Step two involves the application: Online forms are a breeze, but here’s a disruptor—treat it like assembling IKEA furniture; follow the instructions, and you’ll avoid the headaches. Once submitted, fund your account—via bank transfer or paycheck deductions. And for that final twist, consider asset allocation; it’s not just about starting, but growing smartly. In a serious tone, I’d say this process, when done right, is like fortifying your financial fortress, drawing from pop culture’s Iron Man’s suit—built piece by piece for ultimate protection.

In conclusion, what if I told you that starting a Roth IRA isn’t the end of your financial journey, but the beginning of a empowered narrative? By now, you’ve seen how this account can shield your future from taxes and uncertainty. So, take action: Haz this exercise now: Log into your bank’s site and check your eligibility for a Roth IRA today. It’s that straightforward. Reflect on this: Are you ready to prioritize your tomorrow over today’s distractions, ensuring your hard-earned money works as hard as you do? Your comments could spark others’ paths—share below.