Hidden traps lurk in the shadows of every family fortune, turning what should be a seamless handover into a financial fiasco. Picture this: You’ve built a life’s worth of wealth, only to watch it slip away due to poor planning or unforeseen taxes. Statistics from the Williams Group reveal that a staggering 70% of wealthy families lose their fortune by the second generation, a brutal contradiction to the American Dream. But here’s the silver lining – mastering strategies for generational wealth transfer can safeguard your legacy, ensuring your hard-earned assets nurture your descendants for years to come. In this article, we’ll dive into practical, finance-focused tactics that blend smart estate planning with real-world wisdom, helping you avoid common pitfalls and build a lasting impact.

My Grandfather’s Legacy: A Lesson in Timely Transitions

Back in the ’80s, my grandfather, a no-nonsense factory owner from the Midwest, sat me down one rainy afternoon and shared his story – one that still hits me hard today. He’d amassed a solid nest egg through sheer grit, but when it came time to pass it on, red tape and family squabbles nearly wiped it out. «Kid,» he said, his voice cracking a bit, «wealth isn’t just about the dollars; it’s about the plan.» That moment taught me the irreplaceable value of starting early with estate planning. In finance, generational wealth transfer often hinges on tools like trusts and wills, which my grandfather overlooked until it was almost too late.

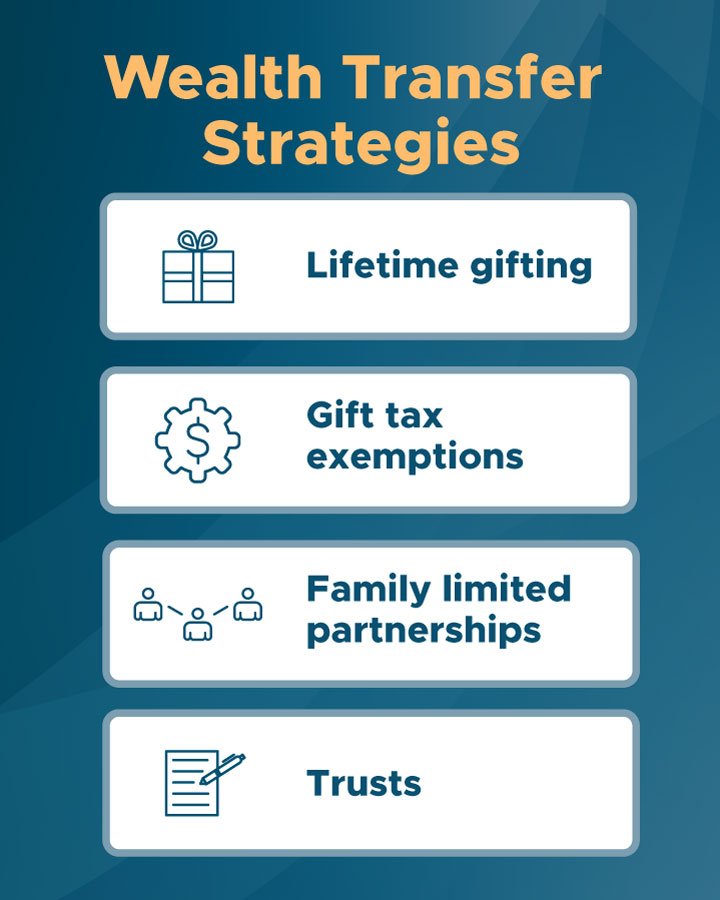

I remember him fumbling through papers, muttering about how a simple revocable trust could’ve shielded his assets from probate delays. It’s a stark reminder that personal anecdotes like this underscore the human side of finance – emotions run high, and mistakes can be costly. From my perspective, ignoring this step is like leaving your house unlocked in a storm; you know trouble’s brewing, but you hope for the best. In the U.S., where estate taxes can gobble up 40% of estates over $13.61 million, strategies like gifting assets during your lifetime – up to $17,000 per recipient annually without tax hits – can make all the difference. This approach not only minimizes tax implications of wealth transfer but also fosters family bonds, turning potential conflicts into conversations about shared values.

From Medieval Monarchies to Today’s Trusts: A Cultural Mirror

Ever think about how kings in medieval Europe handled their riches? Take the Plantagenets, for instance – their successions were a masterclass in chaos, with wars erupting over inheritances. Fast-forward to modern America, and we see echoes in how families navigate wealth preservation strategies. It’s a cultural comparison that highlights the evolution: Back then, primogeniture – passing everything to the eldest son – dominated, often leading to inequality and resentment. Today, in diverse societies like ours, we opt for more equitable methods, such as family limited partnerships, which distribute control while protecting assets.

This shift isn’t just historical trivia; it’s a wake-up call for contemporary finance planning. In places like the UK, across the pond, inheritance tax reforms have pushed families toward sophisticated tools like discretionary trusts, mirroring how European nobility once used entails to lock in wealth. I find it fascinating – and a bit ironic – that while our ancestors fought literal battles over estates, we’re now duking it out with IRS forms. A key takeaway? Blending cultural insights with financial savvy can prevent disasters. For example, comparing tools: A traditional will might be straightforward, but it’s rigid, whereas a living trust offers flexibility, adapting to life changes like divorce or market shifts. To illustrate, here’s a simple breakdown:

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Wills | Easy to create, clear directives | Public probate process, potential delays |

| Revocable Trusts | Private, avoids probate, flexible | More complex setup, ongoing management |

This table isn’t exhaustive, but it drives home how choosing the right generational wealth transfer methods can align with your family’s dynamics, drawing from historical lessons to build a more secure future.

The Overlooked Hazards: Ironies in Estate Planning and Fixes That Work

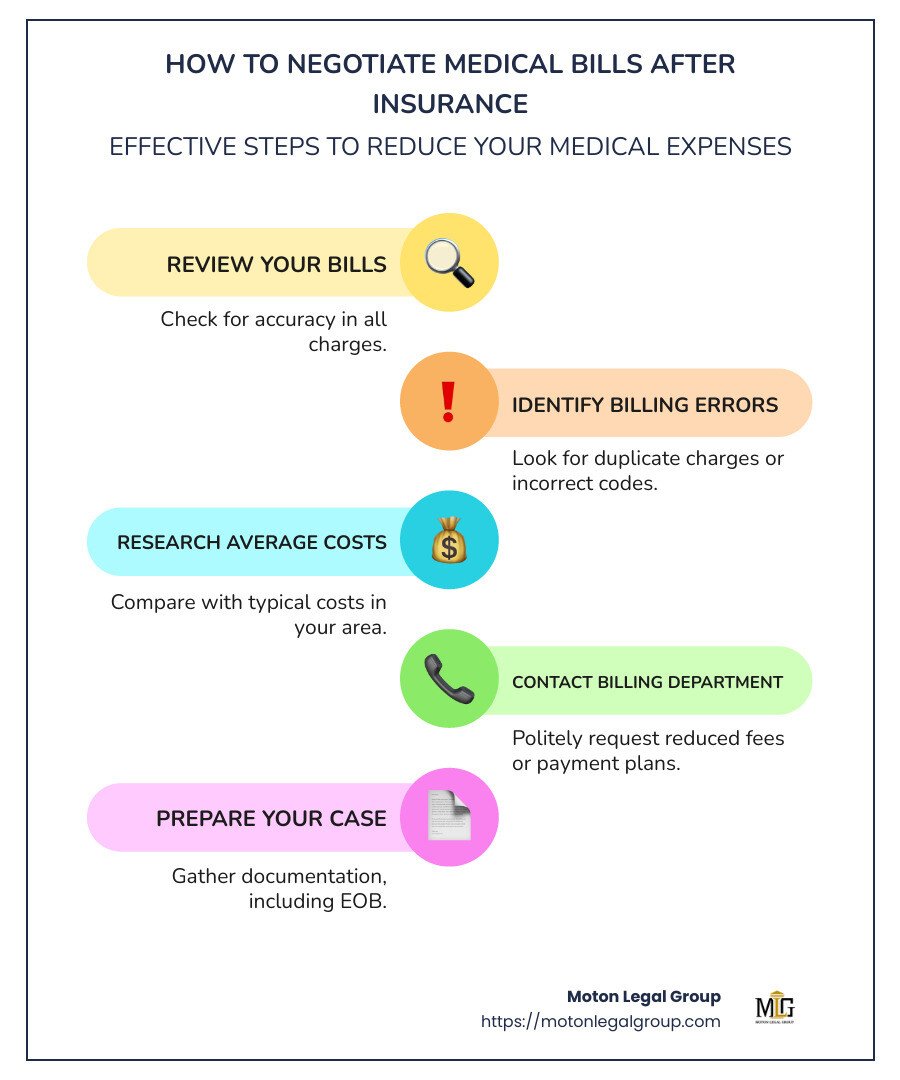

What if I told you that the very tools meant to protect your wealth could backfire if not handled right? It’s an uncomfortable truth in finance circles – something like, «And just when you think you’re set…» – that many overlook the risks of improper beneficiary designations or failing to update plans amid life events. Take the case of families who, in a rush, name heirs without considering their readiness, only to see fortunes squandered on poor investments. From my viewpoint, this irony underscores the need for professional guidance, like consulting a certified financial planner to navigate how to transfer wealth to the next generation effectively.

To tackle this, let’s propose a quick exercise: Grab a notebook and list your assets – from real estate to stocks – then map out potential pitfalls, such as liquidity issues during transfer. Number them for clarity: 1. Identify high-value items and their tax bases. 2. Consult on gifting strategies to reduce estate taxes. 3. Review beneficiary forms annually. This isn’t just busywork; it’s a practical step that could save thousands. In a nod to pop culture, think of it like the Stark family in «Game of Thrones» – their failure to secure succession led to downfall, a dramatic reminder that in finance, as in Westeros, preparation is key. By addressing these hazards head-on, you turn potential ironies into strengths, ensuring your legacy endures without the drama.

In wrapping this up, here’s a twist: Generational wealth transfer isn’t merely about numbers on a balance sheet; it’s a profound act of love, shaping family histories for better or worse. So, take action now – audit your estate plan and discuss it with your heirs this week. What values do you want your wealth to carry forward, and how will you ensure they stick? I’d love to hear your thoughts in the comments; after all, every family’s story adds to the bigger financial tapestry.