Cash vanishes quickly. It’s a brutal truth in the world of finance, where even the savviest entrepreneurs wake up one day to find their bank accounts gasping for air. Did you know that a staggering 82% of small businesses collapse not from lack of profit, but from poor cash flow management? That’s the uncomfortable reality we’re diving into today. In this article, we’ll explore strategies to manage cash flow effectively, turning potential financial pitfalls into pathways for stability and growth. By the end, you’ll have practical tools to safeguard your finances, drawing from real experiences and timeless wisdom.

My Unexpected Cash Flow Nightmare

Picture this: back in 2015, I was running a fledgling consulting firm in the heart of New York, thinking I had it all figured out. Sales were rolling in, but I ignored the whispers of delayed payments and mounting bills. And that’s when the real trouble started—overnight, we were scrambling to cover payroll while clients dragged their feet. It hit me like a ton of bricks; cash flow isn’t just about the money you have, it’s about when you have it. That episode taught me a hard lesson: forecasting isn’t optional; it’s survival.

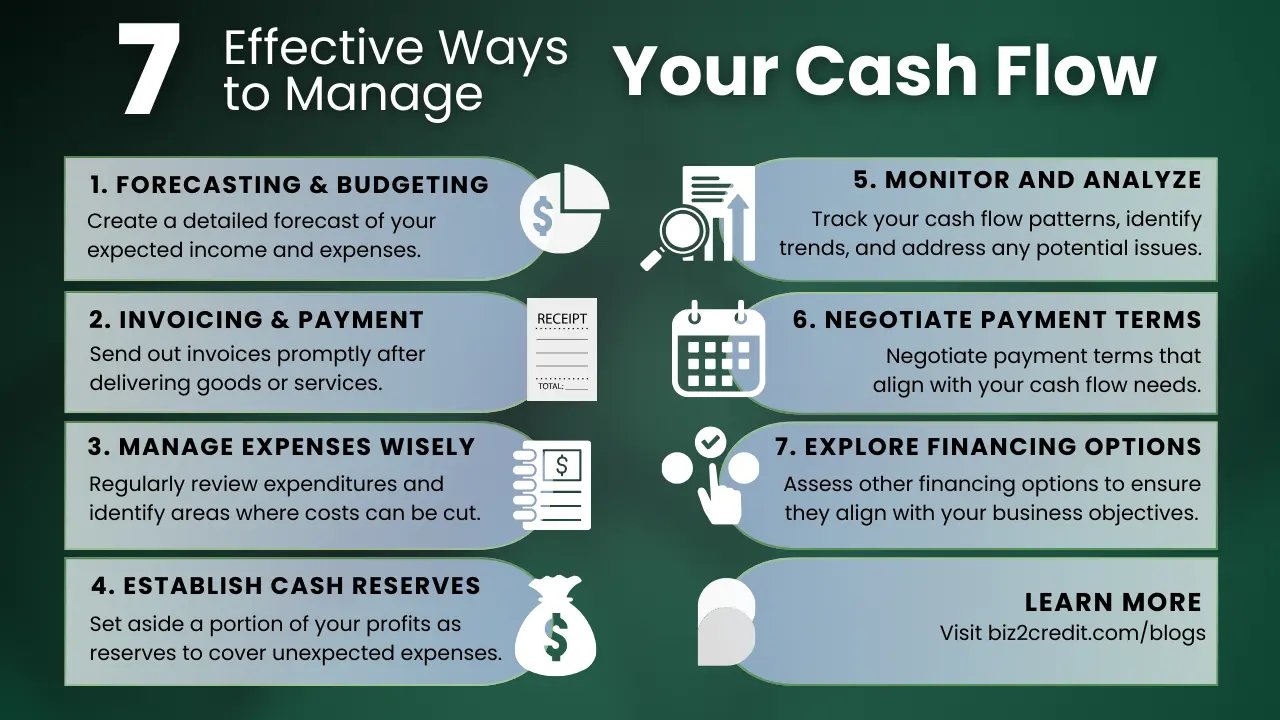

In my opinion, based on years in the trenches, effective cash flow techniques begin with meticulous tracking. I started using simple tools like spreadsheets to monitor inflows and outflows, which revealed patterns I never noticed. Think of it as a financial weather forecast—predicting storms before they hit. For instance, incorporating cash flow forecasting strategies helped me adjust pricing and negotiate better terms with suppliers. It’s not glamorous, but it’s real. And if you’re in the UK, remember the old saying, «Penny wise, pound foolish»—small oversights can lead to big losses, just like they did for me.

To make this relatable, imagine a conversation with a skeptical reader: «Sure, but isn’t this just bean-counting?» I’d counter, «Not if it saves your business from the brink.» This approach isn’t about perfection; it’s about building resilience, drawing from my own imperfect journey where I once burned through reserves on flashy office upgrades—only to regret it later.

Echoes of the Great Depression in Modern Finance

Fast-forward to today, and the shadows of history still loom large over cash flow management strategies. During the 1930s Great Depression, families and businesses alike tightened their belts, much like how we’re forced to in economic downturns. It’s a stark comparison: then, people hoarded cash amid bank failures; now, we face inflation and supply chain disruptions that make every dollar count. This historical lens shows that improve cash flow isn’t a new concept—it’s evolved, but the core principles remain.

One unexpected analogy: managing cash flow is like navigating a ship through foggy waters, as seen in the TV series «The Crown,» where Queen Elizabeth II deals with the financial strains of the monarchy. Just as she had to balance tradition with practicality, you must weigh short-term needs against long-term goals. In regions like Europe, where economic policies often reference historical events, this means adopting strategies like invoice financing, which turns pending payments into immediate cash—avoiding the «wait and see» trap that crippled many during past recessions.

Here’s a simple table to compare two popular financial management strategies for cash flow:

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Cash Flow Forecasting | Anticipates shortfalls; enhances decision-making | Requires accurate data; time-intensive |

| Invoice Financing | Immediate access to funds; improves liquidity | Can be costly with fees; risks if clients default |

This comparison underscores how choosing the right tool depends on your context, blending historical insights with modern needs.

Untangling the Knots of Overspending

Now, let’s address the elephant in the room: overspending sneaks up on even the most disciplined. I remember advising a client who, like me once, thought expanding too quickly was a sign of success—only to face a cash crunch that felt like quicksand. The irony? We often chase growth while ignoring the basics, such as monitoring expenses rigorously.

To solve this, start with a mini experiment: track every outflow for a week, categorizing them as essential or discretionary. You’ll likely uncover surprises, like how «small» subscriptions add up. In American finance culture, we say «don’t let your money burn a hole in your pocket,» and it’s spot-on for cash flow management. By prioritizing payments and negotiating longer terms with vendors, you create a buffer. For example, automating bill payments prevented my own late fees, turning chaos into control.

One quirky metaphor: think of cash flow as a garden—neglect it, and weeds (debts) take over; nurture it with regular weeding (budgeting), and it blooms. This isn’t about rigid rules; it’s about adaptive strategies that fit your life, imperfections and all.

In wrapping this up, here’s a twist: even with the best plans, life throws curveballs, but mastering strategies to manage cash flow effectively builds a safety net you didn’t know you needed. So, take action now—grab a notebook and outline your next month’s cash flow. What’s your most persistent cash flow hurdle, and how might these insights shift your approach? Let’s keep the conversation going in the comments.