As shadows lengthen, taxes beckon. It’s a stark contradiction: governments rely on your hard-earned money, yet savvy individuals slash their liabilities without bending laws. Did you know that in 2023, the average American overpaid taxes by over $1,000 due to missed deductions? That’s money vanishing into bureaucratic voids, funds you could redirect to family vacations or retirement nests. This article unveils strategies to minimize tax liabilities, empowering you to keep more in your pocket through smart, legal maneuvers. Let’s dive in, blending real-world wisdom with practical advice to transform your financial future.

That Eye-Opening Audit: A Personal Wake-Up Call

Picture this: five years ago, I sat in a cramped office, staring at an IRS letter that made my stomach churn. As a finance consultant, I thought I had it all figured out—meticulously tracking expenses, yet overlooking a key deduction for home office setup. And that’s when I realized… the devil’s in the details. This wasn’t just a bureaucratic hiccup; it was a hard lesson on proactive tax planning. By retroactively claiming that deduction, I recouped hundreds, sparking a deeper dive into strategies that minimize tax liabilities.

In my experience, starting with a thorough review of your income sources is crucial. Effective tax planning begins by categorizing earnings—wages, investments, side gigs—and identifying opportunities like the qualified business income deduction for self-employed folks. Don’t just take my word; subjective opinion here, but ignoring this step is like leaving money on the table at a high-stakes poker game. For instance, if you’re in the U.S., leveraging the standard deduction versus itemizing can swing savings dramatically, especially with rising inflation.

To add a cultural twist, think about how British taxpayers use ISAs (Individual Savings Accounts) to shield investments from the taxman— a nod to that stiff-upper-lip approach across the pond. It’s not about evasion; it’s smart navigation. By weaving in such references, we see how tax minimization techniques vary globally, yet the core principle remains: act early, act informed.

Historical Echoes: When Tax Rebels Shaped Economies

Fast-forward from my audit fiasco to the annals of history, where figures like Adam Smith critiqued excessive taxation in «The Wealth of Nations.» It’s an unexpected comparison: the father of modern economics versus your everyday budget. Smith argued that taxes should be certain, convenient, and as low as possible—words that resonate today amid corporate loopholes. But here’s the uncomfortable truth: many assume minimizing taxes is for the elite, yet everyday folks like teachers or small business owners can apply similar principles.

Let’s bust a myth: the idea that tax strategies are overly complex is pure fiction. In reality, tools like 401(k) contributions in the U.S. or RRSPs in Canada offer straightforward ways to defer taxes, building wealth while reducing immediate liabilities. I remember counseling a client who, inspired by this historical lens, shifted funds into a retirement account, cutting their taxable income by 20%. Reduce taxes legally by viewing it as a long game, much like how the Boston Tea Party protesters fought for fair representation—protesting through informed choices, not rebellion.

For a deeper dive, consider this mini-experiment: track your expenses for a month, then map them against deductible categories. You’ll uncover hidden gems, like medical expenses exceeding 7.5% of your AGI in the U.S. This isn’t just number-crunching; it’s reclaiming agency, echoing how past societies adapted to fiscal pressures. And just like in the series «Billions,» where characters navigate financial intricacies with precision—though minus the drama—real-life application demands authenticity.

The Subtle Art of Deductions: Irony in the Overlooked

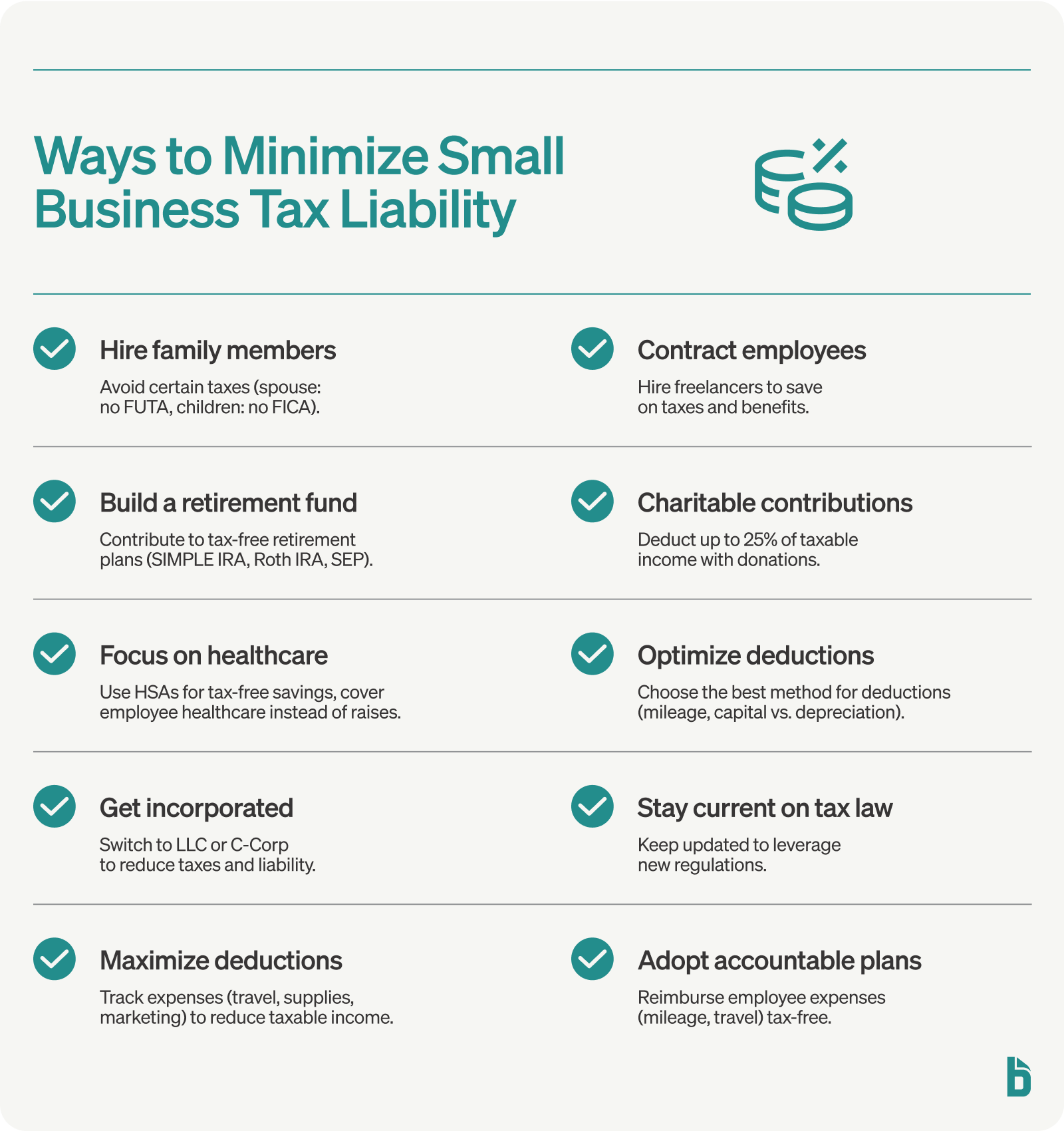

Here’s a serious irony: while everyone obsesses over big-ticket investments, it’s the mundane deductions that slip through the cracks, costing you dearly. Take charitable contributions—often dismissed as minor, yet they can lower your taxable income significantly. In my line of work, I’ve seen folks donate old clothes and claim deductions, only to realize the bottom line impact was substantial.

To tackle this, let’s break it down without a rigid list: first, audit your lifestyle for eligible expenses, like education credits if you’re pursuing further studies. Second, explore credits versus deductions—the former directly reduce your tax bill, a game-changer. For example, the Earned Income Tax Credit targets low-to-moderate earners, turning potential overpayments into refunds. Tax strategies for individuals thrive on such nuances, and here’s a simple table to clarify:

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Deductions (e.g., mortgage interest) | Reduces taxable income, easy to claim | Requires itemizing, which might not always benefit |

| Tax Credits (e.g., Child Tax Credit) | Direct dollar-for-dollar reduction | Eligibility criteria can be strict |

This comparison shows how minimizing tax liabilities isn’t one-size-fits-all. Wrap it with a metaphor: think of taxes as a river; deductions are like channels diverting flow, keeping more in your reservoir. By addressing these overlooked areas, you’re not just saving money—you’re fostering financial resilience.

A Final Twist: Reclaim Your Fiscal Freedom

In wrapping up, here’s the twist: what if minimizing taxes isn’t about outsmarting the system, but aligning it with your life’s rhythm? We’ve covered personal stories, historical insights, and practical tools, all pointing to one truth—you hold the reins. So, take action: review your last tax return today and identify one deduction you missed. It’s that straightforward.

And remember, a question lingers: how will you ensure your hard work doesn’t fund someone else’s gains? Share your thoughts in the comments; let’s build a community of informed taxpayers.