Money whispers secrets. In a world obsessed with get-rich-quick schemes, the harsh truth is that most people juggle bills on a shoestring, and it’s not glamorous. Did you know that nearly 60% of Americans live paycheck to paycheck, according to recent surveys? That’s a stark contradiction to the financial freedom we see splashed across social media. But here’s the benefit: mastering budgeting tips for a tight income can turn that struggle into a pathway for stability, helping you save for rainy days without sacrificing sanity. Let’s dive into practical, real-world strategies that I’ve tested myself.

My Own Budgeting Battle: Lessons from the Trenches

Picture this: a few years back, I was staring at a stack of overdue notices, my bank account resembling a barren wasteland after a storm. Working a modest job in a bustling city, every dollar felt like it was slipping through my fingers—like trying to hold water in a sieve. That was me, fresh out of college, managing finances on a tight budget, and honestly, it was humbling. I remember one winter evening, huddled over a calculator, realizing that my coffee habit alone was torpedoing my savings. It’s not just numbers; it’s personal.

From that mess, I learned a key lesson: tracking every expense is non-negotiable. Start with a simple notebook or app—nothing fancy. One day, I decided to jot down every purchase, from that $3 latte to the gas fill-up. Within a week, patterns emerged, like how dining out was my Achilles’ heel. My opinion? Apps like Mint or YNAB aren’t magic bullets, but they’re lifesavers for folks like us who need that extra nudge. And just when I thought I’d never break the bank on fun, I found ways to redirect funds to what matters, like emergency funds. It’s about that human touch—imperfections and all.

Budgeting Through the Ages: Echoes from History

Ever wonder how our ancestors handled frugal living with limited resources? Take the Great Depression era, for instance—a time when families stretched meals and mended clothes just to make ends meet. It’s a cultural comparison that hits home; in modern America, we have tools like budgeting apps, but the core principle remains: prioritize necessities. Back then, people used the «envelope system,» dividing cash into categories like food and rent, which forced discipline in a way credit cards never could.

Here’s a quick table to compare that old-school method with today’s digital alternatives, because sometimes seeing it side by side clarifies things:

| Method | Advantages | Disadvantages |

|---|---|---|

| Envelope System (Historical) | Tangible, teaches restraint, low-tech | Limited flexibility, risk of theft |

| App-Based Budgeting (Modern) | Real-time tracking, automated alerts, easy adjustments | Requires tech access, potential for overspending if not monitored |

This historical lens shows that tight income strategies evolve, but the essence—cutting waste—stays. In my view, blending these approaches, like using an app to mimic envelopes, adds depth to your financial toolkit. And that’s when history meets today, making budgeting less about deprivation and more about smart choices.

The Irony of Unchecked Spending: Turning It Around

Here’s the thing: we all know impulse buys feel good in the moment, but they sneak up like a plot twist in a thriller movie—think of Walter White’s bad decisions in «Breaking Bad,» but with your wallet. On a tight budget, that $20 fast-food run adds up, creating a cycle that’s as frustrating as it is avoidable. I mean, who hasn’t justified a purchase with «I deserve this»? But seriously, it’s that irony that bites hardest when the month’s end leaves you scraping by.

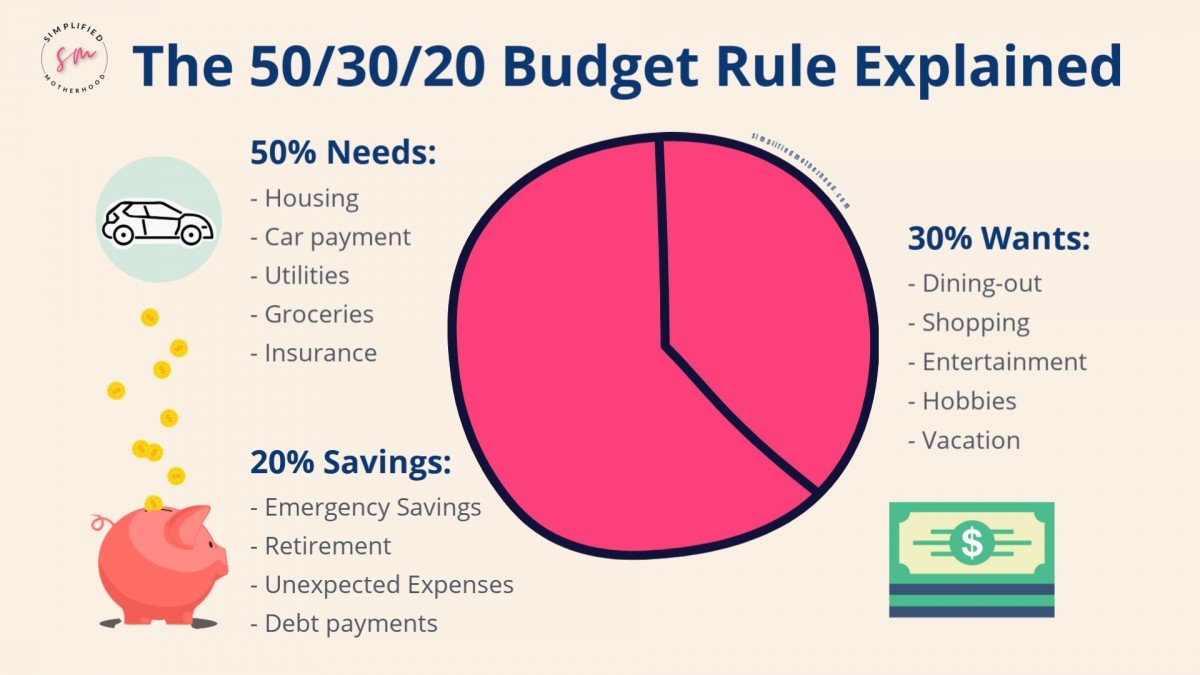

To break it, start with small, actionable steps. First, identify triggers—what sets off those splurges? For me, it was stress from work. 1. Pause before buying: Wait 24 hours for non-essentials. 2. Set spending limits per category, allocating based on income percentages—like 50% for needs, 30% for wants. 3. Build in rewards, but only after hitting savings goals. And Y’know, it’s not perfect; sometimes you slip up. But over time, this method transformed my budgeting on a tight income from a chore into a habit. The solution? Embrace the discomfort—it’s where real growth happens.

A Quick Experiment to Try

Why not test this yourself? Grab a week’s worth of receipts and categorize them. You’ll be surprised at the hidden leaks. And just like that, you’re one step closer.

Wrapping It Up with a Fresh Angle

In the end, financial tips for tight budgets aren’t about restriction; it’s a twist on empowerment, turning scarcity into strategy. Remember, even with modest earnings, you’re the CEO of your own finances. So, take action now: pull out that budget tracker and log your next three expenses—see the difference immediately. And one last thought: what’s the one expense you’d cut first to reclaim control? Share in the comments; let’s keep this conversation real and supportive.