Dreams shatter fast. That’s the harsh reality for many first-time home buyers who dive into the real estate market without a solid plan, only to face crushing debt or buyer’s remorse. In the world of finance for first-time homebuyers, excitement can quickly turn into a financial nightmare if you’re not prepared. But here’s the silver lining: with the right tips and a bit of savvy advice, you can navigate this complex process and turn that house hunt into a smart investment. This article dives deep into practical, serious strategies for buying a first home, drawing from real experiences to help you avoid common pitfalls and build a secure future.

My Own Bumpy Road to Homeownership

Picture this: five years ago, I was staring at a stack of mortgage documents, heart pounding, wondering if I was making the biggest mistake of my life. I’d scrimped and saved for years, only to realize that my dream neighborhood was way out of reach due to skyrocketing interest rates. It was a wake-up call, and boy, did it teach me a lesson about financial planning for home purchase. I remember the exact moment—sitting in that cramped real estate office, coffee going cold—when I decided to pivot from impulse to strategy.

In my opinion, based on that rollercoaster ride, the key is starting with a brutally honest budget assessment. Don’t just glance at your bank statements; dig into every expense, like that monthly streaming subscription that’s eating into your down payment fund. It’s like trying to fix a leaky roof before the storm hits—you’ve got to shore up your finances first. And just as a metaphor, think of your credit score as an unexpected ally, not some abstract number; it’s the gatekeeper to better loan terms, something I wish I’d nurtured earlier instead of letting it slide.

From a cultural angle, here in the U.S., we often glorify the «American Dream» of owning a home, but history shows it’s not always straightforward. Remember the 2008 housing crash? It wasn’t just numbers on a screen; it wrecked lives and economies. By comparing that era to today’s market, you see how real estate finance has evolved, with stricter lending standards that can work in your favor if you’re prepared. This isn’t just theory—it’s a reminder that patience pays off, especially when inflation makes «breaking the bank» for a home feel all too real.

Unpacking the Myths: What the Experts Won’t Tell You Straight

Ever wondered why so many folks buy into the idea that a bigger house means a better life? Let’s shatter that myth with a dose of truth. In first-time home buying tips, one uncomfortable reality is that overextending on a mortgage can trap you in a cycle of debt, much like how characters in «The Big Short» exposed the housing bubble’s dark underbelly. I mean, who knew a movie about finance could hit so close to home? But seriously, the truth is, not all loans are created equal, and ignoring the fine print can lead to years of regret.

Take a mini experiment: grab your latest pay stub and calculate your debt-to-income ratio right now. It’s simple—add up your monthly debts and divide by your gross income. If it’s over 43%, lenders might slam the door in your face. And that’s when it hits you: preparation isn’t optional. To counter this, consider a comparison like fixed-rate versus adjustable-rate mortgages. Here’s a quick table to break it down, because visuals can make home loan options less intimidating:

| Feature | Fixed-Rate Mortgage | Adjustable-Rate Mortgage |

|---|---|---|

| Interest Rate | Stays the same for the loan term | Can fluctuate based on market changes |

| Advantages | Predictable payments; ideal for long-term stability | Lower initial rates; good if you plan to sell soon |

| Disadvantages | Higher initial rates; less flexibility | Risk of rising payments; potential for financial stress |

This isn’t just data—it’s a tool to help you decide, drawing from my own near-miss with an adjustable rate that could’ve sunk me. By weighing these, you’re not just buying a house; you’re investing in your future with eyes wide open.

Conversing with Doubt: Why You Shouldn’t Skip the Fine Print

Imagine you’re chatting with a skeptical friend over coffee: «Why bother with all this homework for a house?» you’d say. Well, here’s my response: because in the realm of tips for buying a first home, overlooking details like appraisal costs or closing fees can turn your dream into a money pit. It’s like ignoring the weather report before a road trip—sure, you might get lucky, but do you really want to risk it?

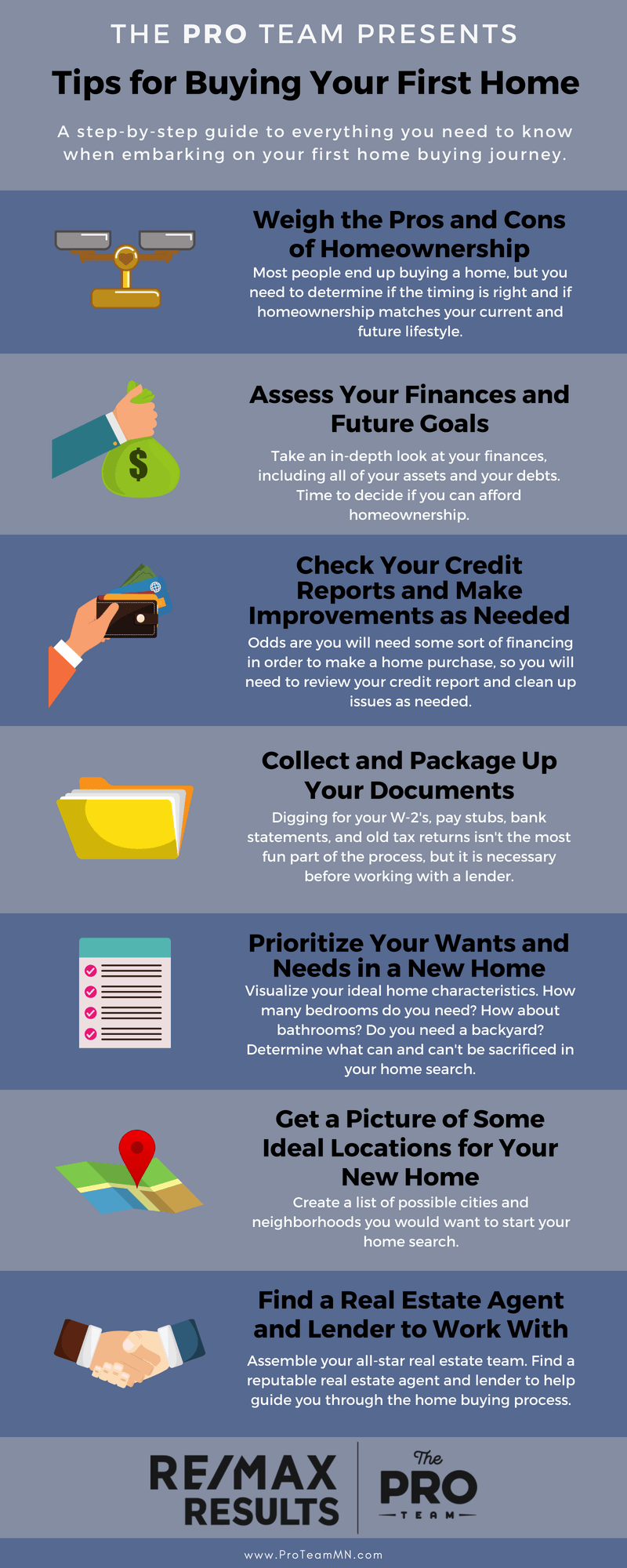

Let’s address a common problem with a straight shot of irony: everyone talks about the joy of keys in hand, but few mention the «in the red» surprise of hidden fees. My solution? Start with a pre-approval letter—1. Gather your financial docs, 2. Shop around for lenders, and 3. Compare offers side by side. This step-by-step approach isn’t rocket science; it’s practical finance that saved me from overpaying by thousands. And just as a unexpected analogy, think of it like preparing for a marathon—you wouldn’t run without training, so don’t buy without this groundwork.

In wrapping up this section, remember that real estate market trends can shift like sand, so staying informed is key. From my experience, consulting a financial advisor isn’t a luxury; it’s a necessity, especially when local market fluctuations in places like suburban America can make or break your deal.

A Final Twist: Rethinking Your Home Buying Journey

And just when you think you’ve got it all figured out, here’s the twist: buying your first home isn’t just about the numbers; it’s about creating a legacy that outlasts market ups and downs. In finance for first-time homebuyers, the real win is building equity that secures your future. So, take action now—grab a notebook and list three must-have financial steps for your home search today. What if your choices today shape tomorrow’s stability? Leave a comment: How has your own financial journey influenced your home buying plans? It’s a question worth pondering, seriously.