Bills lurking everywhere. It’s a harsh reality: medical debt doesn’t discriminate, often leaving even the most prepared folks drowning in red ink. According to recent studies, over 100 million Americans grapple with healthcare costs that can spiral out of control, pushing families toward financial ruin. But here’s the silver lining—negotiating those bills isn’t just possible; it’s a skill that can save you thousands. In this article, we’ll dive into practical, finance-focused tips to reclaim your budget, drawing from real experiences and smart strategies to make you feel empowered, not overwhelmed.

A Personal Tale: The Day My Wallet Surrendered to the ER

Picture this: I’m sitting in a sterile hospital room, heart racing not just from the emergency but from the invoice that’s about to hit. Last year, a routine check-up turned into a hefty medical bill negotiation nightmare, clocking in at over $5,000 for what felt like a quick fix. I remember thinking, «And that’s when it hit me—how did this get so expensive?» As a finance enthusiast who’s always tracked expenses like a hawk, I felt betrayed by the system. But instead of folding, I decided to fight back.

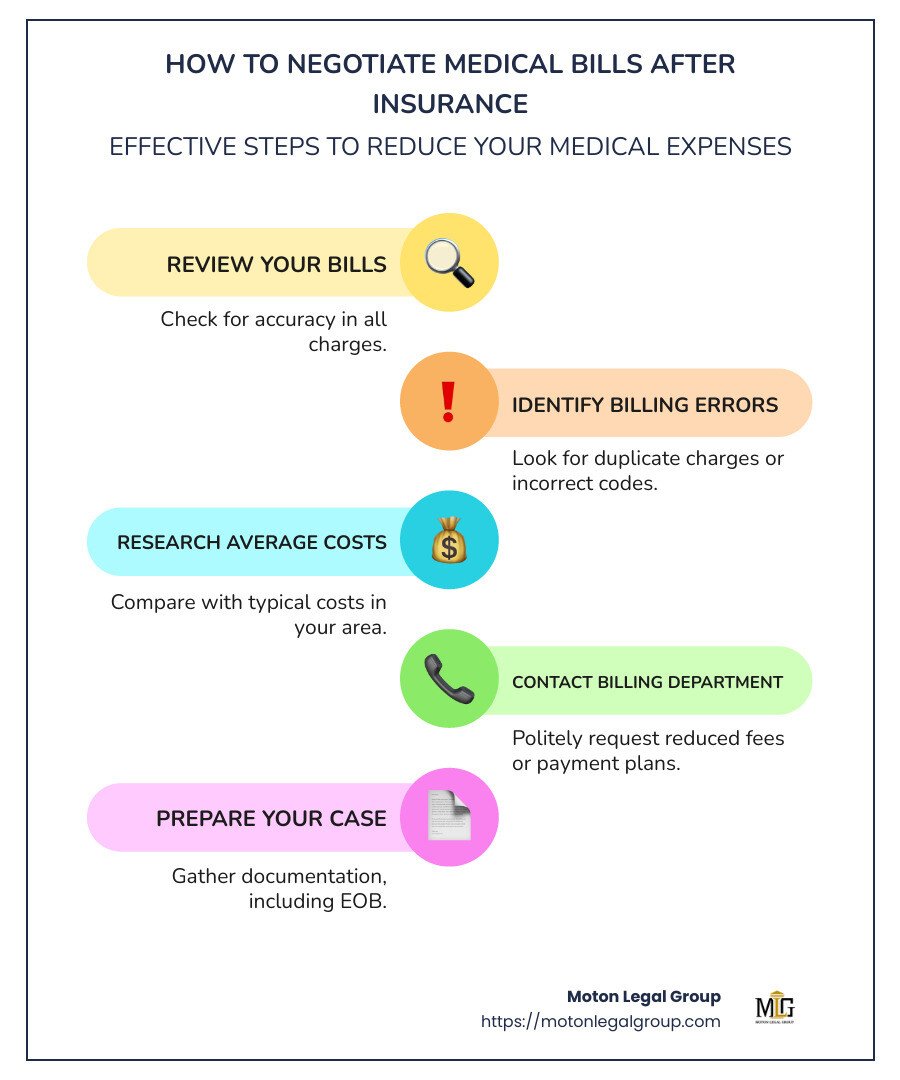

This isn’t just my story; it’s a common one. I started by reviewing every line of the bill, spotting errors like duplicate charges that added up to hundreds. My opinion? Healthcare providers often inflate costs assuming you’ll pay without question. Drawing from my roots in the Midwest, where folks say «pull yourself up by your bootstraps,» I applied that grit. I called the billing department, armed with research on average prices for similar procedures. Using a metaphor like comparing it to haggling at a flea market—unexpected, right?—I realized negotiation is about persistence, not confrontation. The lesson? Don’t let shock paralyze you; turn it into action. By persistently questioning and referencing fair medical debt tips, I knocked 30% off my bill, proving that a little backbone goes a long way in personal finance management.

Lessons from the Ledger: How Past Generations Tackled Medical Expenses

Ever wonder how our grandparents handled doctor bills without modern insurance? Back in the early 20th century, bartering was king—farmers traded crops for care, creating a community safety net that feels worlds away from today’s corporate healthcare. This historical comparison highlights a key finance truth: costs weren’t always this rigid. In contrast, today’s negotiating medical bills strategies echo that resourcefulness, adapting to inflated prices driven by big pharma and administrative fees.

Take the 1930s, for instance, when the Great Depression forced doctors to accept payment plans or even forgive debts for the needy. It’s a stark reminder that what we view as unchangeable can be challenged. From a subjective standpoint, I find it ironic how we’ve lost that human touch in finance. In places like rural America, where «making ends meet» is a daily mantra, people still haggle over bills, much like negotiating a used car deal. This cultural reference underscores the importance of knowing your worth—don’t accept the first number thrown at you. By blending historical insights with current practices, you can approach reducing medical expenses with a fresh perspective, turning potential debt into manageable payments.

The Unseen Traps: Outsmarting Overcharges with Savvy Tactics

Now, let’s get real about the pitfalls. You might think, «Wait, how can something as vital as healthcare come with tricks?» Well, it’s like that plot twist in «The Matrix»—what you see isn’t always the full picture. Hospitals often bill at rates far above what’s necessary, leaving patients strategies to lower hospital bills unexplored. The problem? Many folks just pay up, fearing repercussions, but that’s where the opportunity lies.

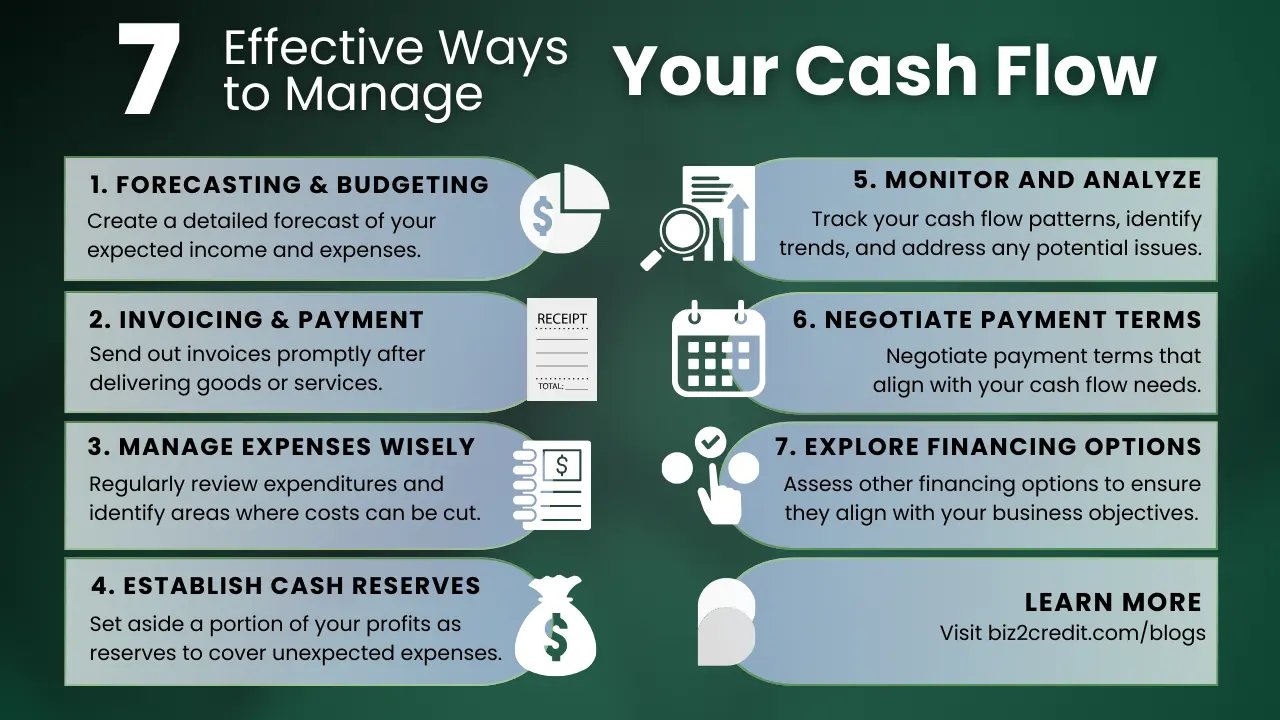

To counter this, start with a simple exercise: gather your bills and cross-reference them online using tools like Healthcare Bluebook for fair price estimates. For example, if you’re facing a $2,000 MRI charge, discover it’s typically $1,000 in your area—that’s your leverage. Number the steps for clarity: 1) Document everything, from dates to providers; 2) Contact the billing office calmly, explaining your situation; 3) Offer to pay a reduced amount upfront, which often sweetens the deal. In my experience, this approach, inspired by financial advisors who’ve seen it all, can cut bills by 20-50%. And just like in that iconic scene from «Breaking Bad» where Walter White calculates risks, weighing your options carefully pays off. By addressing these traps head-on, you’re not just saving money; you’re mastering your financial narrative.

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Direct Phone Call | Immediate response, personal touch | Can be time-consuming |

| Written Dispute | Creates a paper trail, more formal | May take longer for resolution |

| Third-Party Advocate | Expert handling, higher success rates | Potential fees involved |

Wrapping It Up: Your Financial Comeback Story

Here’s the twist: negotiating medical bills isn’t just about dollars; it’s about reclaiming control in a system that often feels stacked against you. By applying these tips, you’re not merely surviving—you’re thriving in the finance world. So, take action now: pull out that bill and make that first call today; you’ll thank yourself later. And one last thought—how has medical debt reshaped your financial journey? Share in the comments; let’s turn personal stories into collective wisdom.