As the thermostat ticks up, wallets thin out. It’s a harsh reality: while we chase financial freedom, energy bills sneak in like uninvited guests, siphoning off hard-earned cash. Did you know that the average household overspends by hundreds annually on utilities, often without realizing it? This isn’t just about pinching pennies; it’s about reclaiming control over your finances, reducing waste, and fostering a more sustainable lifestyle. In this article, we’ll dive into practical tips to save on energy bills, drawing from real experiences and straightforward strategies that can lighten your financial load without dimming your lights.

The Day My Budget Hit the Wall

Picture this: last winter, I stared at a bill that had ballooned unexpectedly, thanks to an old furnace guzzling more power than a teenager with a gaming console. Growing up in the Midwest, where winters bite hard, I’d always shrugged off energy costs as inevitable—like accepting snow in December. But that month, with inflation pinching everywhere, it hit me hard. I remember thinking, «And that’s when I realized how much was slipping away unnoticed.» This wasn’t just numbers on paper; it was a wake-up call to my family’s finances.

This personal anecdote underscores a key lesson in energy efficiency: small, habitual leaks add up. For instance, according to financial experts, unsealed windows and doors can inflate your energy bills by 10-15% each year. In the U.S., where «tightening your belt» is a common phrase for cutting back, I started by auditing my home—checking for drafts and outdated appliances. The result? A noticeable drop in costs, proving that proactive steps can turn a budget buster into a savings win. It’s not about deprivation; it’s about smart, human-centered finance that keeps your home comfortable without breaking the bank.

Debunking the «Set It and Forget It» Myth

We’ve all heard the old wives’ tale that cranking up the heat when you’re home and blasting the AC in summer is the way to go—after all, isn’t that what keeps things cozy? But hold on; this common misconception can actually drain your wallet faster than a plot twist in a thriller like «The Big Short.» In reality, maintaining a consistent temperature, rather than extreme swings, optimizes your system’s efficiency and cuts down on unnecessary energy consumption.

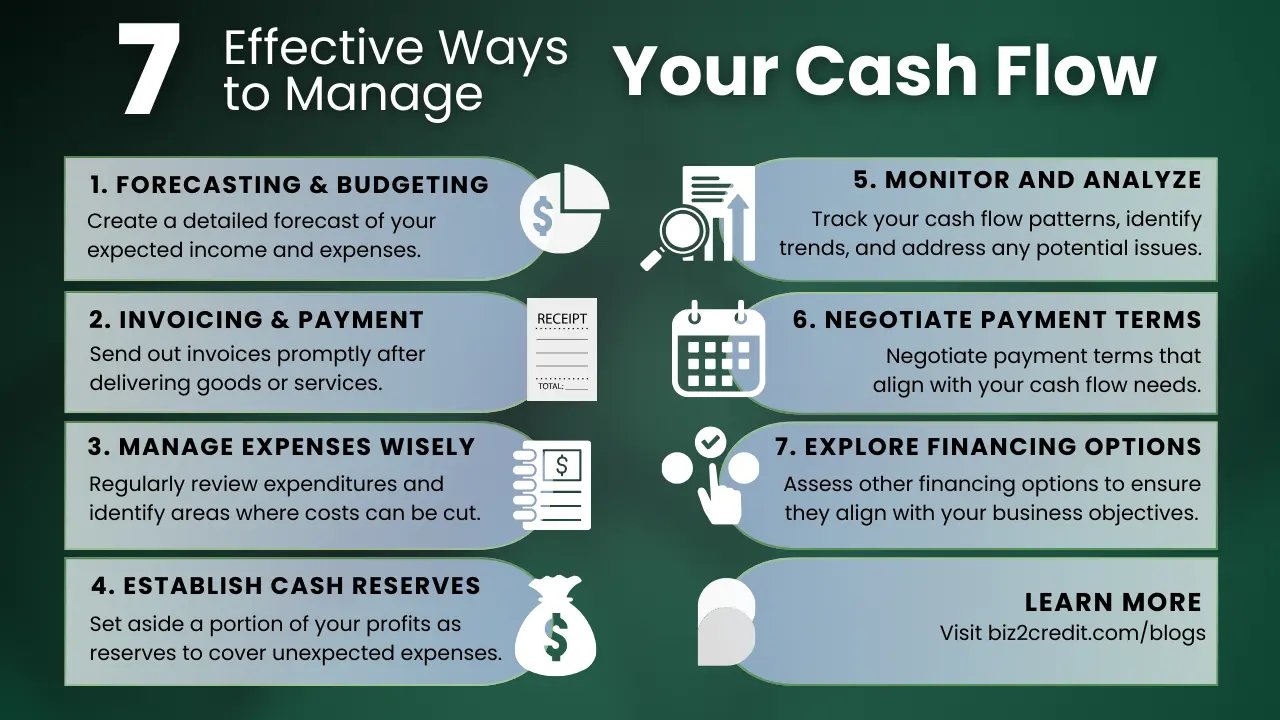

Digging deeper, let’s compare: a programmable thermostat versus manual adjustments. Here’s a simple breakdown to illustrate the point.

| Aspect | Programmable Thermostat | Manual Control |

|---|---|---|

| Annual Savings | Up to $180 on utilities | Minimal, often none |

| Energy Efficiency | Adapts to your routine, reducing waste | Requires constant monitoring, leading to overuse |

| Long-term Finance Impact | Lowers overall household expenses | Can inflate bills during peak seasons |

As you can see, the truth is uncomfortably clear—relying on outdated methods might feel familiar, but it costs more in the long run. From a finance perspective, this ties into broader money management: just as investors diversify portfolios, homeowners should diversify their energy strategies to mitigate risks and enhance savings.

Why Haven’t You Checked Your Usage Yet?

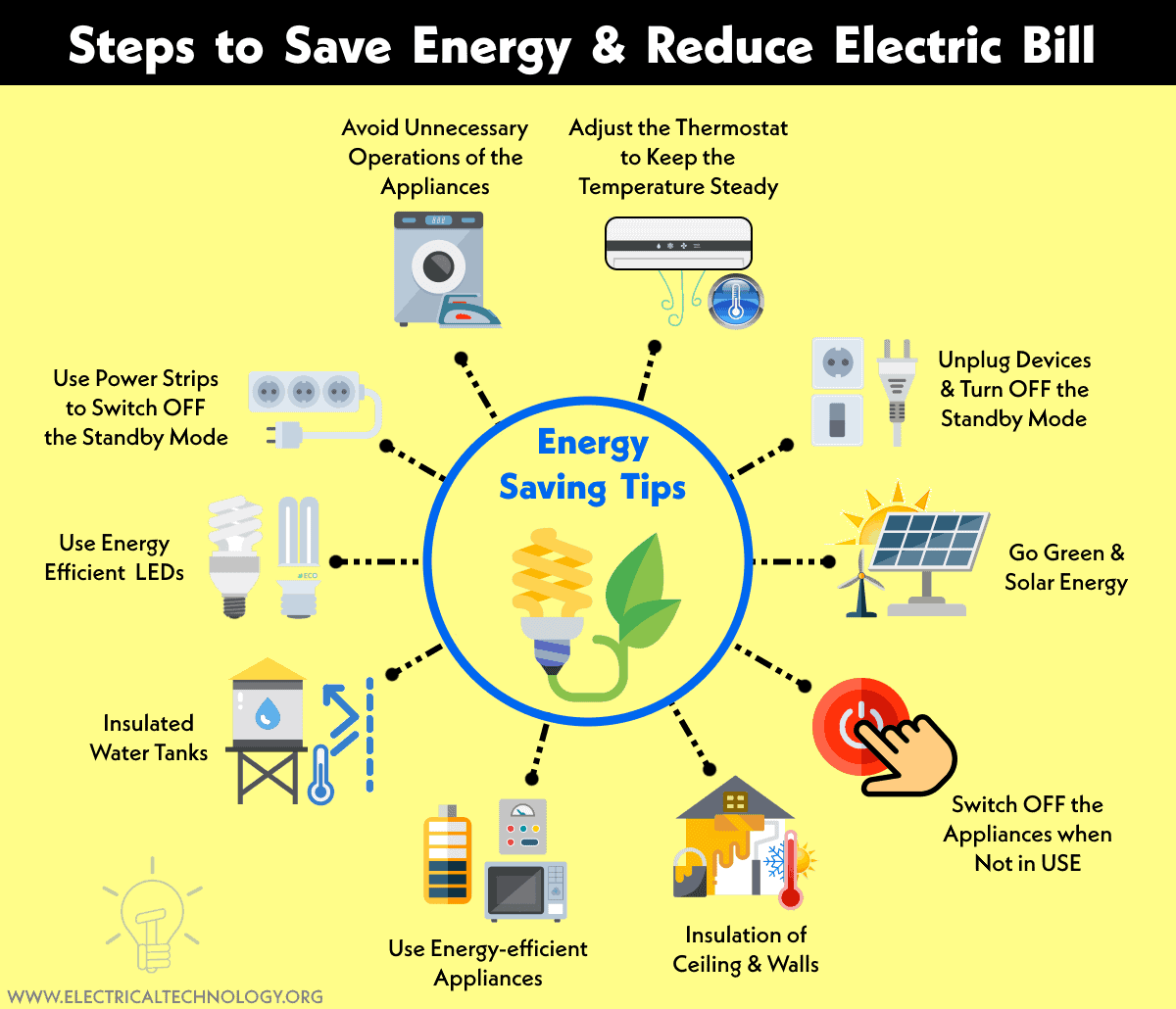

Here’s a disruptor: if energy bills are your biggest financial foe, why treat them like a distant relative you only call on holidays? Let’s flip the script with a mini experiment you can try right now. Grab your latest utility statement and jot down your monthly energy costs. Now, imagine slicing that number by 20%—possible? Absolutely, through targeted actions like switching to LED bulbs or unplugging «vampire» devices that draw power even when off.

In my case, conducting this quick audit revealed that my home office setup was sucking up extra juice, much like how a character in «Money Heist» plans meticulous heists. The irony? We often overlook these details in our rush to handle bigger finances. Start by numbering the steps for clarity: 1) Track your daily usage with a free app, 2) Identify high-consumption areas, and 3) Implement one change, like weatherstripping doors, to measure the impact. This isn’t just theory; it’s a real, actionable path to reducing energy expenses and bolstering your overall financial health. Remember, in finance, every dollar saved is a dollar earned.

Wrapping this up with a fresh angle: what if saving on energy isn’t merely about your bank account, but about leaving a legacy for the planet? It’s a twist that shifts from immediate relief to long-term wisdom. So, take that first step—conduct your energy audit today and watch your finances flourish. And just think: what’s one overlooked habit in your home that’s costing you more than you know? Share in the comments; let’s spark a conversation on smarter living.