As the markets twist and turn, let’s dive straight into the world of stocks. You might think stock market analysis is just for suited-up traders yelling on the floor, but here’s a contradiction: it’s often the everyday folks who make the smartest plays. While millions lose sleep over volatile stocks, basic analysis can turn confusion into confidence, helping you spot opportunities and avoid pitfalls. In this tutorial, we’ll break down essential stock market basics, empowering you to make informed decisions without needing a finance degree. Stick around, and you’ll walk away with practical tools to analyze stocks like a pro—seriously, it’s that straightforward.

My Unexpected Dive into Stocks and the Hard Lessons Learned

Picture this: back in 2015, I was that guy staring at my computer screen, convinced that buying Apple stock was a no-brainer because, well, everyone uses iPhones. But oh, boy, was I wrong. I jumped in without a second thought, ignoring the basics like earnings reports and market trends. Fast forward a few months, and the stock dipped thanks to some regulatory hiccups I hadn’t even heard of. Lost a couple hundred bucks, and it hit me like a ton of bricks—analysis isn’t optional; it’s survival. That personal blunder taught me a key lesson: basic stock market analysis starts with understanding fundamentals, not just hype.

Let me share a subjective take: as someone who’s been burned, I firmly believe beginners should always start with company financials. Look at metrics like price-to-earnings ratios or revenue growth; they’re like the vital signs of a business. For instance, if a company’s earnings are tanking while its stock price is soaring, that’s a red flag waving wildly. And here’s a metaphor you won’t hear every day: treating stocks like uncharted territory in a video game—without mapping the landscape, you’re just wandering into boss fights unprepared. In the U.S., where I’m from, we often say things «go south» when they fail, and that’s exactly what happened to my portfolio that time. Y’know, and just when I thought I had it figured out…

Stocks Through the Lens of History: Surprising Parallels to Modern Finance

Ever wonder how the tulip mania of 17th-century Netherlands mirrors today’s crypto craze? It’s a historical comparison that hits close to home for stock analysis. Back then, people traded tulip bulbs like hot stocks, driving prices through the roof before the bubble burst spectacularly. Fast-forward to now, and we’re seeing similar patterns in overvalued tech stocks. This isn’t just trivia; it’s a wake-up call that basic stock market analysis involves spotting bubbles before they pop.

In my opinion, drawing from cultural references like this makes finance feel less abstract and more relatable. Take the 1929 Wall Street Crash, for example—it’s not just a footnote; it’s a blueprint for understanding market cycles. A company’s stock isn’t isolated; it’s intertwined with broader economic trends, much like how a single episode of a series like «Billions» captures the high-stakes drama of trading floors. But seriously, if you’re analyzing stocks, always check economic indicators like GDP growth or inflation rates. They act as unexpected allies, helping you predict shifts. And remember, in American lingo, «don’t put all your eggs in one basket» applies perfectly here—diversify your analysis to avoid getting caught in a downturn.

Why Economic Cycles Matter More Than You Think

Dig deeper, and you’ll see how these cycles influence stock valuations. For a mini experiment, grab a stock like Tesla and track its price against quarterly GDP reports over six months. You’ll likely notice patterns that reveal whether the stock’s riding a wave or heading for a wipeout.

The Irony of Overhyped Stocks: Spotting Risks and Crafting Solutions

It’s almost laughable how social media turns every stock tip into viral gold, only for investors to «crash and burn» when the hype fades. The problem? Many newcomers chase trends without basic analysis, thinking a meme stock will make them rich overnight. But here’s the truth: relying on social buzz for stock market decisions is like building a house on sand—it might look solid until the first storm hits. In reality, this irony underscores the need for grounded strategies to evaluate stocks properly.

To solve this, start by examining a company’s competitive edge—what makes it stand out in its industry? Use tools like SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to get a fuller picture. For instance, if you’re looking at Amazon, note its dominance in e-commerce as a strength, but factor in regulatory threats as a weakness. And that’s when it all clicks—you’re not just reading numbers; you’re telling a story about the company’s future. In finance circles, we might throw in a localism like «keeping your powder dry,» meaning hold back on investments until you’ve done your homework. Plus, if you’re into pop culture, think of it like the plot twist in «The Big Short»—the real insight comes from digging beneath the surface.

| Analysis Tool | Advantages | Disadvantages |

|---|---|---|

| Fundamental Analysis | Provides deep insights into company health | Takes time to master |

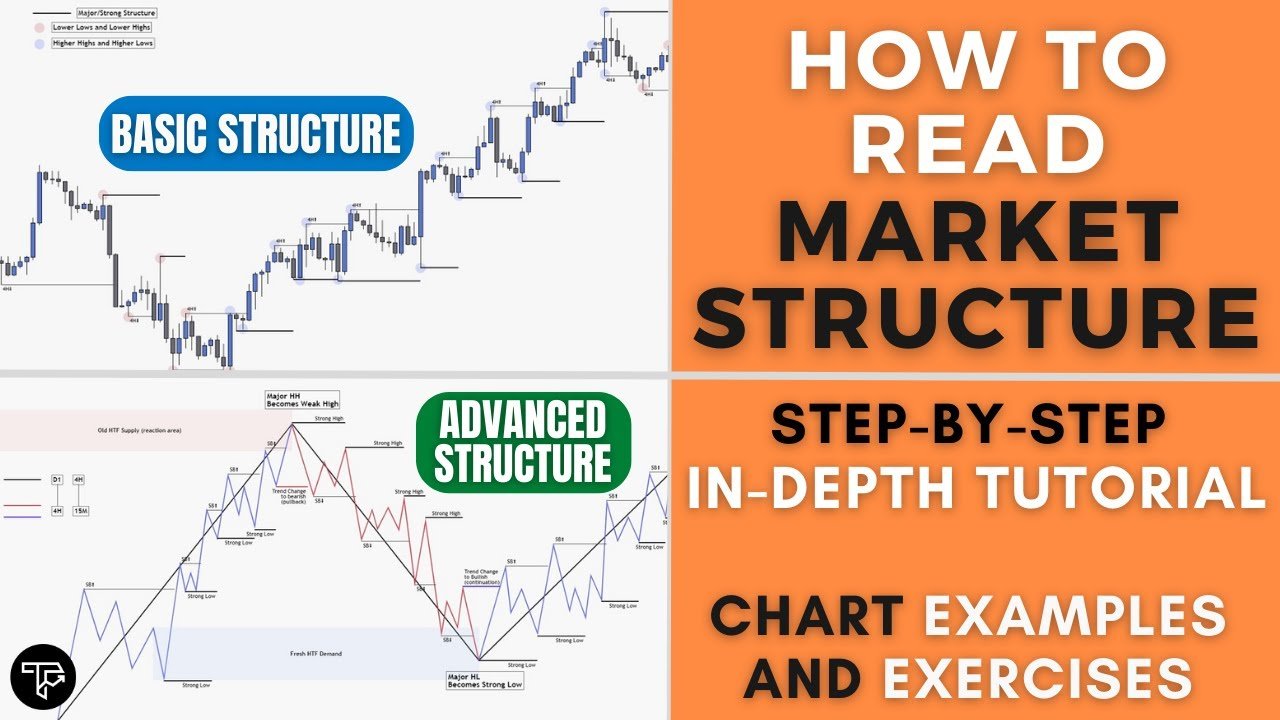

| Technical Analysis | Helps predict short-term trends via charts | Can be misleading without context |

1. Identify key metrics, 2. Research industry trends, and 3. Compare with peers—these steps build a solid foundation.

Wrapping It Up with a Fresh Perspective on Your Investments

Here’s a twist: what if I told you that basic stock market analysis isn’t about predicting the future—it’s about preparing for uncertainty? By now, you’ve seen how a few straightforward techniques can transform your approach, turning guesswork into strategy. So, take action: pick a stock from your watchlist and apply one fundamental analysis method right now—it could be the start of smarter investing.

And finally, a reflective question: how might your financial goals change if you approached stock analysis not as a gamble, but as a calculated step toward security? Share your thoughts in the comments; let’s keep the conversation going.