Silent budget assassins. That’s what unchecked expenses feel like—stealthy, relentless, and often invisible until your bank account whispers a desperate plea. Did you know that according to a recent study by the National Foundation for Credit Counseling, nearly 60% of Americans live paycheck to paycheck, largely because small, daily leaks in their spending go unnoticed? In this tutorial on expense tracking methods, we’ll dive into practical strategies to reclaim control over your finances, turning what feels like a never-ending chase into a manageable routine. By the end, you’ll not only spot those sneaky outflows but also build habits that pave the way for real financial peace—without the dread of surprises.

My Unexpected Financial Awakening

Picture this: a few years back, I was that guy, juggling receipts like they were confetti at a party that had gone on too long. Living in the bustling streets of New York, where every coffee run feels like an investment in productivity, I ignored the little things. «Burning a hole in your pocket» doesn’t even cover it; my wallet was a black hole for cash. One rainy afternoon, after splurging on yet another overpriced umbrella, I sat down with my bank statements and realized I’d overspent by hundreds on «necessities» that month. And that’s when it hit me—incomplete thoughts like these often lead to breakthroughs.

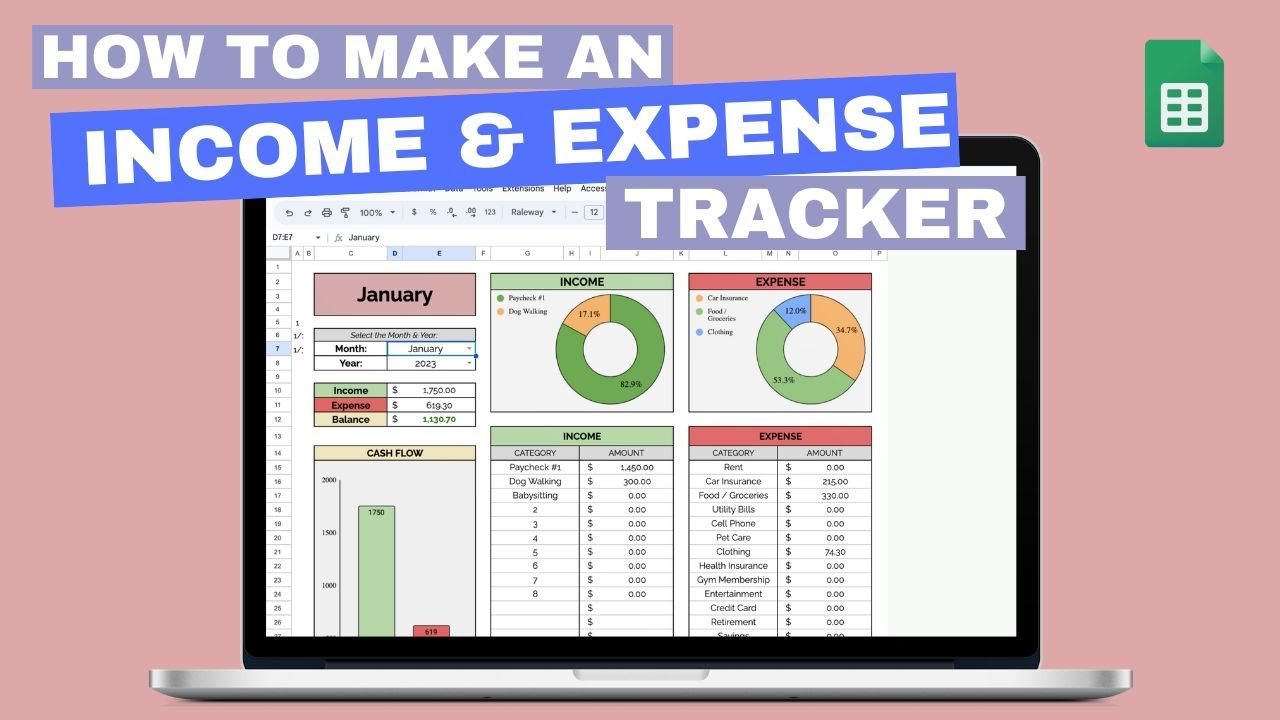

This personal anecdote isn’t just venting; it’s a lesson in the power of simple expense tracking methods. I started with a basic journal, jotting down every purchase, which forced me to confront patterns I never saw coming. Think of it as mapping a hidden river in your budget—seemingly harmless streams that merge into a flood. Opinions vary, but mine, shaped by years in personal finance, is that starting small builds lasting change. In the UK, where mates might say «keeping the pence,» the principle holds: track to transform. To optimize your approach, consider using apps like Mint or YNAB, weaving in long-tail keywords like «effective ways to monitor daily spending» naturally into your routine.

Historical Echoes in Modern Budgeting

Fast-forward from my mishaps to the grand stage of history, where figures like Benjamin Franklin preached the virtues of frugality—ironic, coming from a man who invented bifocals and chased lightning. In the 18th century, Franklin’s Poor Richard’s Almanack compared unmanaged expenses to «a small leak will sink a great ship,» a metaphor that’s as fresh today as it was then. But let’s twist this: in today’s digital age, that «leak» might be subscription services stacking up like unattended bills in a Victorian drawer.

Comparatively, think about how ancient Romans tracked resources for their vast empire, using ledgers that evolved into modern accounting. This isn’t just trivia; it’s a nudge to adapt those disciplined methods to your life. For instance, the envelope system—popularized in American households—mirrors Roman allocation by dividing cash into categories. Here’s a simple table to compare two popular expense tracking techniques:

| Method | Advantages | Disadvantages |

|---|---|---|

| Digital Apps (e.g., Expense Tracker) | Real-time alerts, easy categorization, syncs across devices | Requires internet, potential privacy concerns |

| Manual Ledger | Builds discipline, no tech needed, tangible record | Time-consuming, easy to forget entries |

This comparison highlights how blending historical wisdom with tech can enhance your personal finance management. As someone who’s tried both, I find the manual approach oddly satisfying, like rediscovering a lost art, even if it means sacrificing speed for depth.

Challenging the ‘Set It and Forget It’ Illusion

Ever heard someone quip, «I’ll just wing my budget»? It’s like relying on luck in a game of poker—exciting until you’re out of chips. In finance circles, this ties into the myth that once you set up tracking, it’s autopilot city. Wrong. My take, backed by behavioral economics, is that expenses evolve, much like characters in a Netflix series; just when you think you’ve got them figured, plot twists appear. Take «The Office,» where Michael’s chaotic spending mirrors real-life oversights—remember that disastrous company party?

To counter this, let’s propose a mini experiment: for one week, categorize your expenses not just by amount, but by emotion. Why did that impulse buy happen? Was it stress or boredom? This disruptively simple exercise, which I stumbled upon during a particularly tight month, reveals truths that numbers alone hide. In Australian lingo, it’s like «putting the boot in» to your bad habits—firm but necessary. By integrating synonyms like «budget monitoring strategies» organically, you’ll uncover layers, making your expense tracking methods more robust and less robotic.

As we wrap up this exploration, consider this twist: what if the real power of tracking isn’t in the tools, but in the self-awareness they spark? That’s the game-changer I’ve seen in my own journey and in friends who’ve turned finances around. So, take action now—pick one method from this tutorial and apply it today. How has mastering expense tracking reshaped your financial story? Share your thoughts in the comments; it’s more than curiosity—it’s a step toward collective wisdom.