Shadows of debt. Yes, that’s what lingers long after the signature dries on a loan agreement. In a world where borrowing is as common as coffee runs, most folks overlook the fine print of loan amortization schedules. It’s a contradiction: We crave financial freedom, yet we dive into debt without fully grasping how it unravels over time. This tutorial isn’t just another dry finance lesson; it’s your roadmap to demystifying those schedules, saving you from unexpected interest pitfalls and empowering smarter borrowing decisions. By the end, you’ll wield this knowledge like a shield, turning abstract numbers into actionable insights that could trim thousands off your repayments. Let’s dive in, shall we?

The Day My Car Loan Hit Hard: A Personal Wake-Up Call

Picture this: Back in 2015, I was that guy—eager to buy my first reliable car, but clueless about the beast called amortization. I signed for a $20,000 loan at 5% interest over five years, thinking I’d just pay it off monthly. Loan amortization schedule sounded like jargon for bankers, not me. But oh, boy, was I wrong. Fast forward a year, and I stared at my statement: Most of my payments were vanishing into interest, barely touching the principal. It hit me like a ton of bricks—Y justo ahí fue cuando realized how these schedules map out every payment, showing how interest and principal share the spotlight over time.

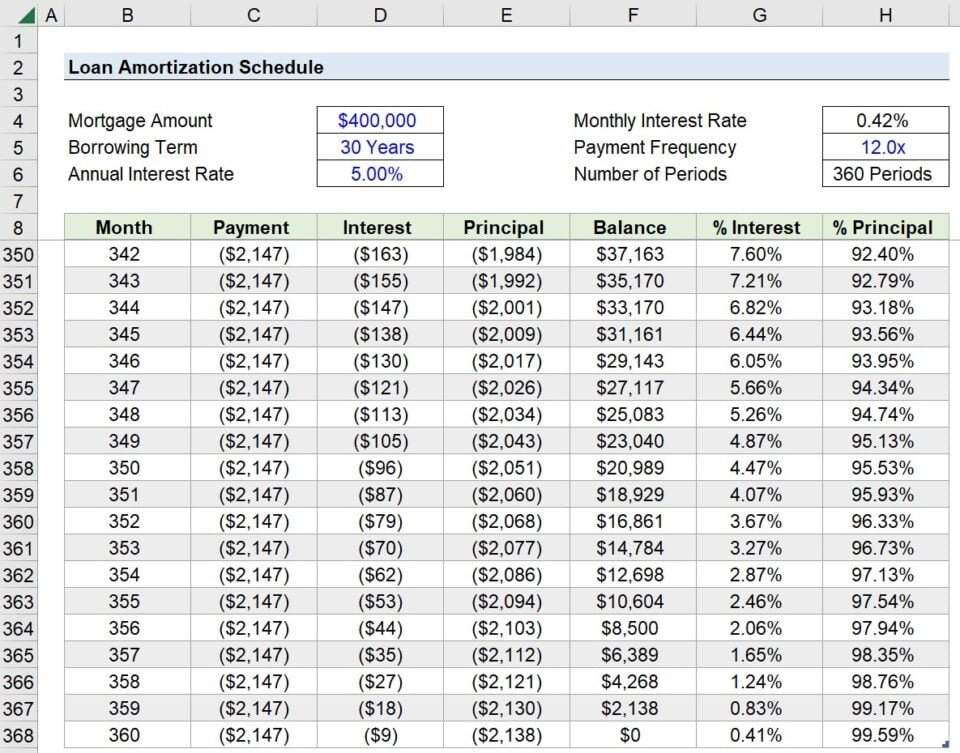

In my opinion, this isn’t just math; it’s a life lesson on patience and planning. Think of it as peeling an onion—layer by layer, you uncover the real cost. According to the Consumer Financial Protection Bureau, the average American with a car loan overpays by hundreds due to misunderstood amortization. My anecdote? It taught me that early payments pack more punch against interest, a trick I’ll swear by. Now, for a quick how to create a loan amortization schedule, grab a calculator: Start with your loan amount, annual interest rate, and term. The formula’s straightforward—monthly payment = [P x R(1+R)^N]/[(1+R)^N – 1], where P is principal, R is monthly rate, and N is total payments. But don’t just take my word; try it with your own numbers to see the magic.

From Ancient Lends to Modern Spreadsheets: A Historical Twist

Ever wonder how loan amortization evolved? It’s like comparing a horse-drawn carriage to a Tesla—both get you places, but one’s a smoother ride. Historically, in ancient Mesopotamia around 1750 BC, Hammurabi’s Code laid early ground rules for loans, but amortization as we know it didn’t exist. Fast forward to the 20th century, and the US banking system standardized these schedules during the Great Depression to build trust and transparency in lending. Today, it’s a cornerstone of amortization table tools, helping borrowers like you visualize debt repayment.

This cultural shift highlights a truth: In places like the UK or US, where credit scores rule, understanding amortization isn’t optional—it’s survival. I remember chatting with a friend in London who juggled a mortgage; he likened it to a «pound for pound» battle, a local modism meaning direct exchange. The irony? While historical loans were often interest-free or short-term, modern ones, like student loans in America, stretch for decades, inflating total costs. For instance, a $10,000 loan at 6% over 10 years versus 20 years balloons from $11,000 to nearly $14,000 in interest. That’s on the money—a phrase echoing Wall Street’s precision. To compare, here’s a simple table:

| Loan Term | Total Interest Paid | Monthly Payment |

|---|---|---|

| 10 years | $1,000 | $111 |

| 20 years | $4,000 | $72 |

This shows how longer terms might ease monthly burdens but break the bank overall. It’s a stark reminder that, as in «The Wolf of Wall Street,» not all that glitters is gold when it comes to finance.

Unpacking the Interest Trap: Irony in Repayment and a Straightforward Fix

Here’s the rub: Many borrowers think they’re chipping away at their loan from day one, but irony strikes when front-loaded interest payments leave the principal nearly intact. It’s like expecting a straight path uphill—only to find switchbacks. A common myth? That extra payments don’t matter much early on. The uncomfortable truth: They do, slashing future interest like a well-timed cut. Let’s say you’re dealing with a loan repayment plan for a home mortgage; ignoring amortization could cost you years of extra payments.

To counter this, imagine a conversation with a skeptical reader: «But why bother with all this?» I’d say, «Because, my friend, it’s the difference between owning your home in 15 years or 30.» For a mini experiment, pull up an online amortization calculator—enter your loan details and tweak the extra payment field. Watch how an additional $100 monthly accelerates payoff. Step 1: Gather your loan specifics. Step 2: Input into a tool like Excel or a free calculator. Step 3: Analyze the schedule to spot interest peaks. This exercise isn’t fluff; it’s your ticket to financial clarity, turning what-ifs into what’s next.

And just when you thought debt was a straight jacket… it’s actually a customizable fit. That’s the twist: Mastering loan amortization schedules isn’t about dread; it’s about reclaiming control, making your money work for you instead of against. So, take action now—grab that calculator and map out your own schedule today. It could be the move that saves you a fortune. Finally, here’s a reflective question: What hidden costs in your current loans might you’re overlooking, and how could understanding amortization change that? Share your thoughts in the comments; let’s keep the conversation going.