Money vanishes quickly—that’s the harsh reality when it comes to retirement account withdrawals. You see, while we’ve been told that saving for retirement is the ultimate financial safety net, the truth is that pulling funds too early can turn your golden years into a scramble for scraps. In the U.S., where over 60 million Americans hold some form of retirement account, early withdrawals lead to more than $5 billion in penalties annually. This tutorial isn’t just about numbers; it’s about empowering you to navigate these waters without sinking your future. By the end, you’ll grasp how to withdraw wisely, minimizing taxes and maximizing your nest egg, all while avoiding common pitfalls that could erode your hard-earned savings.

My Wake-Up Call with Early Withdrawals

Let me take you back to 2012, when I was staring at my first 401(k) statement, feeling like I’d hit the jackpot with years of contributions. But life threw a curveball—job loss—and I toyed with the idea of tapping into that account. In a moment of panic, I withdrew $10,000, only to get slammed with a 10% penalty and additional taxes. That sting wasn’t just financial; it was a personal low point, teaching me that retirement funds aren’t an emergency fund. In my view, this kind of mistake is all too common, especially among millennials facing economic uncertainty.

Picture this: Imagine a conversation with a skeptical friend who’s eyeing their IRA like it’s a rainy-day piggy bank. «But what if I need the money now?» they’d say. I’d counter with a hard truth—early withdrawals from traditional accounts before age 59½ often trigger not only penalties but also income tax on the full amount. It’s like opening a time capsule too soon and finding it half-empty. For Roth IRAs, though, it’s different; contributions can come out penalty-free, but earnings? Those are trickier, especially if you’re under 59½ and haven’t had the account for five years. This nuance saved me later, when I needed funds for a home purchase without the fallout.

And just like that scene in «The Big Short» where experts missed the housing bubble, many overlook these rules until it’s too late. To add depth, consider this unexpected analogy: Retirement withdrawals are like harvesting a vineyard—pull the grapes too early, and the wine tastes sour; wait just right, and you get a vintage worth savoring. In the U.S., with our tax code as complex as a Washington insider’s playbook, understanding these timelines can mean the difference between a comfortable retirement and one filled with regrets.

From Pensions to 401(k)s: How Retirement Has Evolved

Shift gears for a moment and think about how we’ve moved from the era of company pensions—those reliable, old-school promises—to the self-managed 401(k)s of today. Back in the 1980s, when «Dallas» was dominating TV screens, most workers didn’t worry about withdrawals; their employers handled it. Fast forward, and we’re in a world where individuals must orchestrate their own exits, facing a maze of options like traditional IRAs, Roths, and even SEP plans for the self-employed.

This evolution brings an uncomfortable truth: While pensions offered security, modern accounts demand strategy. For instance, comparing the two in a simple table highlights the shift:

| Aspect | Pension Plans | Modern Retirement Accounts |

|---|---|---|

| Control | Employer-managed | Individual decisions on withdrawals |

| Tax Treatment | Often tax-free at payout | Potential for early withdrawal penalties and taxes |

| Risks | Company solvency | Market fluctuations and personal choices |

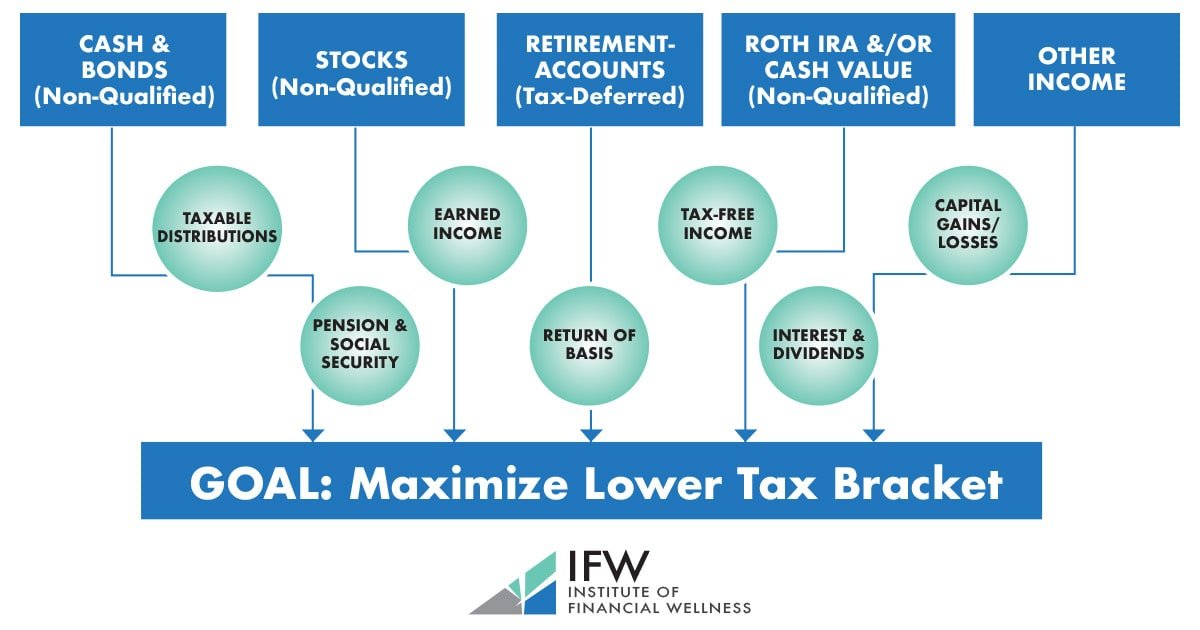

In a nutshell, this comparison shows why understanding withdrawal rules is crucial. Take Roth conversions, for example—they’re like betting on a long game, allowing tax-free growth if planned right. But mess it up, and Uncle Sam’s cut could leave you reeling. From my experience advising friends, the key is to align withdrawals with your tax bracket; in low-income years, it’s often smarter to pull from traditional accounts to minimize the hit.

The Tax Traps and How to Sidestep Them

What if I told you that the biggest enemy of your retirement plan isn’t market crashes, but overlooked tax rules? Enter the world of required minimum distributions (RMDs), which kick in at age 73 for most accounts. I remember counseling a colleague who, at 74, faced a hefty bill because he didn’t calculate his RMD properly—turns out, not withdrawing enough meant penalties equaling 50% of the shortfall. Ouch.

But wait, there’s more to dodging these traps. Let’s break it down: First, know your account type—traditional IRAs require you to pay taxes on withdrawals as ordinary income, while Roths let you withdraw earnings tax-free under certain conditions. Second, consider the 72(t) rule for early access without penalties; it’s like a loophole in a fortress, allowing substantially equal periodic payments over your life expectancy. And third, don’t forget state taxes, which vary wildly; in high-tax states like California, withdrawals can feel like double jeopardy.

Here’s a mini experiment for you: Grab your latest statement and jot down potential withdrawal scenarios. What if you retired early? Run the numbers through a calculator—tools like those on IRS.gov can help. In my opinion, this hands-on approach reveals how a strategic withdrawal plan can preserve your wealth, much like a seasoned investor in a financial thriller.

As we wrap this up, here’s a twist: What if your retirement account isn’t just savings, but a legacy that could support your family? By mastering withdrawals, you’re not just securing your future—you’re building one. So, take action now: Review your account rules and consult a financial advisor to map out your strategy. And think on this: Are you letting tax traps dictate your golden years, or are you the one in control? Share your thoughts in the comments; let’s discuss how you’re preparing for what’s ahead.