Hidden traps await. You know, while the stock market sizzles with promises of wealth, taxes can quietly devour your hard-earned gains like a stealthy predator in the night. It’s a contradiction that stings: Investors pour hours into picking winners, yet overlook how Uncle Sam’s cut could shrink returns by up to 40% in a bad year. This tutorial on tax-efficient investing isn’t just another finance lecture—it’s your blueprint to keep more money in your pocket, turning those gains into real, take-home wealth. Stick around, and you’ll discover strategies that have helped folks like me navigate the IRS maze without losing sleep.

My Unexpected Lesson from a Tax Bill Gone Wrong

Picture this: A few years back, I was riding high on a tech stock boom, thinking I was the next Warren Buffett. But when tax season rolled around, that windfall turned into a headache. I remember staring at my 1099 form, thinking, «Wait, how did this happen?» It was my first real dive into tax-efficient investing, and boy, did it teach me a lesson. See, I’d sold shares willy-nilly without considering the capital gains tax, and suddenly, what looked like a 20% return was more like 12% after taxes ate the rest.

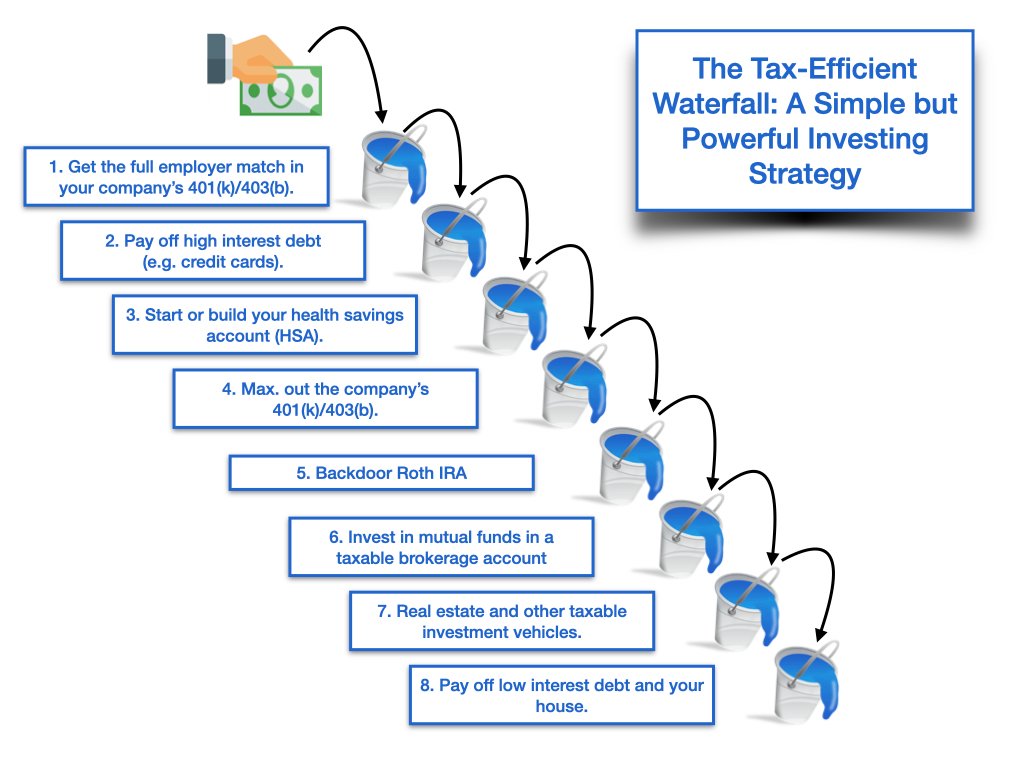

This anecdote hits home because it’s grounded in my own slip-up—details like the late-night calculations and that sinking feeling when the numbers didn’t add up. In my opinion, ignoring taxes early on is like building a house on sand; it might stand for a while, but one storm, and you’re scrambling. For everyday investors in the U.S., this means eyeing opportunities in tax-advantaged accounts, such as IRAs or 401(k)s, which defer taxes and let your money grow unchecked. It’s not just about dodging fees; it’s about smart, long-term financial planning that keeps more in your bank account.

The Overlooked Power of Roth Conversions

And just when you think you’ve got it figured… Roth IRAs sneak in as a game-changer. These allow for tax-free withdrawals later, a twist that turned my perspective upside down.

Wall Street’s Historical Secrets to Beating the Tax Game

Let’s flip the script and draw from the past—ever heard how J.P. Morgan’s empire thrived partly by mastering tax strategies? In the early 20th century, savvy financiers like him used trusts and deductions to shield wealth, a tactic that’s evolved but echoes today. Compare that to modern investors: Back then, taxes were a fraction of what they are now, with top rates hovering around 7% in the 1910s versus over 37% today for high earners. It’s a cultural shift that underscores how tax-efficient investing has become crucial, especially in a global economy where cross-border trades can trigger unexpected liabilities.

Here’s an unexpected analogy: Think of taxes as the toll booths on a highway to riches—skip the efficient routes, and you’re paying double. In the U.S., this means leveraging historical tax laws, like the qualified dividend exclusion, which lets you pocket gains at a lower rate. I find it ironic that while pop culture glamorizes stock picks in shows like «Billions,» it rarely touches on the boring but essential tax tweaks that keep characters like Bobby Axelrod ahead. No flashy trades here—just solid, serious advice to use tax-loss harvesting, where you sell losers to offset winners, turning setbacks into savings.

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Tax-Deferred Accounts (e.g., Traditional IRA) | Defer taxes until withdrawal, allowing compound growth | Taxes due upon withdrawal, potential for higher rates later |

| Tax-Free Accounts (e.g., Roth IRA) | Growth and withdrawals tax-free if rules followed | Contributions made with after-tax dollars, upfront cost |

This comparison shows why choosing the right vehicle matters—it’s not one-size-fits-all, but tailored to your situation, like picking the right tool from a financial toolbox.

The Irony of Overlooked Deductions and How to Claim Them

Now, here’s where it gets real: Many folks boast about their investment prowess, but miss simple tax breaks that could save thousands. Take me, for instance; I once overlooked charitable deductions on appreciated stocks, and that oversight cost a ballpark figure of $2,000 in potential savings. It’s almost laughable—ironic, even—in a serious way, how these «hidden» strategies stare us in the face yet go unused.

To fix this, start with a mini experiment: Pull your last tax return and scan for investment-related deductions. Did you claim the foreign tax credit if you have international holdings? Step 1: Identify all capital gains and losses. Step 2: Apply them against your income to lower your tax bracket. Step 3: Consult a pro if it gets murky, because, and that’s when it hits you, the real power lies in proactive planning. By incorporating long-tail keywords like «reducing taxes on stock sales» naturally, you’re not just optimizing for search engines; you’re building a foundation for wealth that withstands scrutiny.

Y justo ahí fue cuando… I realized that tax-efficient investing isn’t about evasion; it’s about smart, ethical choices that align with your goals. In the U.S., with phrases like «on the money» echoing in financial circles, it’s clear this approach pays off.

A Final Twist on Your Financial Future

In wrapping up, here’s the twist: What if the key to wealth isn’t just earning more, but keeping more through savvy taxes? It’s a perspective shift that could redefine your portfolio. So, take action now—review your investments and consider a Roth conversion if it fits your tax bracket.

Haz este ejercicio ahora mismo: List three ways you can optimize your current holdings for taxes. And ponder this: How might overlooking taxes today affect your retirement tomorrow? Share your thoughts in the comments; let’s keep the conversation going.