As economies falter unexpectedly, the financial world spins into chaos. Did you know that since 2000, the global economy has endured no less than five major recessions, each eroding trillions in personal wealth almost overnight? This harsh reality hits hard: while downturns are inevitable, they’re not insurmountable. In this article, we’ll dive into practical ways to prepare for economic downturns, arming you with strategies that could shield your finances from the storm. By the end, you’ll gain a clearer path to stability, turning potential panic into proactive planning. Let’s get real about economic downturn preparation—it’s not just about surviving; it’s about thriving when others falter.

A Personal Tale of Financial Resilience

Back in 2008, I watched my retirement portfolio plummet like a stone in a pond, ripples of stress spreading through my daily life. I’d always thought I was prepared, squirreling away savings and diversifying investments, but when the market crashed, it exposed my blind spots. And just like that, what I assumed was solid ground turned to quicksand. I remember staying up nights, calculating how to prepare for economic downturns without unraveling my family’s security.

This isn’t some polished success story—it’s raw. I firmly believe that building an emergency fund is non-negotiable; it’s like having a lifeboat in a shipwreck. For me, that meant cutting back on luxuries and focusing on high-yield savings accounts. The lesson? Personal finance isn’t about perfection; it’s about adaptability. In the U.S., where I hail from, we’ve got this saying: «Keep your head above water,» which perfectly captures the grit needed to weather financial storms. Through that experience, I learned that financial strategies for recession start with self-reflection—assess your risks now, before the tide turns.

Lessons from the Great Depression: Unraveling Economic Myths

Picture this: the 1930s, when breadlines snaked through American streets and families «tightened their belts» just to make ends meet. It’s a stark comparison to today’s digital economy, yet the truths remain eerily similar. A common myth is that economic downturns strike out of nowhere, leaving us helpless—but that’s far from the truth. Historically, signs like rising unemployment or inflating debt bubbles often precede these events, as seen in the lead-up to the Great Depression.

Let me challenge you: If we ignore these patterns, are we dooming ourselves to repeat history? The uncomfortable reality is that many overlook the power of historical data in modern recession-proof finances. Take the 2008 crisis, inspired by unchecked speculation much like in the ’30s. By studying these cycles, you can spot red flags early. For instance, diversifying your portfolio isn’t just wise; it’s a hedge against volatility, drawing from how survivors of past downturns shifted to safer assets. And here’s a twist on pop culture—think of it like the resilient characters in «The Big Short,» who bet against the market’s folly. In essence, preparing for economic downturns means embracing education over denial, turning myths into actionable insights.

Challenging Your Financial Assumptions: A Quick Reality Check

Ever asked yourself, «Am I truly ready if the economy tanks tomorrow?» It’s a disruptor, isn’t it? Most people assume their steady job or modest investments will carry them through, but let’s get honest—that’s a risky gamble. In finance, overlooking debt management can be like ignoring a ticking bomb in your basement. For example, high-interest loans can snowball during recessions, eroding your stability faster than you think.

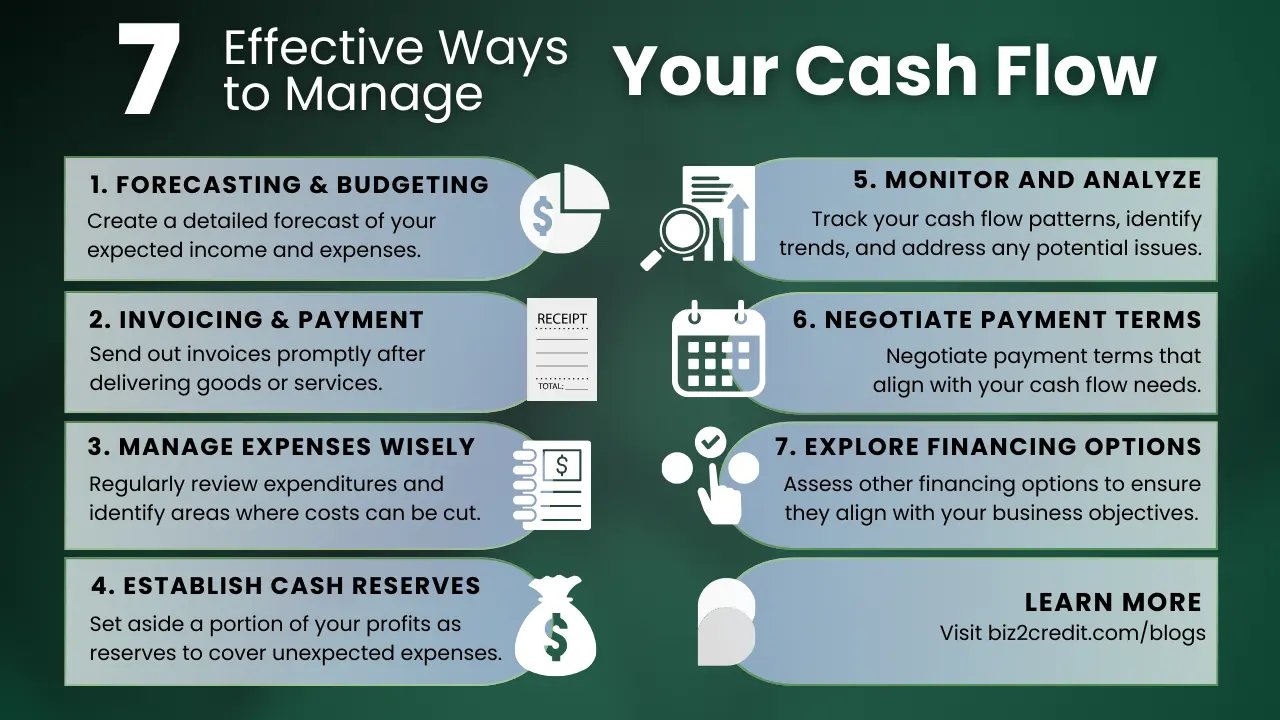

To counter this, try a mini experiment right now: Grab a notebook and list your monthly expenses versus income. What if your earnings dropped 20%? Would you budgeting strategies for downturns hold up? This exercise, drawn from real financial planning tools, reveals vulnerabilities. Compare it in a simple table below—see how different approaches stack up:

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Building an Emergency Fund | Covers 3-6 months of expenses, provides peace of mind | Requires discipline and time to accumulate |

| Diversifying Investments | Reduces risk across asset classes, like stocks and bonds | May yield lower returns in stable times |

| Reducing High-Interest Debt | Frees up cash flow for savings, minimizes interest costs | Can feel restrictive in the short term |

This isn’t about overwhelming you; it’s about empowering choices. I often think of finance as an unexpected journey, like navigating a labyrinth where one wrong turn can lead to dead ends. By confronting these assumptions head-on, you’ll craft a more robust plan, ensuring ways to prepare for economic downturns become second nature.

In wrapping this up, here’s a final twist: Economic downturns, while daunting, often spark innovation and growth for those who’ve prepared. Instead of viewing them as disasters, see them as opportunities to rebuild smarter. So, take action today—start by reviewing your budget and setting aside even a small emergency fund. And think about this: How has a past financial challenge shaped your approach to money? Share your thoughts in the comments; let’s learn from each other.