Ways to Track Investment Performance

Silent numbers whisper. In the world of finance, where fortunes rise and fall like unpredictable waves, ignoring your investment performance can feel like walking a tightrope blindfolded. Here’s a stark truth: studies show that over 70% of individual investors never properly monitor their portfolios, leading to missed opportunities and costly mistakes. But what if you could turn that around? This article dives into practical, human-centered ways to track your investments, helping you make smarter decisions and build lasting financial security without the usual jargon overload.

My Unexpected Stock Market Epiphany

Back in 2015, I remember staring at my computer screen, coffee going cold, as my portfolio dipped lower than a bad comedy sketch. I’d thrown money into stocks based on tips from a friend—think of it as my own mini «Wolf of Wall Street» blunder, minus the excess. What hit me hardest wasn’t the loss itself, but realizing I’d never tracked performance beyond a quick glance at quarterly statements. That oversight cost me thousands, and it taught a gritty lesson: tracking isn’t just about numbers; it’s about understanding the story behind them.

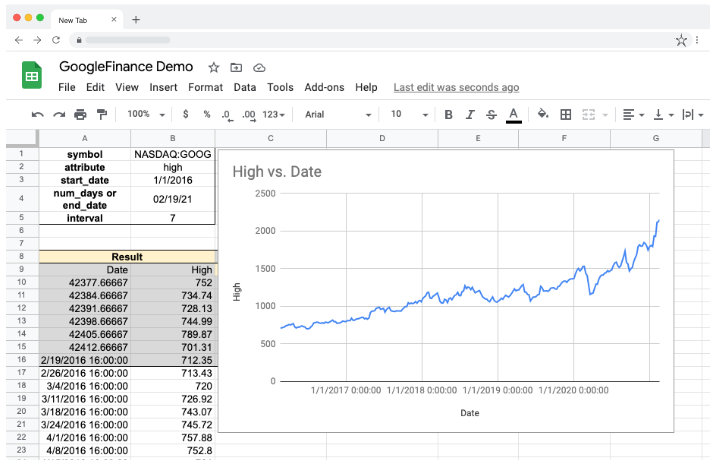

So, how do you start? Begin with **key performance indicators (KPIs)** like return on investment (ROI) and compound annual growth rate (CAGR). These metrics, often overlooked in the heat of the moment, act as your financial compass. For instance, calculating ROI isn’t rocket science—it’s simply (gain from investment minus cost of investment) divided by cost of investment, multiplied by 100. But here’s where it gets personal: I once used a simple spreadsheet to track my ROI weekly, and that habit turned vague hopes into tangible progress. In the U.S., where market volatility hits like a New York subway rush, tools like Excel or Google Sheets can be your best mate, offering real-time insights without fancy subscriptions.

Don’t just stop at basics, though. Dive into **volatility measures**, such as standard deviation, to gauge risk. It’s like checking the weather before a road trip—essential if you want to avoid surprises. And that’s when it hit me: blending these with personal anecdotes, like journaling your investment rationale, adds depth, making tracking feel less mechanical and more like a conversation with your future self.

Wall Street Echoes: Historical Parallels in Modern Tracking

Picture this: in the 1920s, investors like Jesse Livermore rode the market highs, only to crash with the Great Depression because they ignored performance trends. Fast-forward to today, and it’s eerily similar—many folks still rely on outdated methods, mistaking gut feelings for solid data. This historical comparison underscores a uncomfortable truth: without consistent tracking, you’re repeating past blunders. In finance circles across the pond in London, they call this «chasing shadows,» a nod to how elusive market patterns can be if not monitored properly.

Let’s contrast that with modern tools. For example, platforms like Morningstar or Yahoo Finance offer dashboards that make historical data analysis a breeze, much like how Netflix recommends shows based on your viewing history. But here’s an unexpected analogy: tracking investments is akin to tending a garden. Just as you prune overgrown plants to ensure growth, regularly reviewing your portfolio’s beta (a measure of volatility relative to the market) helps weed out underperformers. In my experience, using beta alongside the Sharpe ratio—calculated as (expected return minus risk-free rate) divided by standard deviation—has been a game-changer for balancing risk and reward.

To make this actionable, consider a mini experiment: pick one investment and track its performance over a month using free tools. You’ll likely uncover patterns, like how economic news impacts your holdings, much like how a plot twist in «Succession» reveals family dynamics. This approach, blending historical lessons with current tech, ensures you’re not just reacting but proactively steering your financial ship.

A Closer Look at Portfolio Analytics

Within this, don’t overlook advanced analytics; they’re the unsung heroes. For instance, attribution analysis breaks down returns by asset class, showing what’s truly driving growth—far from the «set it and forget it» myth.

The Hidden Dangers of Ignoring Metrics and How to Fix Them

Overlooking metrics in your investment strategy is like ignoring a check-engine light on your car—eventually, it breaks down. In finance, this means potential losses piling up while you scroll through social media distractions. But let’s address the irony: even experts, with their polished suits and Wall Street bravado, sometimes skip daily tracking, assuming the market will «sort itself out.» Wrong. The solution lies in adopting a multi-faceted approach, starting with automated tools that send alerts for deviations in performance benchmarks.

First off, integrate **benchmark comparisons**. Compare your portfolio’s returns against standards like the S&P 500 to see if you’re beating the market or lagging behind. Number one: set up a baseline by choosing a relevant index. Number two: use software like Personal Capital or Mint to automate the process, flagging when your investments underperform. Number three: adjust based on insights, perhaps reallocating funds to higher-yield options. This isn’t just theory; during the 2020 market dip, I recalibrated my tracking to include more bond metrics, which helped stabilize my returns when stocks were as unpredictable as a plot from «Black Mirror.»

And here’s where it gets real: incorporating behavioral finance elements, like noting emotional responses to market swings, adds a human layer. It’s not perfect, but blending quantitative data with qualitative reflections can hit the nail on the head for long-term success. Remember, in the U.S. financial landscape, where regulations evolve faster than tech trends, staying vigilant means you’re one step ahead.

Wrapping Up with a Fresh Financial Lens

In closing, what if tracking your investments wasn’t just a chore but a path to empowerment? We’ve explored personal stories, historical insights, and practical fixes, all pointing to one truth: consistent monitoring transforms uncertainty into control. So, take this step right now—download a tracking app and review your portfolio for just 15 minutes today. It could be the difference between regret and reward.

One last thought: how might your financial future shift if you started questioning those silent numbers? Share in the comments—I’m genuinely curious about your tracking triumphs or pitfalls.