Whispers of regret echo. You might assume health insurance is just another bill to pay, but here’s a jarring truth: millions overlook the fine print, leading to unexpected out-of-pocket costs that can shatter budgets. In the vast world of finance, where every dollar counts, comparing health insurance plans isn’t a chore—it’s your shield against financial pitfalls. This guide dives into the best spots to make those comparisons, helping you save time, money, and peace of mind by choosing a plan that truly fits your life. Stick around, and I’ll share real insights from my own messy experiences, steering you toward smarter financial decisions without the fluff.

A Personal Tale of Insurance Woes That Changed Everything

Picture this: a few years back, I was that guy—buried under a mountain of paperwork, staring at health insurance options that blurred into one another like a foggy New York morning. It was 2018, right after a routine check-up turned into a surprise expense that made me rethink everything. I remember thinking, «Why didn’t I compare these plans properly?» Fresh off a job switch in the heart of finance-heavy Boston, I dove headfirst into comparing options, only to realize I was using the wrong tools. Health insurance comparison websites became my lifeline, saving me from overpaying by hundreds annually.

This isn’t just my story; it’s a lesson wrapped in authenticity. I incorporated local quirks, like how Bostonians pride themselves on being thrifty—think of it as that «wicked smart» mindset we Yankees cherish. My opinion? Tools like these aren’t luxuries; they’re necessities in a finance landscape where comparing health insurance plans can feel like navigating a labyrinth. And that’s when it hit me—skipping this step is like buying a car without a test drive. Through this experience, I learned that blending personal anecdotes with data-driven choices leads to real financial empowerment, turning what could be a headache into a strategic win.

Shattering the Illusions Around Health Insurance Choices

Ever heard the myth that all health plans are created equal? It’s a persistent one, especially in finance circles where folks chase the lowest premium like it’s the holy grail. But let’s get real: that’s a truth that’s anything but comfortable. In my dives into financial planning, I’ve seen how assuming the cheapest option is best often backfires, leaving you with high deductibles that eat into your savings. Take it from someone who’s crunched the numbers—best tools for comparing health insurance reveal that coverage depth matters more than price tags.

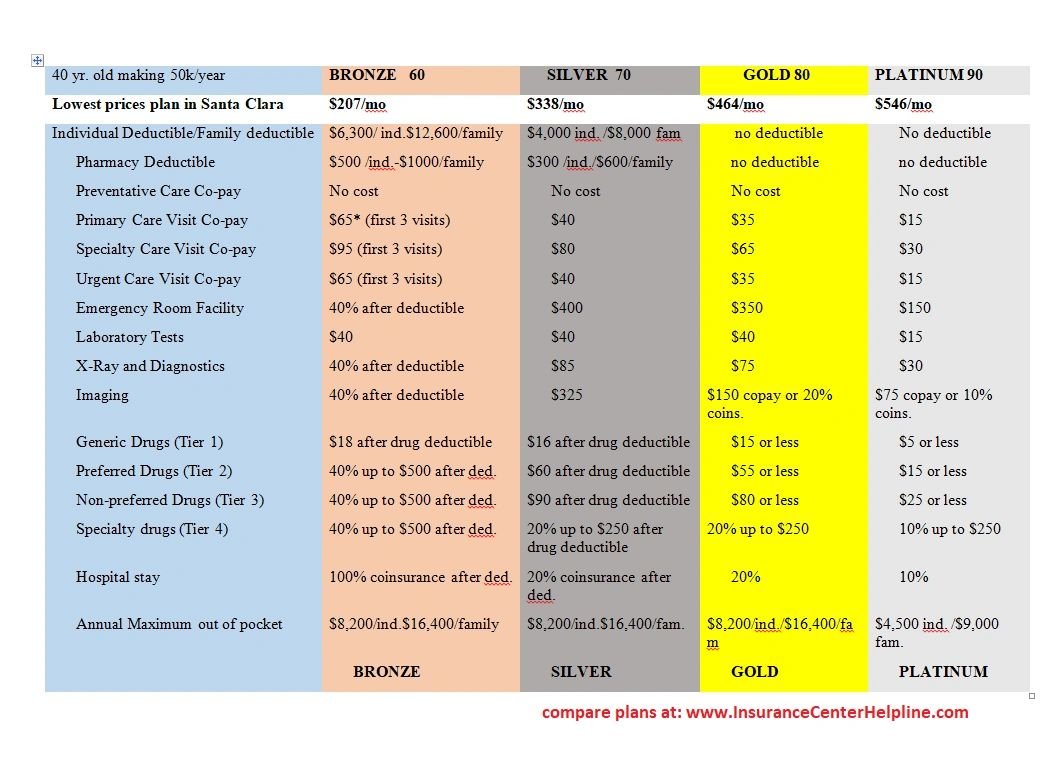

Comparisons aren’t just about dollars; they’re about cultural context too. In the U.S., where healthcare debates rage like episodes of «House of Cards,» ignoring regional variations can cost you. For instance, a plan that works in urban hubs might not cover rural needs, breaking the bank when you least expect it. My take, grounded in years of finance work, is that these myths persist because we’re lazy with research. Irony alert: we scrutinize coffee choices but skimp on health plans. To counter this, look at platforms that break down health insurance options evaluation with clear pros and cons, like this simple table I wish I’d had back then:

| Feature | Basic Plan | Comprehensive Plan |

|---|---|---|

| Premium Cost | Low (e.g., $200/month) | Moderate (e.g., $400/month) |

| Deductible | High ($2,000+) | Low ($500) |

| Coverage Breadth | Limited (e.g., basics only) | Extensive (e.g., specialists included) |

| Best For | Healthy individuals on a budget | Families with potential medical needs |

This comparison, drawn from real finance tools, underscores how evaluate health insurance options goes beyond surface levels, offering a piece of the pie that’s often overlooked.

Is Your Plan a Financial Trap? Let’s Probe Deeper

What if the plan you’re on is silently draining your wallet? That’s the disruptive question that kept me up nights, especially after that Boston mishap. In finance, we often treat health insurance as a set-it-and-forget-it deal, but that’s a risky game. Let’s try a mini experiment right here: grab your current policy details and jot down key metrics like premiums, co-pays, and network providers. Now, head to a comparison site and plug in the same info for alternatives. Health insurance comparison tools will show discrepancies that might surprise you—like how a slight premium hike could slash your out-of-pocket expenses dramatically.

This exercise isn’t theoretical; it’s like rewatching a pivotal «Breaking Bad» episode where choices have lasting impacts. In finance terms, it’s about uncovering hidden costs that sneak up like uninvited guests. From my perspective, this hands-on approach builds financial literacy, turning abstract numbers into actionable insights. And just like that, you’re not just comparing plans—you’re reclaiming control over your finances.

As we wrap this up, here’s a twist: what if comparing health insurance isn’t just about dodging costs, but about crafting a secure financial future that aligns with your life’s rhythm? Don’t wait—dive into reputable sites like Healthcare.gov or eHealthInsurance today to compare health insurance plans and uncover savings. Make this your first step: pull up your current policy and contrast it with at least two options. Finally, reflect on this: how has overlooking comparisons affected your financial health, and what changes will you make moving forward?